“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” — Seth Klarman

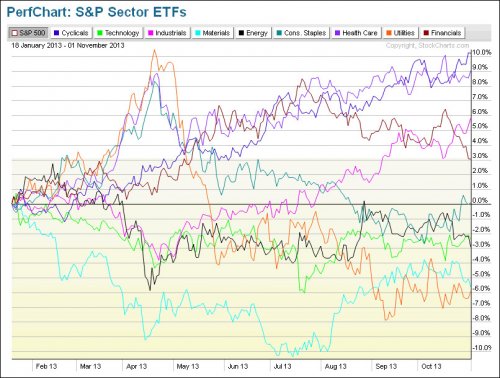

I thought we would take a look at sector performance for 2013 to get an idea of where money has been flowing. The chart below shows the performance of the S&P Sector ETFs in relation to the performance of the S&P 500. Sectors above the 0% line have outperformed the S&P 500 by the percent shown and sectors below the 0% line have underperformed the index by the percent shown.

As of yesterday, Cyclicals (dark purple line) have been the strongest performing sector year-to-date. This is a good sign if you buy into the general sector rotation thesis which underscores buying cyclicals when the economy is growing and moving money back to defensive names (like consumer staples, utilities) during economic downturns.

For those who need more logic behind this, the idea is that some companies like Ford will perform much better in a booming economy when consumers are spending heavily. These are considered cyclical companies because they tend to outperform when the business cycle is booming. Other companies, such as Proctor & Gamble, produce products (like toothpaste) which have relatively static demand regardless of where we are in the business cycle. These types of companies generally perform better in down economies.

….read more HERE