Here’s what I really think

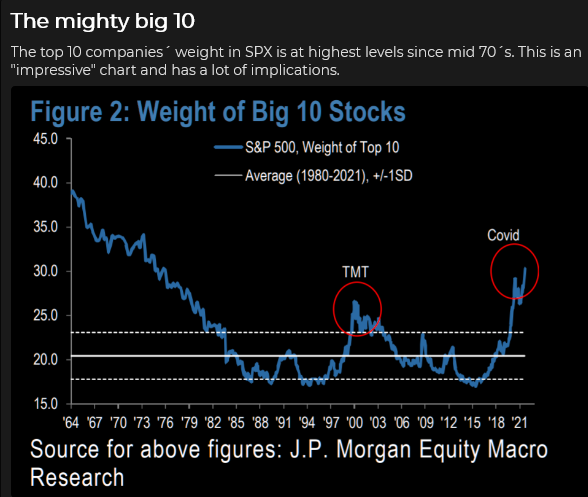

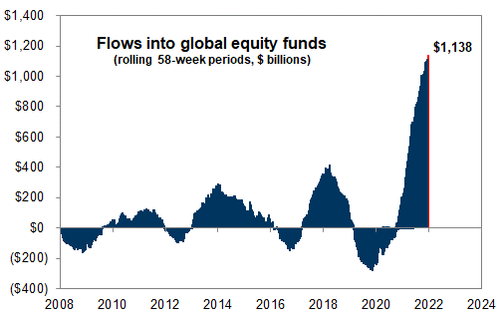

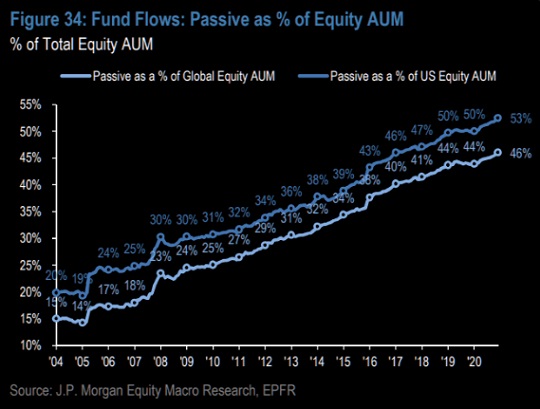

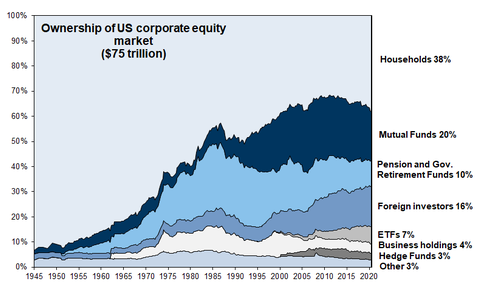

We’ve had an extraordinary run of bullish enthusiasm since the March 2020 Covid panic lows. The S+P has rallied ~120%. A tidal wave of new money has come into the equity markets, with more than half of that going into passive index-linked investments. A handful of (richly-valued) Big Cap Tech stocks account for a HUGE percentage of the index gains. People think stocks only go up – that corrections are great opportunities to buy more shares at bargain prices. I think that’s going to change.

