Gold took a knockdown punch at the start of Round 1when I suggested gold could be bottoming soon. Gold proceeded to fall another 8% in the days following those comments.

But gold got up off the matt and started swinging.

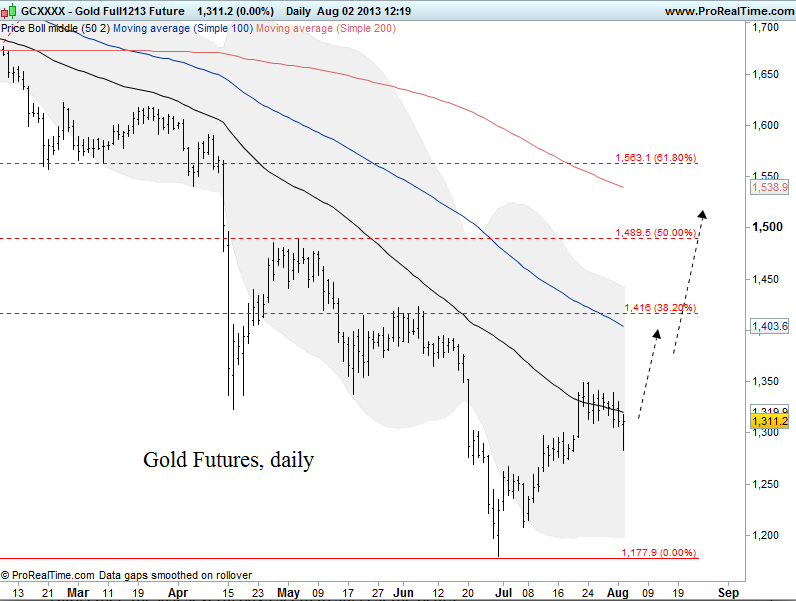

Gold is now trading above the $1,290 level where it stood last time I wrote about it. From June 28 to July 23 gold rallied more than 11%. The last eight sessions have seen a consolidation that’s hovering along gold’s 50-day moving average:

Today, immediately following the mediocre July US Nonfarm Payrolls report, gold dropped along with the US dollar. Gold, however, unlike the US dollar, has recovered those losses.

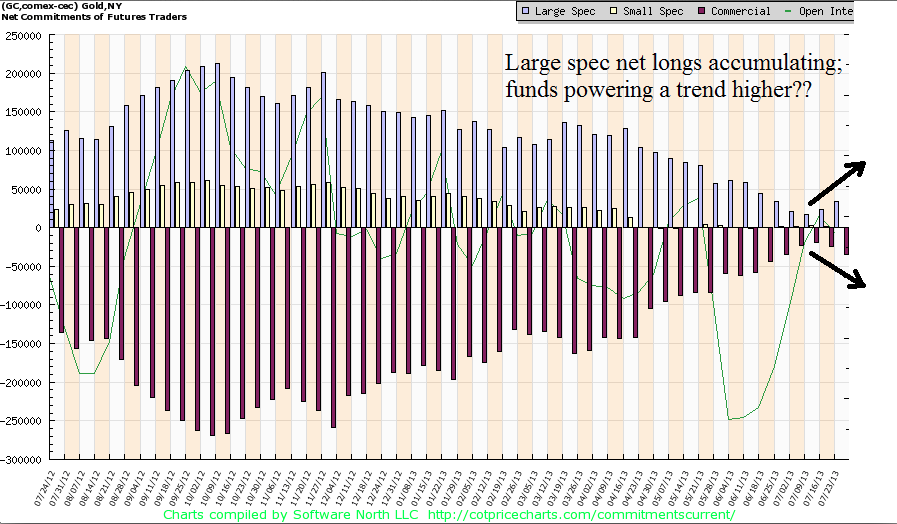

Altogether, the last several days seem to suggest the bears are having trouble pushing gold much lower. In looking at the positioning in the futures market, commercials are beginning to rebuild their net short position (hedging) while speculators are beginning to rebuild their net long position. That suggests an uptrend could be in the making:

More to that point, I was forwarded these comments from a friend who receives some technical and sentiment analysis on the futures markets. Regarding gold:

GOLD: The current fund trend is down, but funds have bought $4.1b over two weeks. This is bullish because buying interest from trend-following funds powers uptrends. Another bullish factor is the extreme reading in the three trend cycles, which reveal a grossly oversold condition.