We are going to focus this week on two stories from the property market; one in Canada and one back home here in the UK. Property market analysis is not exactly the main focus of our day job, but these stories may well have important implications for financial markets, which of course is what our day job is all about.

It is no secret with our readers that we have had a bearish fundamental bias for quite some time now. We have tried our very best to supress these bearish feelings as financial prices move further into bubble territory supported by extraordinary central bank policies and also the activities of price insensitive buyers (central banks, companies buying their own shares and index providers). However, we do believe that these forces will ultimately dissipate and that there will one day be another bear market.

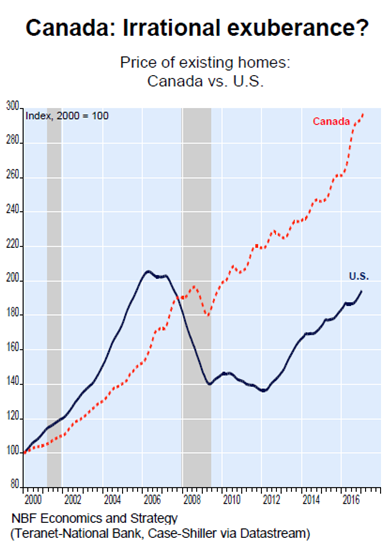

Nobody knows what will be the visible trigger or triggers for the next bear market (academics are still unsure of the cause of the 1987 stock market crash!). We still look back at 2007 and pinpoint the collapse of two highly leveraged Bear Sterns hedge funds in June of that year as the first visible evidence that the financial bubble was bursting (the property bubble began to burst in 2006 in the US). So, we present these two stories as evidence that leveraged speculation by unsophisticated investors is rife today, and that visible problems are emerging.

We will start this week on the story of the collapsing share price of Home Capital Group (HCG), the largest non-bank mortgage lender in Canada. The shares collapsed by over 60% last week after it emerged that the Company had arranged an emergency liquidity line via a C$1.5 billion loan facility. The reason for the liquidity need appears to be some C$600 million of deposits had been withdrawn and they had to plug the gap. As can be seen in chart 1 below, the 60% decline on Wednesday was not the start of the bear market for Home Capital Group; the shares have now fallen by 85% from the 2014 high. In our opinion, this story has an eerie parallel with Northern Rock in 2008 in the UK – a mortgage provider suffering a deposit run.

Chart 1 – Home Capital Group share price