U.S. Stock Market – I continue to look for the economy to roll over and whatever “tapering” occurs to be lessen, then halted; then eventually a new “easing” as the economy and jobs slip further than Obama’s popularity. But until the easing and perception that the FED is now “behind” the curve, the stock market is not likely to fall sharply.

U.S. Bonds – Avoid!

Gold – Once again selling large quantities at the worst possible time is taking place, which strongly suggesting the agenda we seen earlier this year is not complete. One of the obvious goals is to demoralize the sentiment. It’s working as I’m fed up with all the manipulation and horrific media response to it. Need to get back above $1,350 fairly soon or the rest of 2013 shall likely be shot.

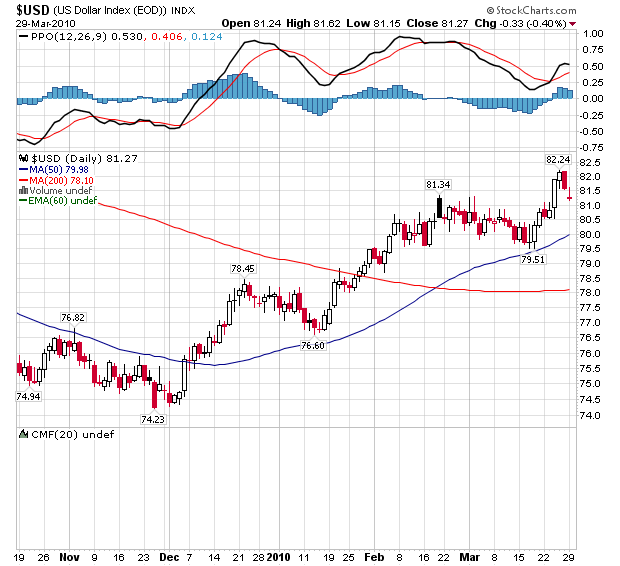

U.S. Dollar – How long will it remain like kissing your sister? Your guess is as good as mine.

Mining and Exploration Shares – While the price movement of gold shall have a direct impact on the mining shares, the further one goes down the food chain in the juniors, the darker the outlook becomes. I’ve said it for many, many months now and sadly it continues to play out – the junior resource market is on life-support and at best, it shall be 2014 before we see any sustained lift – if at all.

I can assure you this belief of mine doesn’t help business or my own portfolio but in all cases – the truth shall always set you free.