Tuesday December 15, 2015 3:00 Pacific

DOW + 156 on 1750 net advances

NASDAQ COMP + 43 on 1150 net advances

SHORT TERM TREND Bullish (change)

INTERMEDIATE TERM TREND Bullish

STOCKS : I’ve been saying that the market was near a bottom and today was probably the lift off.

There are some concerns. I still don’t like the recent action of breadth, but the majority of indicators seem to be pointing upward. Breadth was good today. Pessimism has been rampant and we have been very oversold.

And don’t forget the seasonal bullishness of December and January. This tends to manifest itself in the latter half of this month.

GOLD: Gold dropped $3. Probably strength in the dollar.

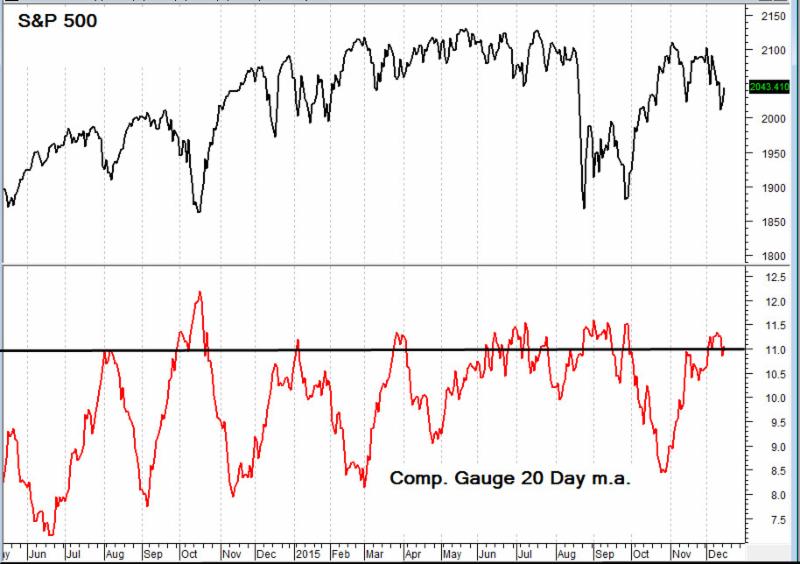

CHART: The 20 day moving average of the Composite Gauge peaked over 11.0. that is a level that frequently presages a multi week rally.

BOTTOM LINE: (Trading)

Our intermediate term system is on a buy as of August 26.

System 7 We are in cash. Buy the SSO at the open on Wednesday.

System 8 We are in cash. Stay there.

GOLD We are in cash. Stay there. News and fundamentals: The Consumer Price Index was flat, in line with expectations. The Empire State mfg survey was minus 4.59, higher than the expected minus 7.00. The housing market index came in at 61, lower than the expected 63. On Wednesday we get the PM mfg index flash, housing starts, industrial production and the FOMC announcement.

Interesting Stuff : No matter what the FOMC announcement says, expect some very wild market swings after 2 p.m. EST.

TORONTO EXCHAN GE: Toronto gained 224.

S&P/TSX VENTURE COMP: The TSX was flat.

BONDS: Bonds fell again.

THE REST: The dollar was higher. Silver was lower. Crude oil moved up.

Bonds –Bullish from Dec. 11.

U.S. dollar –Change to bullish as of Dec. 12.

Euro — Bullish as of December 3.

Gold —-Bearish from December 14.

Silver—- Bearish from December 14.

Crude oil —- Change to bullish on Dec. 15.

Toronto Stock Exchange—- Bearish since December 8.

S&P\ TSX Venture Fund — Bearish since December 8.

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

| Tue. | Wed. | Thu. | Fri. | Mon. | Tue. | Evaluation | |

| Monetary conditions | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 5 day RSI S&P 500 | 41 | 34 | 38 | 23 | 31 | 47 | 0 |

| 5 day RSI NASDAQ | 49 | 33 | 40 | 24 | 30 | 43 | 0 |

|

McCl-

lAN OSC.

|

-169 | -176 | -152 | -252 | -290 | -156 |

+

|

| Composite Gauge | 15 | 13 | 12 | 17 | 9 | 9 | 0 |

| Comp. Gauge, 5 day m.a. | 13.6 | 13.0 | 12.2 | 14.4 | 13.2 | 12.0 | 0 |

| CBOE Put Call Ratio | 1.11 | .91 | 1.22 | 1.07 | 1.07 | .88 |

0

|

| VIX | 17.60 | 19.61 | 19.61 | 24.39 | 22.73 | 20.95 | 0 |

| VIX % change | +11 | +11 | -1 | +26 | -7 | -8 | – |

| VIX % change 5 day m.a. | +4.4 | +5.0 | +2.0 | +10.8 | +8.0 | +4.2 | + |

| Adv – Dec 3 day m.a. | -621 | -726 | -645 | -972 | -1252 | -613 | + |

| Supply Demand 5 day m.a. | .43 | .47 | .49 | .32 | .43 | .45 | + |

| Trading Index (TRIN) | 1.26 | .70 | .61 | 1.54 | .55 | .75 |

0

|

|

S&P 500

|

2064 | 2048 | 2052 | 2012 | 2022 | 2043 | Plurality +3 |

INDICATOR PARAMETERS

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 13.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.