It seems like investors were writing off the real estate sector entirely.

With the rise of technology used to shop online, work from home and even go to school, real estate has been a hated sector.

But it’s a sector I have been a fan of this year, triggering gains of 15% and 17% in my Pure Income service.

That’s because even though I know the landscape for real estate is changing, I still see the crowds at the malls, the wait times at restaurants and the continued need for hospitals and health care facilities.

So the decline in values recently has looked like an opportunity to me.

But my personal experience or viewpoint doesn’t have anything to do with my recommendation today.

Instead, three separate computer-based buy signals are flashing bullish signals on the real estate sector, and I have a possible triple-digit opportunity for you.

Let me explain.

Three Buy Signals for the Real Estate Sector

Let’s start with the three buy signals on the sector before I give you the opportunity.

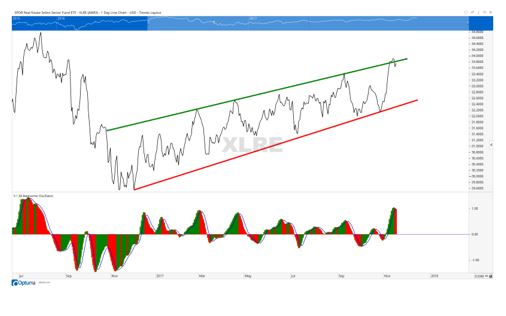

The first is the most basic, a price chart of the SPDR Real Estate Select Sector ETF (NYSE: XLRE).

This is showing a possible breakout of a long trend channel.

It may have just had a false breakout, since the price jumped above the trendline, then fell back below it. But this can also hold as a new, steeper uptrend for the exchange-traded fund (ETF). As long as it can hold above its previous peak, around $33.50, prices should continue to climb.

The second is a seasonality chart.

Right now, it is a great time to enter the real estate sector based on a 10-year seasonal analysis of the Vanguard REIT ETF (NYSE: VNQ). I used this ETF because it has data going farther back than the newly listed XLRE in the price chart.

December is clearly the strongest month to be in real estate, and we just bought a real estate investment trust (REIT) in my seasonal service, Automatic Profits Alert, a couple of weeks ago that is already benefiting from this trend.

The third chart is something you may not be too familiar with, but it is a concept I have discussed before called a Relative Rotation Graph™.

If you want to learn more about the concept, you can click here to read more about it.

Basically, it’s the idea that stocks rotate in and out of leading and lagging the market. And there are key turning points, where a sector will shift from lagging, to improving and eventually leading the market.

The real estate sector is at such a point. Take a look:

If you can read the text, you’ll notice it is in the lagging section of the chart. But when an ETF is in that section and turns sharply higher, like XLRE did, that is a sign momentum is shifting and the sector is turning around — which is the exact time we want to jump in.

A Unique Way to Profit

All told, the real estate sector is a solid buy right now.

In my service, I handpick certain stocks to benefit from these trends. For today, I’m going to recommend a unique way to profit, and that’s to buy a call option on the XLRE real estate ETF.

The option we are going to buy is the February 16, 2018, $34 call option.

With this option, we are expecting the ETF to rise as predicted by the three charts above. However, whenever you buy an option, it’s important to remember you can lose everything you paid to buy the option. Even though we have three buy signals, there’s always a chance the trade doesn’t work out, so just keep that in mind.

This option costs roughly $0.55, depending on when you purchase it. Since one contract covers 100 shares, one contract will cost about $55.

Now, I want to highlight that this is not a position that I will be tracking or updating you on, so it will be up to you to pull the trigger to take profits or cut losses.

A good rule of thumb for a trade like this is to sell half of your position at a 50% gain, and manage the second half to either take profits if it begins to fall by about 30% in value, or start to sell the second half once it is above 100%.

For a loss, you can cut it if it falls to a 50% loss.

For the ETF, all we need is it to rise about 4.2% over the next three months to hand us a 100% gain.

Regards,

Chad Shoop, CMT,

Editor, Automatic Profits Alert