Seasonality refers to particular time frames when stocks/sectors/indices are subjected to and influenced by recurring tendencies that produce patterns that are apparent in the investment valuation. Tendencies can range from weather events (temperature in winter vs. summer, probability of inclement conditions, etc.) to calendar events (quarterly reporting expectations, announcements, etc.). The key is that the tendency is recurring and provides a sustainable probability of performing in a manner consistent to previous results.

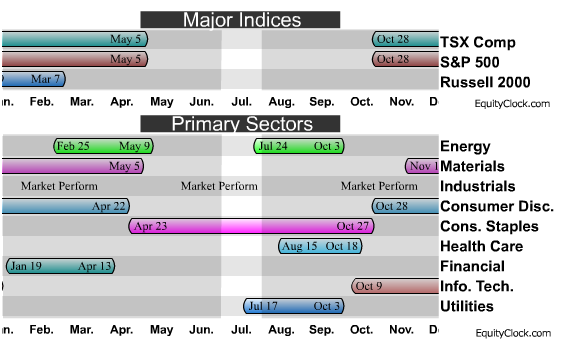

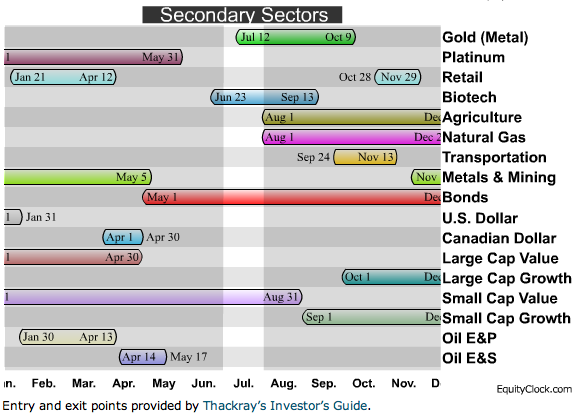

Identified below are the periods of seasonal strength for each market segment, as identified by Brooke Thackray. Each bar will indicate a buy and sell date based upon the optimal holding period for each market sector/index.

A seasonality study preferably uses at least 10 years of data. Most of our studies use 10-20 years of data, however, data may not always be available for periods greater than 10 years in length. Studies using less than ten years of data can be used, but they tend to be less reliable. Results of shorter term studies have a higher chance of being skewed by a single data point.

About Equity Clock

Equity Clock is a division of the Tech Talk Financial Network, a market analysis company that provides technical, fundamental and seasonality analysis on a daily basis via TimingTheMarkets.com andEquityClock.com. Equity Clock’s mission is to identify periods of reoccurring strength among individual equities in the market using methodologies presented by some of the top analysts in the industry, including that of Don Vialoux, author of TimingTheMarkets.com.

Feel free to use any of the content or seasonality studies (charts, timelines, or otherwise) presented as long as a link-back to this site at EquityClock.com is provided.

For further information on indicators used in reports presented on this site, please visit our reference page.

Horizons AlphaPro Seasonal Rotation ETF (HAC)

Interested in the methodologies and strategies presented by Tech Talk? The Horizons AlphaPro Seasonal Rotation ETF (trading on the Toronto Stock Exchange under symbol HAC) uses a proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux and Brooke Thackray. The strategy’s core position consists of broad markets at seasonally favourable times of the year and money market securities at seasonally unfavourable times of the year. The strategy allocates from the core portfolio to various sectors when those sectors offer favourable opportunities. Rotating a portfolio in anticipation of these opportunities is designed to deliver returns that are superior to a static investment in broad markets. As seasonal periods are never the same, this investment strategy is supported by additional fundamental and technical analysis.

For more information, Click Here.