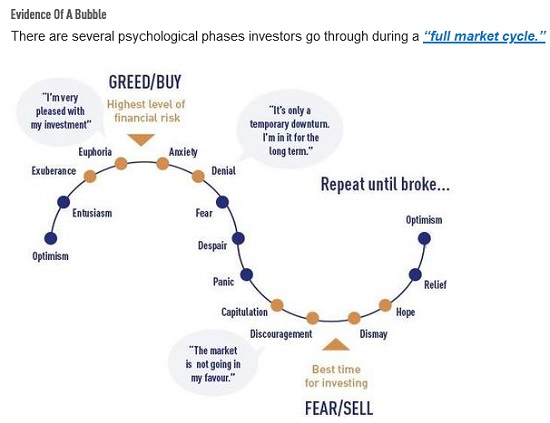

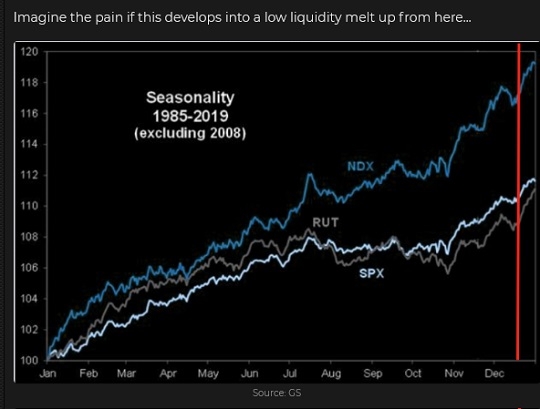

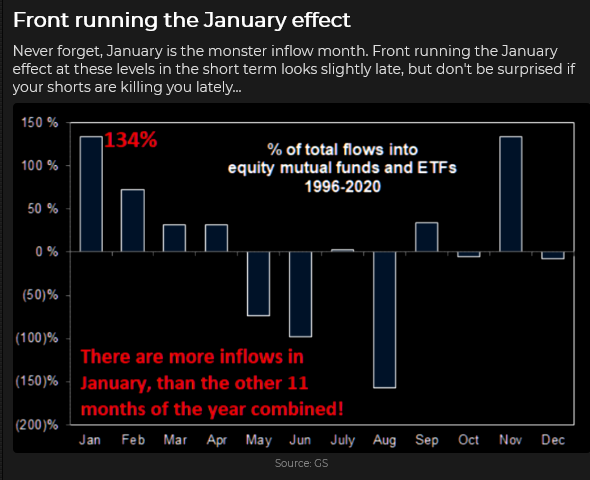

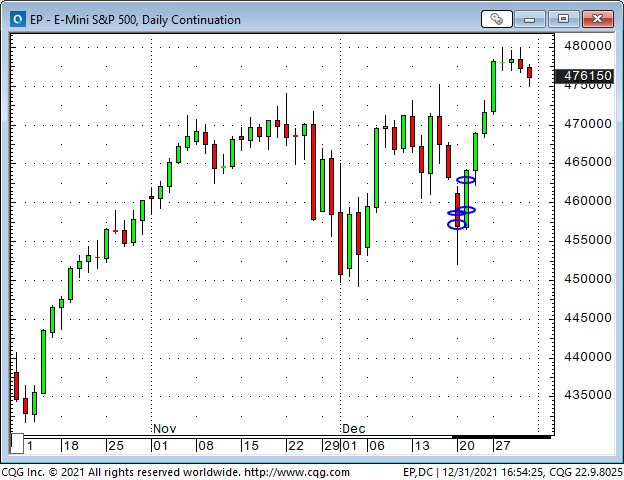

The current market psychology reminds me of late 1999, and I think we will see a severe correction sometime within the next few months. It could start as early as next week. The “Santa rally” from the December 20 lows looks like people front-running an anticipated flood of new cash coming into the market in January. Where do you think we are in the full market cycle?

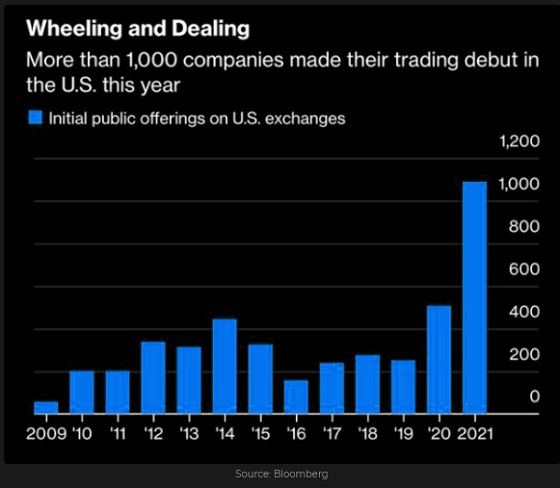

There have been many expressions of extraordinary bullish enthusiasm, including a HUGE increase in the buying of short-dated call options. IPOs have also taken advantage of risk-on investor psychology. (Bob Farrell: The public buys the most at the top.)

