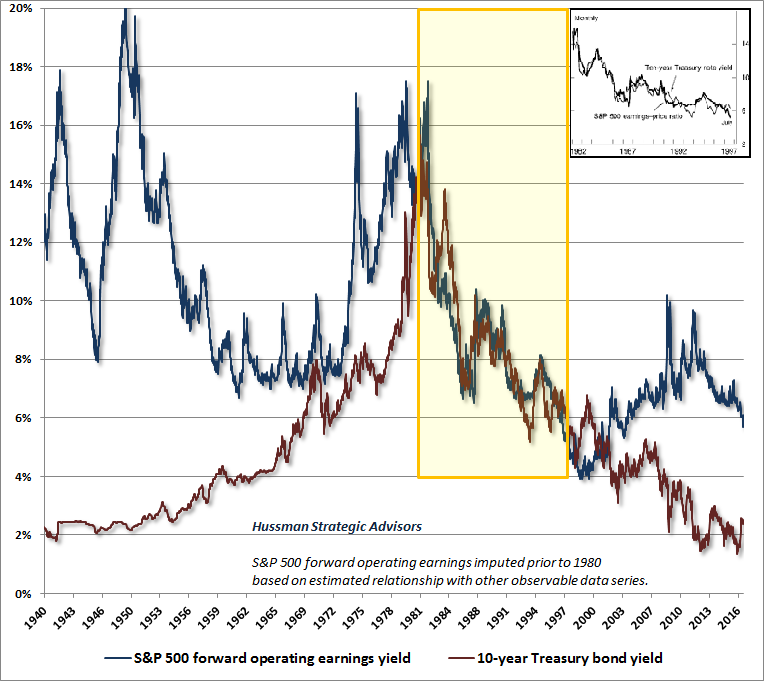

On Wednesday, the consensus of the most reliable equity market valuation measures we identify (those most tightly correlated with actual subsequent S&P 500 total returns in market cycles across history) advanced within 5% of the extreme registered in March 2000. Recall that following that peak, the S&P 500 did indeed lose half of its value, the Nasdaq Composite lost 80% of its value, and the tech-heavy Nasdaq 100 Index lost an oddly precise 83% of its value. With historically reliable valuation measures beyond those of 1929 and lesser peaks, capitalization-weighted measures are essentially tied with the most offensive levels in history. Meanwhile, the valuation of the median component of the S&P 500 is already far beyond the median valuations observed at the peaks of 2000, 2007 and prior market cycles, while our estimate for 10-12 year returns on a conventional 60/30/10 mix of stocks, bonds, and T-bills fell to a record low last week, making this the most broadly overvalued moment in market history.