One quick look at the long term Uranium price chart below highlights Uranium is a very long way from its high in 2007, and it certainly isn’t trending upward. That said, this analyst has found that Uranium stocks are bucking the Uranium metal trend significanly, and are rising from a very sold out low. That, this analyst believes, means “we’re looking at a big, cyclical move in uranium prices” – R. Zurrer for Money Talks

The White-Hot Metal

Have you noticed what’s happening in uranium lately? Not the metal, which continues to snooze. The miners. They are ramping up. Take a look at this chart …

Why is This Happening?

On the demand side …

Global nuclear capacity is ramping up. In fact, it should double to at least 58 gigawatts by 2020-’21, then up to 150 gigawatts by 2030, and much more by 2050. That’s according to a new research report by the World Nuclear Association.

The same report says that China — which has 36 nuclear power reactors in operation — is building 21 new atomic power plants. They’ll all need to be fueled up. Nuclear plants take three times as much uranium at start-up as they normally use in a year.

Japan shut down all its atomic reactors after the Fukushima earthquake/tidal wave caused three of them to melt down. That country recently started bringing its nuclear plants back online. It’s preparing for the eighth restart right now … out of 43.

This is important because one of the things suppressing the uranium price was Japan selling its nuclear stockpiles from shut-down plants into the market. Now, it will have to stock up again.

On the supply side …

Kazakhstan, the world’s biggest uranium producer, has cut its uranium production twice in the last year.

Then Cameco (CCJ), the biggest producing company in the West, suspended production at its McArthur River Mine in Canada. That all adds up to 17,762 metric tons per year of supply taken off the market.

And just recently, the Department of Energy suspended its practice of selling excess uranium. That amounts to 2,100 metric tons per year.

There’s a lot more to the story. But you get the gist of it. We are seeing a good ol’-fashioned supply/demand squeeze in the glow-in-the-dark metal.

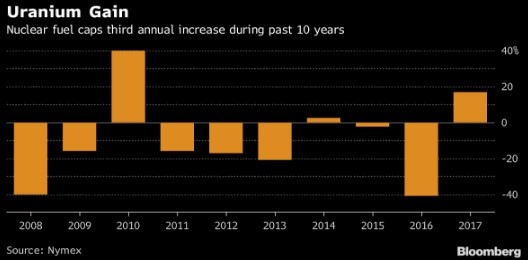

The price of uranium has been depressed for years. But last year, the price went up. By 17%. That’s not much, but it’s the first time that uranium prices have gone higher in years.

|

That’s nice. But you know what? Prices are still 67% below the 2011 peak!

You can see why I believe uranium might be at a tipping point. I believe we’re looking at a big, cyclical move in uranium prices. And it could be a melt-up, rather than a melt-down.

I’ve been around long enough that I’ve seen this before. In 2006-2007, my subscribers made one big profit after another on uranium stocks. Bam! Bam! Bam!

I just gave my Wealth Supercycle subscribers a new uranium report. It’s chock full of picks, too.

If you want your own copy of the report, click here.

The next big up-cycle in uranium is coming. You want to be onboard for it. My subscribers made a heck of a lot of money the last time this happened. This time could be even bigger.

All the best,

Sean