The U.S. Dollar is positioned between points 3 and 4 on the monthly chart and around point F on the daily charts. Assuming that support holds close to this month’s lows, the upside target is 93 within the next two years (33 months from the May 2011 low).

The recent four-week correction fit the parameters of 1981 and 1996 well:

- Tested 89-day exponential moving average

- Tested 34-day Bollinger Band

- Generated RSI(14) of 36

- Retraced 49% of the rally from October

First resistance is at 80.50. A failure to close through there could result in another test of support around 78.25. Next target is the upper channel line at 84.

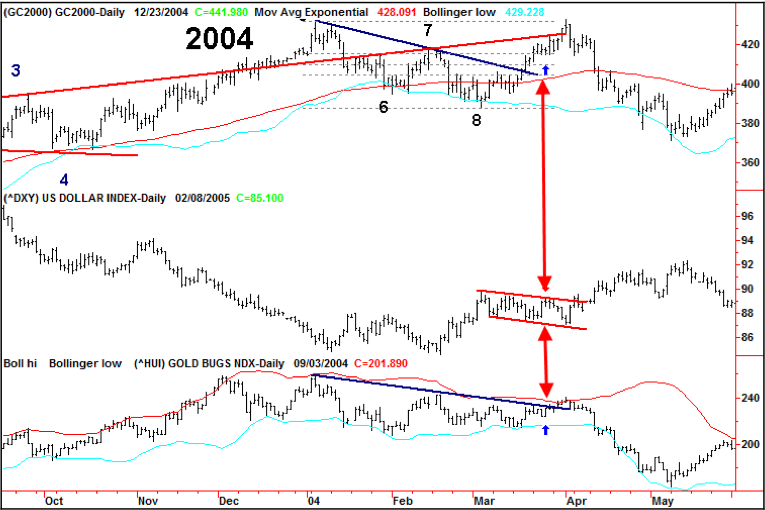

Gold, HUI and the Dollar also continue to track the 2004 model. Therefore, we now recommend that traders view last week’s lows as the critical support in gold and the miners. Independently, timing models point towards a late February to early March high in gold.

The correlation of Gold’s decade long bull market with the 1976-80 run from $100 to $850 continues to center around the action of the U.S. Dollar. The current price patterns relate to November 8, 1979. A close above 81 in the Dollar and a close below $1640 in gold would be outside the model. However, a close below 78 would be a catalyst for upside action in virtually all asset classes (except T-Bonds).

CHARTWORKS – 2/19/2012

BOB HOYE, INSTITUTIONAL ADVISORS

EMAIL bobhoye@institutionaladvisors.com” data-mce-href=”mailto:bobhoye@institutionaladvisors.com“>bobhoye@institutionaladvisors.com

The opinions in this report are solely those of the author. The information herein was obtained from various sources; however we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized.

Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures contracts. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report. In addition, investors in securities such as ADRs, whose values are influenced by the currency of the underlying security, effectively assume currency risk. Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications.