Emerging economies including China and India, which are growing several times faster than the U.S., have nevertheless disappointed investors this year. The S&P 500 Index of the U.S. has rallied 22 percent, compared with the benchmark MXEF, MSCI Emerging Markets Index’s 1.46 percent loss.

U.S. stock markets clearly aren’t forward-looking. They’re blind. They’re no longer following fundamentals. They’re bedazzled by only one thing: How much money the Federal Reserve and other central banks will print.Nothing else matters.

Does that mean it’s time for investors seeking long-term value to look outside the U.S.?

With the U.S. economy expected to grow 2 percent a year and the U.K. at 1.5 percent, compared with China expanding at 7.5 percent and India at 5 percent, it may be time to look elsewhere.

Consider this: Other than the U.S. and Germany, all Western markets are lower than they were in 1999. In real-inflation-adjusted terms, even the U.S. and Germany are down about 30 percent.

So far this year, investors have disregarded emerging markets’ economic advantages in favor of focusing on the risks, namely Fed policies that suck capital out of their financial systems like a giant vacuum cleaner and into speculative U.S. assets.

So far this year, investors have disregarded emerging markets’ economic advantages in favor of focusing on the risks, namely Fed policies that suck capital out of their financial systems like a giant vacuum cleaner and into speculative U.S. assets.

However, investors who are focused only on American investments run the risk of missing out over the long run. That’s because the fundamental advantages of emerging markets, particularly in Asia, remain solidly in place, including:

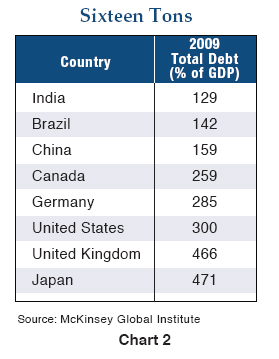

- A strong banking system supported by high personal savings rates. Banks have avoided foolish lending practices and are in a much stronger position to finance economic growth than peers in the developed world.

- Ample foreign-currency reserves with flexible exchange-rate policies.

- Companies with healthy balance sheets.

- Strong growth fundamentals — fast-growing, increasingly richer, middle classes; continuing strong investment in infrastructure that promotes economic growth; generally business-friendly government economic policies.

With forward-looking price-to-earnings ratios for emerging markets now below 10 (compared with almost double that in the U.S.), shares of companies in the emerging world have rarely been so cheap.

As the iconic investor Warren Buffett says: “Price is what you pay, value is what you get.”

Along that line, that’s why I believe the emerging markets have fallen back toward levels that represent good value. While they could continue to lag in the short run, especially if their currencies weaken, it’s my view that patient investors who maintain a balanced portfolio will be well-rewarded.

See Money and Markets‘ Facebook page to get my investment recommendation for emerging markets.

Best wishes,

Bill