Downside risk in North American equity markets exceeds upside potential in equity markets during the next 2-3 weeks prior to start of the third quarter earnings report season. Thereafter, prospects turn positive. Selected positive seasonal trades such as gold and energy have performed well, but are approaching their end of their period of seasonal strength. Similarly, selected negative seasonal trades such as Transportation and Semiconductors are approaching the end of their seasonal weakness. The time to take profits in these seasonal trades is rapidly approaching. Short term technical indicators will be useful for determining exit points. A new series of seasonal trades will appear as the end of October approaches.

The weakest period in the year for North American equity markets from September 16th to October 9th is happening again this year. This is the time of year when companies most frequently lower guidance prior to release of third quarter results (i.e. earnings confession season). Lots of examples last week including FedEx, Norfolk Southern and Bed Bath & Beyond! Possibilities of more frequent guidance declines this year are higher than usual. Third quarter year-over-year consensus for Dow Jones Industrial Average companies already calls for a 1.6% decline. Consensus for S&P 500 companies is a decline of 2.7% (down from 2.1% a week ago) despite a 20.2% gain by Apple Computer. Since release of second quarter reports, 80% of S&P 500 companies that changed guidance lowered their guidance. Consensus for TSX 60 companies is an average decline of 7.8%. Despite consensus estimates calling for lower earnings on a year-over-year basis, consensus estimates appear too high and likely will continue to fall prior to release of third quarter results.

Macro events outside of North America also will influence equity markets. A decision by Spain to ask the European Central Bank to purchase Spanish sovereign debt is scheduled on Thursday. The Eurozone consumer confidence index is released on Thursday.

U.S. economic news this week is expected to be mixed. Case-Shiller and Consumer Confidence on Tuesday are potential positive events. Weekly initial jobless claimes, Durable Goods Orders on Thursday and Chicago PMI and Michigan Sentiment on Friday are potential negative events.

Earnings reports this week are not expected to be significant. Focus is on Nike on Thursday.

Historically, North American equity markets have moved lower from mid- September to mid-October during a U.S. Presidential election year (particularly when the polls show a close election as is indicated this year. Thereafter, equity markets have moved higher until at least the beginning of January (The exception was the year 2000 when confirmation of President Bush as President was delayed until January 2001).

Cash on the sidelines is substantial and growing. However, political uncertainties (including the fiscal cliff) preclude major commitments by investors and corporations before the Presidential election.

Equity Trends

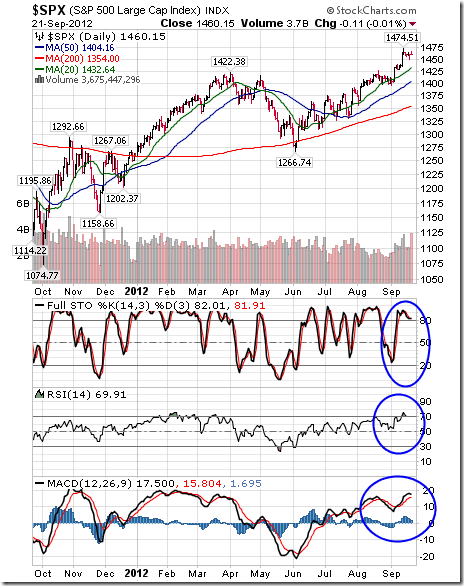

The S&P 500 Index slipped 5.62 points (0.38%) last week. Intermediate trend is up. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought and showing early signs of rolling over (e.g. a fall by RSI below its 70% level on Friday).

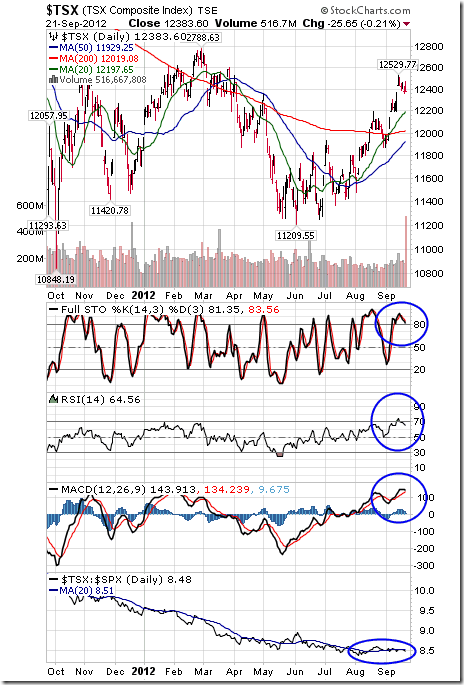

The TSX Composite Index fell 115.87 points (0.93%) last week. Intermediate trend is up. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought and showing early signs of rolling over (e.g. RSI falling below the 70% level). Strength relative to the S&P 500 Index remains neutral.

Ed Note: to view another 44 charts on Equities, Currencies and Commodities go HERE