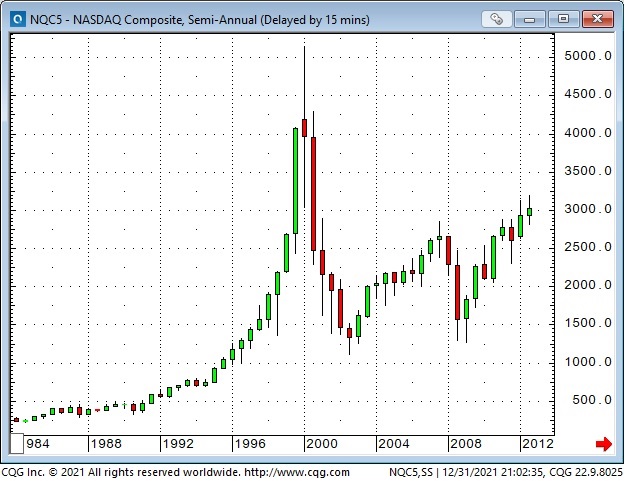

The leading American stock indices have HUGELY outperformed stock indices in the Rest Of The World – because of Big Cap Tech. Again, this reminds me of 1999 when capital flowed from the ROW to the American markets. Those foreign capital flows added to the buying pressure on the US stock indices and helped boost the US Dollar Index to a 15 year high. It was a classic virtuous circle. Note what happened to the USD and the Nasdaq when the momentum blew out.

Emerging markets had a big bounce in 2020 but HUGELY under-performed the American markets in 2021. Part of the blame for that was China’s “common prosperity” policies.

Commodity markets have also been “hot” since hitting a 20-year low during the Covid panic of March 2020. The Goldman Sachs commodity index rallied ~175% from March 2020 to October 2021 (when WTI hit $85.)

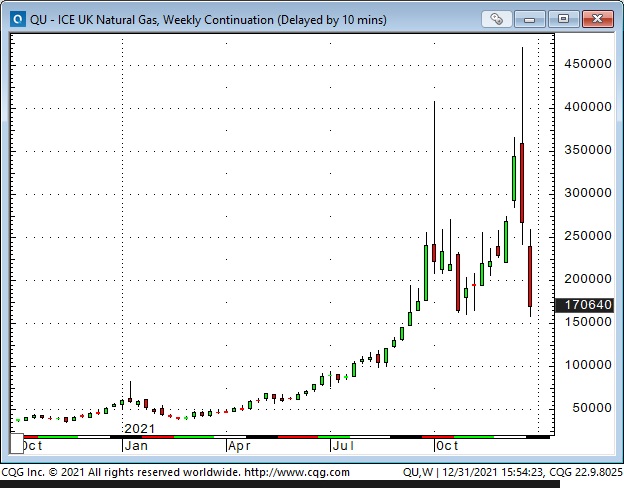

Back in the day, “energy” used to be ~20% of the S+P; lately, it’s been more like 2%. I anticipate that the volatility we’ve seen recently in European NatGas prices may be “just the start” of wild fluctuations in the energy markets in the future. NatGas in Europe was trading at ~10X North American prices – selling at the equivalent of $250 crude oil – until LNG cargos from America started to arb the difference and Putin signalled that Nord Stream flows would be increased.

My reason for anticipating volatility (and great trading opportunities) in the energy markets is that the ESG movement is contributing to massive blunders in government policies with their desire to embrace “green and clean” energy while shunning fossil fuels and nuclear power.

I believe enormous amounts of money have been and will be poorly invested in pursuing “green and clean” energy sources. The pipe dream of a “smooth transition” from current energy sources to “green and clean” energy sources will not happen without “gaps” in energy supplies that will roil markets – and enrage public opinion.

Open interest across the exchange-traded energy markets has dropped to the lowest levels in several years; perhaps people are backing away from short-term price volatility – but less liquidity will likely lead to even greater volatility.

My short term-trading

I started the Christmas week with no positions. I bought the S+P when it rallied off its December 20 lows and sold it for a small gain later that day. I rebought it on December 21 and sold it later in the day for a decent profit. Once again, I was out too early!

On December 21, I bought the CAD and wrote OTM calls against it to reduce risk. (The CAD had just made a new low for the year the day before.) I saw the CAD as possibly over-sold while the S+P and WTI were rallying. I covered both positions for a decent profit on December 28. (Too early again!)

