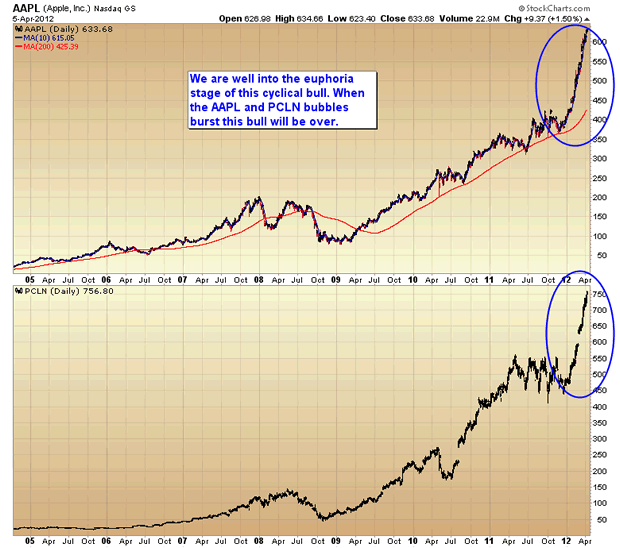

Two stocks, AAPL and PCLN, have been the leaders of this bull market. Both have entered the euphoric “bubble” stage. When the Apple and Priceline parabolas break it will almost certainly signal the end of this bull market.

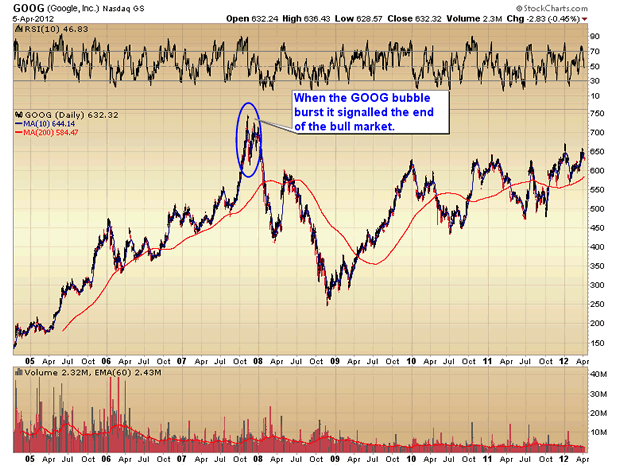

The last bull ended when the leading stock, GOOG, entered a parabolic “bubble” phase. That was the signal that the bull had reached the euphoria stage. When the GOOG bubble popped it signaled the end of the bull market.

Apple is now stretched 49% above the 200 day moving average. Anything between 50 and 60% above the mean is extreme dangerous territory.

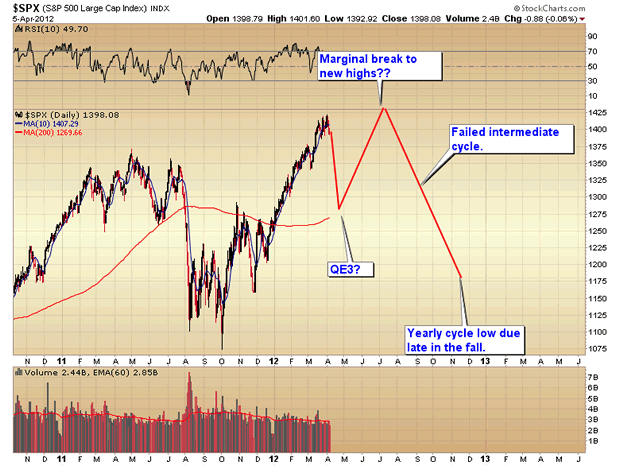

As I pointed out in my last article the dollar is beginning its second daily cycle up in what could very well be a cyclical bull market. This should correspond with the stock market topping and the next leg down in the secular bear market.

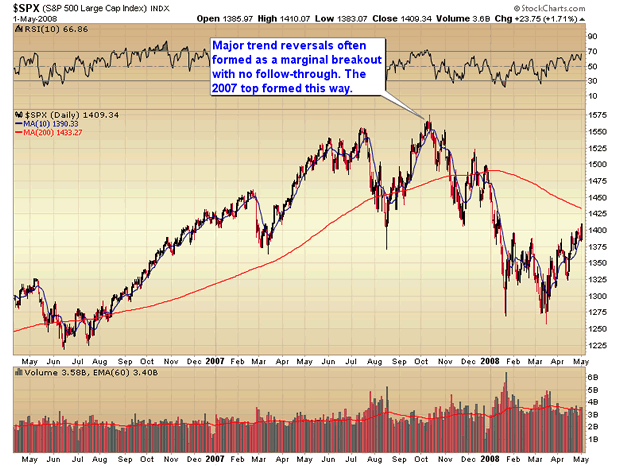

My best guess is that we will see a sharp selloff over the next 2 to 3 weeks, followed by a sharp rebound (QE3) that may, or may not, move stocks to marginal new highs, similar to the 2007 top.

The poor employment report on Friday is the first warning shot across the bow that the economy is slowing in preparation for moving down into the next recession/depression.

Bernanke is in the same position he was in 2007. Printing more money won’t stop the collapse. It will only continue to spike the price of energy and exacerbate the decline.

About Safehaven

At some point in your life you will want to, or be forced to consider an investment program. The main criteria in choosing one that is right for you is summed up in three words “Preservation of Capital”. Sounds pretty simple doesn’t it? Remember, “Investing is not Saving”! The mainstream media would lead us to believe otherwise and seldom comment on the risks inherent in equity ownership or debt investments. They are quick to point out the positive aspects of every news event with prepared soundbites of information. They provide simple, continual commentary on the respective markets to show they are up to date with the latest developments. They don’t comment on developing trends until the trend is obvious to everyone; acting as cheerleaders for the greatest bull market of the twentieth century. A cautious and more reasoned approach is needed.

We are not permabears, nor are we bullish for the foreseeable future. The Stock Market Bubble is not our greatest concern. The Credit Bubble, however, when it inevitably implodes, will wreak havoc on all sectors of the World Economy, including the Stock Market.

The articles from GoldenBar and PrudentBear are all a must read. As a starter, we suggest you read On the Manipulation of Money and Credit by Doug Noland of Prudent Bear and Inflation versus Deflationby Ed Bugos of GoldenBar. These articles help towards an understanding of the Bubble and monetary inflation. GoldenBar articles are published bi-weekly, and PrudentBear is published Wednesday and Friday evenings. Please visit their web sites.

If you have an interest in long-term cycles, then start with Generations and Business Cycles by Michael A. Alexander and Measuring Financial Time: The Magic of Pi by Barclay T. Leib.

Also strongly recommended is David Jensen’s In Denial of Crisis and Antal Fekete’s two series,Revisionist View of the Great Depression and The Goldbug Variations I.

We won’t update every hour of every day- it is not necessary. Bull and bear markets evolve over many months and years, and a single news event has never changed the long-term direction of markets. If you have written an article, if you wish to provide a link to a newsworthy item, or if you have comments, suggestions, or recommendations, please Contact Us.

The site has been kept simple to allow quick download times and to keep problems with old browsers to a minimum. If you are having a problem, please email us and we will try to adjust for your browser or printer.

Enjoy your visit and visit often!