Most Dividend Payers Will Outperform.

We’ve all seen the statistics that extoll the virtues of the dividend payers – for instance, that from 1980 to 2005, Standard & Poor’s 500 Index dividend payers outperformed their non-dividend-paying counterparts by more than 2.6 percentage points a year (an outperformance that, over a long period, translates into major additional gains in a portfolio).

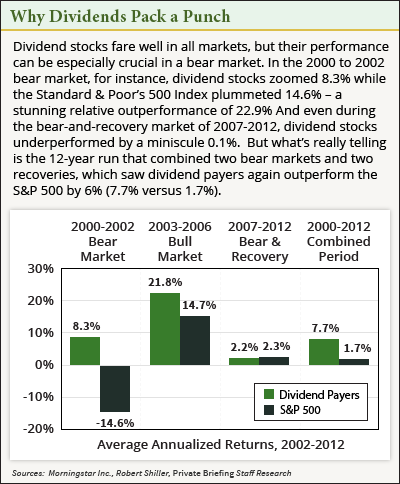

And there’s lots of research that underscores the fact that dividend payers gain more than the market averages in bull markets and lose a lot less in bear markets.

But a chart (see below) depicting some recent research by Morningstar Inc. really caught my eye: It very nicely illustrates that dividend stocks will deliver this “outperformance” over the course of multiple bull-and-bear markets. From 2000 to 2012, a 12-year run that combined two bear markets and two recoveries, dividend payers outperformed the S&P 500 by 6% (7.7% vs. 1.7%).