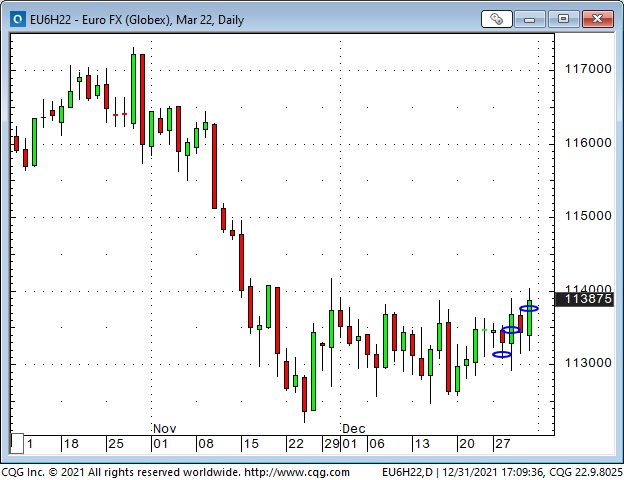

I sold the EUR short on December 28, looking for it to drop below the range it has been in for the past month but was stopped for a slight loss. I bought the EUR on December 31, looking for it to rally out of the past month’s range, and I still hold that position.

I shorted WTI on December 29 and still hold that position. My realized P+L for the Christmas and New Year’s week was a gain of just under 1%, and I have small unrealized gains in the EUR and WTI.

Thoughts on Trading

It’s hard not to have an opinion about different markets, but I don’t use those opinions as a “timing tool” for trading purposes.

I recently re-read Reminiscences of a Stock Operator, and he talks about getting a sense of “General Conditions” and then looking at “the tape” for confirmation. I do much the same thing, and if price action confirms my opinion about a market, I will start looking for an entry point.

I’m always looking at inter-market and intra-market relationships – they often give me insights into a market that I can’t get just by looking at the flat price.

As a commodity trader, I only think in terms of absolute returns. The concept of relative returns makes no sense to me. I don’t measure my performance against a “benchmark.” I either make money or lose money. To say that I lost money, but managed to outperform a benchmark or a group of other commodity traders, gives me no comfort.

The measurement that is important to me is how much risk I take to generate a return. (My friend Kevin Muir scornfully refers to some hedge funds as leveraged beta dressed up as alpha.) I don’t calculate VaR or Shape ratios or other metrics – I just cut losses quickly and keep my sizing reasonable. For me, the name of the game is to grind away and make sure I don’t get blown away.

My friend Peter Brandt likes to talk about the Pareto Principle (the 80/20 rule) as it applies to trading. Peter has discovered that ~80% of his total trading profits came from only ~15% of his trades over the years, and the other 85% of his trades essentially offset one another. The important thing, says Peter, is to make sure those 85% trades don’t eat up the profits from the 15% trades.

I’ve got two “New Year’s Resolutions“ for 2022: I will try to stay with my winning trades longer, and I’m going to be more aggressive.

Listen to my December 30 interview with Howe Street Radio

The interview is 39 minutes long. I discuss different markets, how I generate trading ideas and manage risk.

Quotes from the notebook

“I’m not concerned about anything. My job is not to set policies. I’m not an economist or a politician, or a central banker. I invest people’s money. So I’m agnostic about what’s good and bad in terms of policy. I just deal with it.” Jeff Gundlach April 2016

My comment: I agree 100%. If I can quote my friend Kevin Muir again, “We don’t trade on what we think should happen, we trade on what we think will happen.” There is a HUGE difference between those two things.

“There is no easier way to make money in the market than to have (and to have the confidence to implement) the correct Variant Perception.”Michael Steinhardt in an RTV interview with (the one and only) Jim Grant July 2018.

My comment: I agree 100%. People who “see things differently” and have the courage of their convictions to trade based on how they see things are the ones who make outsized gains – if they get their timing right. Michael Burry (the Big Short) had variant perception, but he came very close, in terms of timing, to NOT making BIG money – because he took positions early and the clock was running against him.

A Small Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

The Barney report

Barney came to live with us two months ago when he was eight weeks old (first picture.) he was 13 pounds then, he’s 31 pounds now, and he loves going for a walk in the snow with Papa.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.