The stronger than expected February’s job market report fueled expectations that the Fed will increase interest rates sooner rather than later. We believed that market reaction was a bit exaggerated, and suggested in the Gold News Monitor not taking the hike for granted. The U.S. recovery is not as strong as it is commonly believed (as it was confirmed by the downgraded Fed’s economic projections) and there are many downside risks, such as Greece’s crisis, stubbornly low inflation, sluggish wage growth, the Chinese and global slowdown and too strong a greenback, which may stall the Fed’s hike.

For sure, there are many positive indicators for the American economy: solid GDP growth in 2014, and low unemployment and inflation rates. Consequently, the real disposable personal incomes as standards of living are rising. Indeed, the U.S. economy looks definitely brighter than a few years ago. It also performs better than many other developed countries, thanks mostly to a freer economy and a much more flexible job market.

On the other hand, if you scratch beneath the surface, the outlook for the U.S. economy is grimmer. We have already written in past editions of Gold Monitor News about rising inventories to sales ratio, decreasing new orders for durable goods, falling U.S. retail sales for three months in a row (in February) and the unemployment rate drop in February was mostly because people gave up looking for jobs. Some economists also question the accuracy of the data published by the Labor Department, and rightly so. February was another month with a huge discrepancy between the Labor Department’s job survey and the Census Bureau’s American Household Survey. According to the latter, the U.S. economy added only 96.000 new jobs in February, much below the 215.000 expected and the 295.000 reported by the Labor Department.

Why does such a discrepancy exist? There are many differences between those two reports, but the most important is that the nonfarm payroll survey does not include agricultural workers and the self-employed. It turns out that if we add those categories, the number of jobs actually fell from January to February. Please note that this fact also explains why the Labor Department’s data understate the job losses in the energy sector. The truth is that the U.S. oil and gas industries rely heavily on the use of independent contractors. Therefore, the workers in the energy sector are not counted as part of the nonfarm payroll, so layoffs in this industry are not covered in the establishment of employment statistics.

Another significant difference is that the payroll survey double-counts many workers who change jobs or have few part-time jobs. There are also other problems with the Labor Department’s statistics, such as an inaccurate model of birth and death of companies and seasonal adjustments. It is worth pointing out that the disparity between the payroll and household employment surveys is cyclical and widens during recessions, which may indicate that the U.S. recovery is based on rather fragile foundations. This is perhaps why the Federal Reserve’s labor market condition index, which combines 19 labor market indicators, actually fell from 4.8 in January to 4 in February. Does this look like a strong job market?

Other main macroeconomic indicators also do not look so rosy. First, the revised data show that GDP expanded in the fourth quarter at a 2.2 percent annual pace, down from the estimated 2.6 percent (advance estimates). Even more importantly, the Atlanta Fed’s real-time monitor of the U.S. GDP indicates that the economy has slowed considerably over the first quarter of this year. The FOMC (in its March statement) finally noticed that “economic growth has moderated somewhat.” And ‘somewhat’ means in this case the 0.3 percentage point, since the FOMC’s members downgraded its economic growth median projections for this year from 2.6-3.0 percent in December to 2.3-2.7 percent.

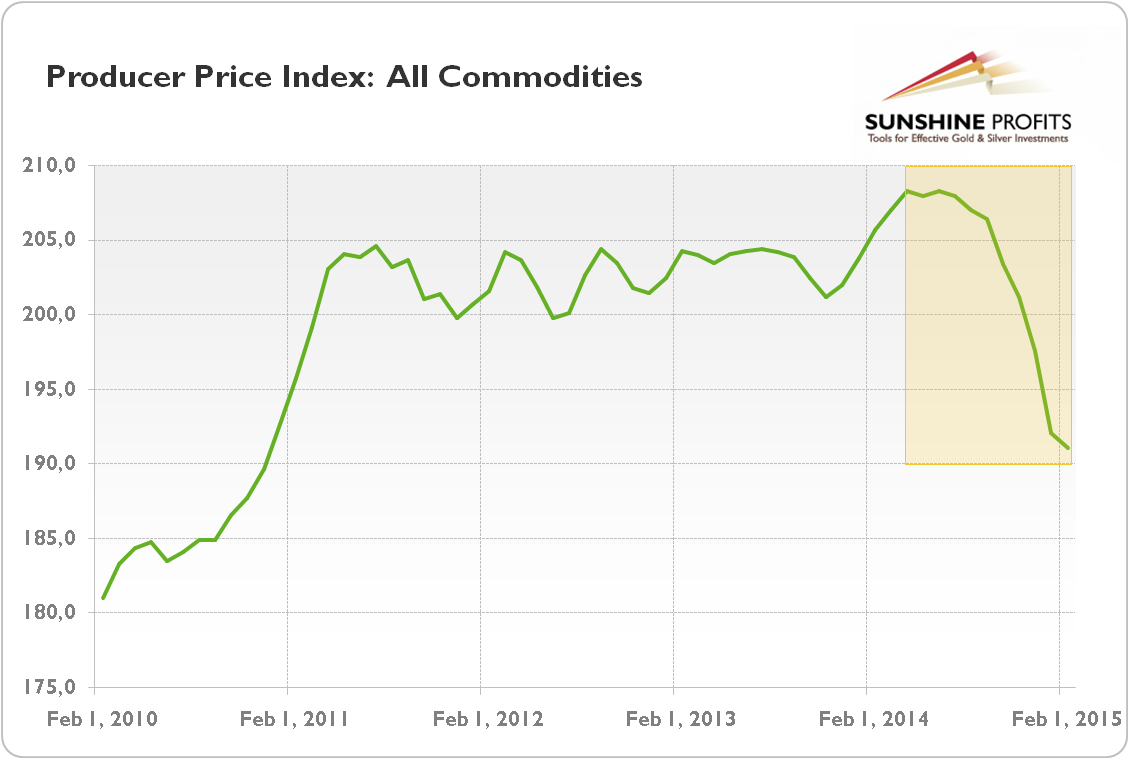

Second, the low inflation may not be transitory as Fed believes, but a sign of a coming recession. We do not consider disinflation or deflation as negative phenomena, but only when they reflect rising productivity. At present, the falling producer prices (see the chart below) signal the economic slowdown in America and globally. How else would you explain the expected fall of all nine key commodity price indices or the decline in new factory orders? No, do not blame the weather.

How does it all affect the gold market? The analysis shows that although the U.S. economy is in much better

shape compared to other countries or to itself a few years ago, the full recovery was probably proclaimed too early. It is unclear whether the Fed examines the whole spectrum of data or focuses on official statistics; however we believe that sooner rather than later it will become obvious that the U.S. economy and labor market are not as strong as the February job report suggested.

To some extent, the Fed admitted it in March, by revising its projections on economic growth (it downgraded its forecasts of the GDP growth in 2016 and 2017, which clearly shows that it is not only a harsh winter which softened the economic activity), however it increased its expectations about the employment rate.

Therefore, the Fed may slow down the hike of its interest rates (or undo it if Fed raises it eventually) even further (the U.S. central bank also cut its expectations for the level of federal funds rate over the next couple of years), which will positively affect the gold prices.

We hope you enjoyed the above article. If you’re interested in reading more, please note that we focus on the economic fundamentals in our monthly Market Overview reports and we also provide Gold & Silver Trading Alerts for traders interested more in the short-term prospects. If you’re not ready to subscribe today, please sign up for our mailing list and stay up-to-date. It’s free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor