Strengths

- The best performing precious metal for the week was palladium with a 7.14 percent gain. Bloomberg highlighted that automotive production in China grew 34 percent in September and 18 percent in October. As other gold investors are heading for the exit, billionaire hedge fund manager John Paulson has maintained his holding in the world’s biggest ETF backed by gold, reports Bloomberg. Even as gold prices posted their first quarterly loss this year, Paulson & Co. kept its holdings unchanged from June through the end of September.

- According to Bloomberg calculations, mine supply may fall about a third in the 10 years to 2025, with the number of newly discovered primary gold deposits already falling to three in 2014 from 37 in 1987, writes Mark O’Byrne. CEO of Randgold Resources, Mark Bristow, says gold production may peak in the next three years as miners fail to replace their reserves. The silver market is in the same boat, reports Reuters, with 2016 marking the fourth consecutive year in which the market has realized a physical shortfall. In Russia, in fact, silver production fell 9.4 percent year-over-year from January to September, and gold output declined 1.4 percent.

- BonTerra Resources announced this week that it has significantly extended its Gladiator Gold Zones by over 250 meters with “multiple intersections of high grades and meaningful widths.” The Drill Hole BA-16-39 generated gold bearing horizons including an intersection of 70 g/t over 5.5 meters at the eastern extent of the deposit and over 600 meters in depth below surface.

Weaknesses

- The worst performing precious metal for the week was silver with a loss of 4.47 percent. Bloomberg notes that holdings in all silver-backed ETFs they track fell 2.9 million ounces, set for the first monthly decline in 10 months.

- Total ETF gold fund holdings slid for a sixth straight day through Thursday, reports Bloomberg, making it the longest stretch in a year. The outlook for higher U.S. interest rates has dented the metal’s appeal as a store of value, even to billionaire investors George Soros and Stanley Druckenmiller. Naeem Aslam of Think Markets in London says investors are abandoning ship and jumping into risk trade. He believes now the clear trade is to go long the dollar index given that the odds of a rate hike are 91 percent in December. It’s hard to say, however, what “clear trades” to follow, since many analysts also believed a Clinton win was just as “clear.”

- MarketWatch writer Nigam Arora believes the real reason behind the crash in gold price is India, not Trump. India’s Prime Minister Narendra Modi has directed that 500 and 1,000 rupee notes be banned; these represent 20 percent of the cash value in circulation and 80 percent of cash outstanding. “The most common method to convert black money into white money over the past 50 years has been too slowly buy gold by paying cash in large bills,” Arora writes. “Now that large bills used to buy gold are worthless, demand for physical gold will decline.” Market observers in India say demand for gold is at the rock bottom even though marriage season has started in the country, reports the Business Standard.

Opportunities

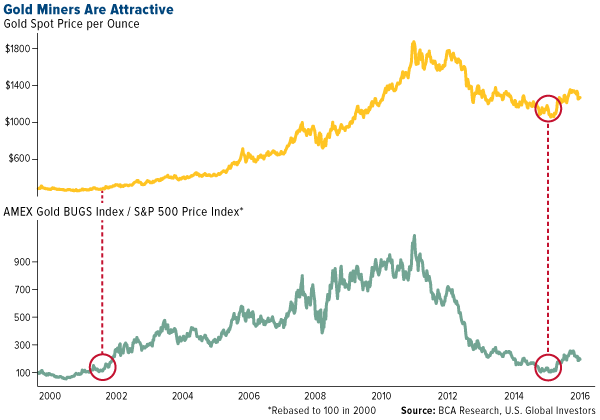

- In its November 14 report, RBC Capital Markets says that now is the time to meaningfully reposition portfolios following the election of Donald Trump. The report examines the presidency’s impact on markets, how to best position portfolios and risks associated with Trump. RBC states clearly that an increase in inflation and interest rates should accompany a Trump presidency. It notes that within the materials sector, gold stocks should be among the greatest beneficiaries. In another report from the group on its 15th Annual Senior Gold Conference, RBC notes that careful capital allocation continues to be a theme going into 2017 despite a constructive outlook for gold. Companies continue to focus on maximizing free cash flow from assets and dividends are a primary focus which should translate to higher share prices. As shown in the chart below, the valuation of gold stocks relative to gold prices today are much more depressed than the gold price.

- Ray Dalio of Bridgewater Associates sees a “major reversal” in store for the global economy, reports HSBC. The reversal will involve things like falling globalization and free trade, quicker U.S. growth and aggressive government spending. Although gold was not mentioned, the main points of his statement are more likely than not to boost gold, the report continues. Dalio also commented on bonds, saying there’s a significant likelihood that we have made the 30-year low in bond yield and inflation and both have nowhere to go but up.

- In response to Stanley Druckenmiller’s bearish comments on gold, St. Joseph Partners noted in its latest Trading Update what the slightest change in interest rates could mean for investors. “If rates increase 1 percent on 30-year bonds from recent levels, investors would endure an 18 percent loss,” the group writes. They leave their readers with this question, particularly in regards to emerging markets: What assets thrive alongside currency weakness and rising inflation? A consistent answer, they believe, is gold and silver.

Threats

- Concerns over the potential for a gold import ban are prompting some Indian gold traders to place bulk, short-term orders of gold. The Indian Bullion and Jewellers Association has circulated messages to its members that the government may enact such a ban through the end of the fiscal year. The uncertainty in the Indian gold market, after the ban on high-denomination banknotes last week, is exacerbated by the threat of an import ban, and wild swings in the gold price are likely.

- Commerzbank AG noted on Monday that “Gold is still facing considerable headwind.” The bank cited the strong dollar, rising bond yields and declining gold fund holdings, and also noted that speculative investors have withdrawn from gold, which is also putting pressure on prices.

- GFMS analysts at Thomson Reuters this week noted that physical silver demand hit a four-year low this year. Purchases in jewelry, coins and bars have declined. Johann Weibe said in the report that “a decline in discretionary spending, thrifting, lower economic growth and a higher silver price have all contributed to the overall decline.” In 2015, sales of silver coins and bars were at a record high of 292.4 million ounces, while they have fallen to 222 million ounces in 2016.