It was the most surprising bull market of 2013…

One that almost nobody is talking about… And it has huge implications for natural-resource investors in 2014…

I’m talking about the bull market in Chinese commodity imports.

I know this statement might sound odd. So let me explain…

Most folks know that over the past 20 years, China has become a major player in the commodity sector. It’s the world’s largest importer of vital raw materials, like iron ore and copper. China’s emergence as a major economic power helped drive a big bull market in commodities from 2002 to 2008.

But over the past few years, calling for a “China crash” has become a popular activity for Wall Street analysts, fund managers, and CNBC talking heads. It has become so popular that if you watch financial television for a week, you’d think China is imploding.

Because China is such a major driver of commodity demand, it’s vital for us to monitor what’s going on there. As I mentioned, China is the largest importer of iron ore and copper. And as of December 2012, it surpassed the U.S. as the world’s largest oil importer. Despite what many people believe, China’s economy is still growing… and its demand for imported resources is at an all-time high.

Over the next few days, we’ll take a close look at the facts… and how they can help you make terrific investments over the coming years…

China has the world’s largest population, and its economy is growing more than 5% per year. This means a large and growing demand for cars.

In 2002, there were 3.3 million cars sold in China. It took steel, copper, and other raw materials to build each one. It took crude oil and its derivatives to keep them running.

In 2012, there were 20 million cars sold in China. That’s a huge 500% increase in just 10 years. And when you compare China’s car market with America’s, you can see there’s a tremendous amount of growth ahead…

In 2012, there was about one car for every 85 people in China. In America, the ratio was 0.9 cars per person. In other words, we have nearly as many cars as people. This simple comparison shows how China has lots of catching up to do with developed nations like the U.S.

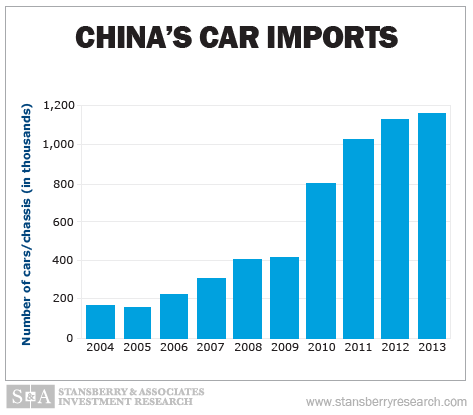

Contrary to what many people believe, China’s economy isn’t falling apart. For proof, we can look at China’s car imports. As you can see in the chart below, they just hit an all-time high. The chart shows monthly imports of cars and car chassis (which become cars).

All of those cars need oil and gasoline. China’s demand for oil happened in spectacular fashion. As recently as 1985, China exported about 142 million barrels of oil. However, in 1993 the country’s demand for oil used up all its domestic production.

By 2002, the country imported 496 million barrels of oil. As you can see in the chart below, they hit a record high of 1.9 billion barrels in 2013. And daily imports continue to break records.

Again, China didn’t begin to import oil until the 1990s. In less than 20 years, it went from zero to the world’s largest importer. And most of that demand came from its newfound love of cars.

China’s love of cars provides a growing demand for oil… and will likely place a floor under the price of oil around $80/barrel for years. This is good news for major oil companies like ExxonMobil, Chevron, and Eni (a huge Italian oil firm). An investment with these companies gets a big boost from the numbers I’ve just shown you.

China may not be growing at 10% a year these days… but it’s still growing enough to propel commodity imports to all-time highs. Tomorrow, I’ll share why this is such big news for two of my favorite precious metals right now…

Good investing,

Matt Badiali

Further Reading: