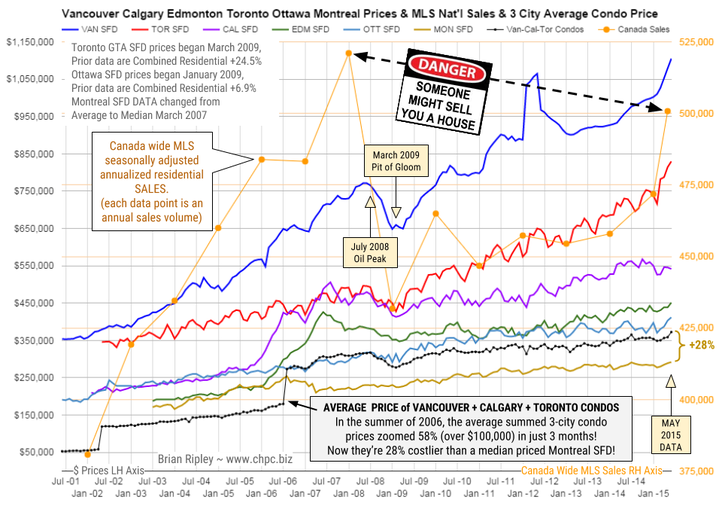

The chart above shows the average detached housing prices for Vancouver, Calgary, Edmonton, Toronto*, Ottawa* and Montréal* (the six Canadian cities with over a million people) as well as the average of the sum of Vancouver, Calgary and Toronto condo (apartment) prices on the left axis. On the right axis is the seasonally adjusted annualized rate (SAAR) of MLS® Residential Sales across Canada.

Check out Brian Ripley’s Plunge-o-meter HERE (The Plunge-O-Meter tracks the dollar and percentage losses from the peak and projects when prices might find support.)

May 2015 Canada’s big city metro SFD prices all caught a bid and only Calgary houses did not set new historic highs. Apparently it’s all about the land that real estate sits on; big money is willing to pay a premium for sitting on it.

Price gains were accomplished on a zoom higher in sales volume of the Canadian national MLS residential annualized housing sales data. Trophy hunters are looking for well located SFD properties in hot markets and the hoi polloi want in before they are priced out.

Can the “posted retail” 5 year fixed rate mortgage low of 4.64% (sub-3% on the street) drive the hunger games into overtime in 2015? Or is the commodity crash signalling an upcoming major correction for Canadian housing? Your opinion is welcome.

Mattress money has gushed into condos with no respect for fundamentals or plan for contingencies that may be required if Pit of Gloom II develops and one must write off capital gains and or rely on employment earnings to subsidize negative yields.