According to many analysts and investors, mining shares have bottomed.

As much as I would like to agree, my view is that mining shares have not bottomed. Instead, the recent rally in mining shares is nothing but a dead-cat bounce that will soon give way to new lows.

There are three solid reasons why I say that.

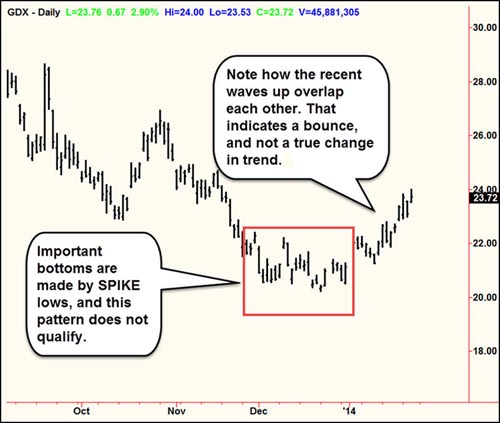

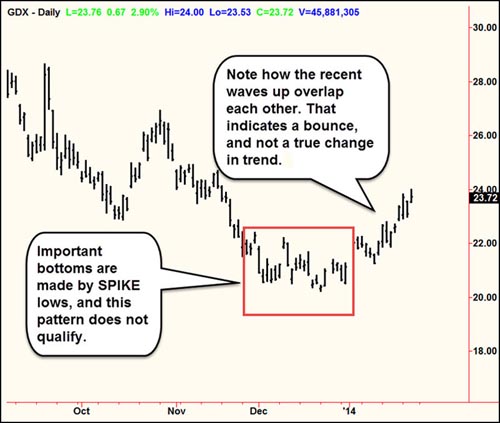

First, the charts of the mining ETFs: Market Vectors Gold Miners ETF (GDX) and Market Vectors Junior Gold Miners ETF (GDXJ).

For GDX, notice two important clues here.

The recent bottoming action had no substantial spike lower. Important bottoms almost always involve a washout spike lower, and there is none here.

Next, notice the recent rally. It’s largely one of two short thrusts higher, but they overlap each other.

That’s not conducive of a major rally. Instead, it’s indicative of a bounce and nothing more.

You can see the same patterns here in the chart of the GDXJ.

Bottom line: Neither of these charts indicates a major low is at hand.

Second, my cycle models for the mining shares. They show that the rally can extend a bit further, but then they are flashing sell signals for Feb. 1, just a few days from now. And by the way, my signal models for GDX and GDXJ show 87.5 percent winning trades for the past five years.

Third, the price of gold. For most producing miners, the current price of gold is below the cost of production. For most miners to become profitable, gold would have to rally to at least $1,400 and stay there.

Third, the price of gold. For most producing miners, the current price of gold is below the cost of production. For most miners to become profitable, gold would have to rally to at least $1,400 and stay there.

That’s not likely to happen, given the recent rally in the metals also appears to be nothing more than a dead-cat bounce and new lows lie on the horizon.

Fourth, the broad stock markets. They are all extremely overbought and extremely vulnerable to a shakeout. You might counter and say that if stocks take a nosedive, contrarian investments like mining shares should explode higher.

In normal times, that may be true. But these aren’t normal times. The back wall of the financial hurricane looms right around the corner. When it hits, mining shares will likely perform the same way they did back in 2008 and 2009, losing as much as half their value in very short order.

Lastly, my signal models have not yet generated any major buy signals. Not on the daily models, or the weekly, or the monthly levels of activity. Until we get at least one weekly buy signal on my models, I’m going to stay on the sidelines because, simply put, the odds favor another leg down to new lows.

So what about gold and silver? Are their recent rallies the start of something bigger? Did I miss the bottom?

My answer: No, the recent rallies do not appear to be the start of something bigger. I do not believe the bottom is in for gold or silver.

Like the mining shares, the recent rally in gold looks more like a bounce than anything else. And while the bounce may continue a tad higher, to as high as $1,289 in gold …

My work shows that the near perfect double bottom in gold at the June 2013 low of $1,178 and the Dec. 31 low of $1,181.40 (both lows basis the continuous nearby futures contract) … will not hold.

Instead, it will give way to another sharp decline, with gold still on target to move below at least $1,100.

The big question, of course, is when. My timing models still show that if gold doesn’t collapse by the end of this month, the next target is May. Yes, that stinks, as it will drag out the bear market, something none of us want to see.

But it is what it is, and I can only convey what the gold market is telling me. It is still not time to buy, gold has not bottomed, and it is far better to wait for the right timing and right price before staking out either conservative or aggressive positions.

As to silver, its action is absolutely pathetic. Its recent rally couldn’t even get it above the first level of major resistance at the $20.50 level. In fact, its recent rally was so weak that the spread between gold and silver has now widened out to nearly 63 to 1.

Pay heed to that, because the last time the gold-to-silver ratio started widening out like that was just before the 2008/2009 financial crisis.

With the back wall of that crisis still out there, the current widening in the ratio could be a leading indicator that the back wall will soon be upon us.

But don’t count on the metals rallying when it hits. In the 2008/2009 front wall of the storm, gold and silver plunged as much as 33 percent.

No, I don’t expect them to fall that much this time around. But my point still stands: I do not believe gold and silver have bottomed yet.

Best wishes,

Larry

About Larry Edelson