Watching the market’s panicked reaction this morning as the reality of the recent surge in first breakevens then real yields, is finally appreciated by the “cubic zirconium” hands, the momentum chasing algos and the puking CTAs, can’t help but bring a smile to the face of any market cynic who has seen this hilarious market reaction ever so often when markets freak out over a modest if rapid rise in yields (putting the 10Y in perspective, it is at 1.35%, well below any level it traded at prior to the Covid crash of 2020 and financial conditions are still just about the loosest they have ever been).

So, with the world seemingly coming to an end – if only for all those WallStreetBets traders who have never seen a 3% drawdown in their trading careers – here are some very quick words of comfort from Deutsche Bank’s Jim Reid who – unlike so many this morning – gets that there will be no real rise in rates “for the most of our careers.”

Here is Reid:

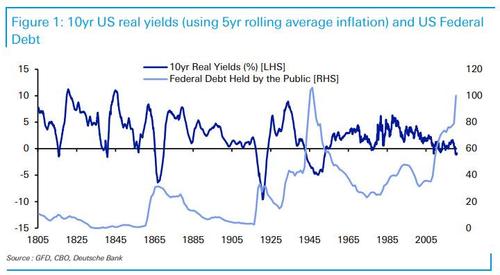

I did a CoTD showing real yields back over 200 years and highlighted that the only time real yields are negative for any period of time are around episodes of high debt. Given today’s debt levels, it’s likely real yields will stay ultra low for as far as the eye can see even if we’re seeing some cyclical pressure now.

And the punchline:

So with debt so high and likely to go notably higher, it is likely that real yields will have to stay artificially low for a very long period of time. Any return to something close to long-term averages would have grave consequences for debt sustainability. The Fed would likely step in well before this point.

Financial repression and QE will likely be alive and well for the rest of most of our careers.

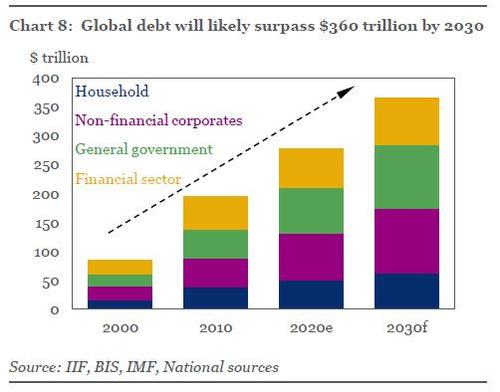

Why this matters? Because as the IIF forecast back in November, “if the global debt pile continues to grow at the average pace of the last 15 years, our back-of-the-envelope estimates suggest that global debt could exceed $360 trillion by 2030—over $85 trillion higher than current levels.”

Needless to say, $360TN in debt will never happen if rates rise from current levels without apocalyptic consequences.

What this means is that the Fed will never again allow rates to go up again or even approach reasonable levels, or else everything – not just stocks – but global economies and society will crash. It also means that the Fed’s nationalization of the bond market which started with purchases of IG bonds and junk ETFs last year alongside the tsunami of liquidity unleashed last March, is about to be complete.

So for everyone panicking about rising rates and liquidating stocks (such as what the CTAs did this morning) over fears of imminent rate hikes… don’t.