Gold has been taking a battering all day (written Monday April 15th). Gold is off 8.5% to $1,373.80 an ounce.

Gold has been taking a battering all day (written Monday April 15th). Gold is off 8.5% to $1,373.80 an ounce.

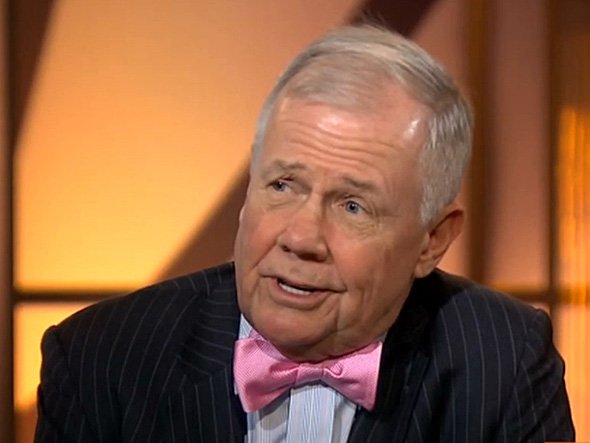

Commodities guru Jim Rogers isn’t buying gold yet.

He told Business Insider there were four key things driving the sell-off.

- India – The country hiked its gold import tax rate by 50% to 6% at the start of the year. This has curbed gold demand.

- Chartists – Technical analysts that have warned that gold prices will continue to fall.

- Cyprus – “Ms. Merkel is seeking re-election so she has told Cyprus and others that they should sell some of their gold to pay their debts. The Germans are tired of bailing people out and she needs to be tough.”

- Bitcoins – “The collapse of Bitcoin since most of them also own gold.”

Rogers said he hasn’t hedged his positions at the moment.

“I have repeatedly babbled about $1200-1300, but that is just because that would be a 30-35% correction which is normal in markets,” he told Business Insider. “But I am a hopeless market timer/trader.”

Rogers said he expects gold prices to fall further for the “foreseeable future” but expects “gold to eventually go higher over the decade.”

Read more: http://www.businessinsider.com/jim-rogers-normal-gold-price-correction-2013-4#ixzz2QT4nmXJv