….Oil & Gas Spike

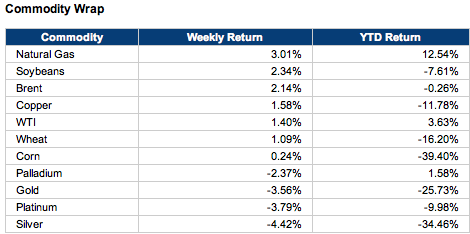

Energy outperformed, while precious metals underperformed.

Precious metals plunged, but other commodities rose this week on the back of strong economic data. Stocks, as measured by the S&P 500, edged up fractionally. The stock index was last trading close to record highs above 1,800—up 26.3 percent since the start of the year.

Macroeconomic Highlights

On Wednesday, the Fed released the minutes to the Oct. 30 FOMC meeting, which indicated that the central bank could taper its quantitative-easing program in the coming months.

According to the Fed minutes, “if economic conditions warranted, the Committee could decide to slow the pace of purchases at one of its next few meetings.”

Of course, that’s not necessarily surprising—market participants have been expecting the Fed to scale back its purchases. The only question is whether it happens at the December meeting or at another meeting early next year. That still remains unclear.

Meanwhile, strong economic data also lent credence to the view that the Fed could take action soon. The U.S. Census Bureau reported that retail sales in October rose by 0.4 percent, much better than the 0.1 percent increase that was expected.

At the same time, the Department of Labor said that the number of people filing for unemployment benefits fell from 344K to 323K last week, also better than expected.

On the flip side, a mild inflation reading suggested that there was no urgency for the Fed to rein in stimulus. The Bureau of Labor Statistics said that the Consumer Price Index in the U.S. actually fell by 0.1 percent in October due to declining food and energy prices. Economists had expected no change. Core prices (excluding food and energy) grew by 0.1 percent, as expected. On a year-over-year basis, the headline and core CPIs were up by 1 percent and 1.7 percent, respectively.

Finally, in housing news, the National Association of Realtors said that existing home sales slipped from 5.29 million to 5.12 million units annualized in October.

….much more HERE