Most of the boom in North America’s tight oil production so far has come from the Bakken formation in North Dakota. But Texas, the biggest producer in The Union, is experiencing a huge increase—in fact, a 230-fold increase in tight oil crude output over the past three years. And it’s just getting started.

Two new tight oil plays in south Texas are attracting a lot of investor and industry attention—the Eagle Ford and the Eaglebine.

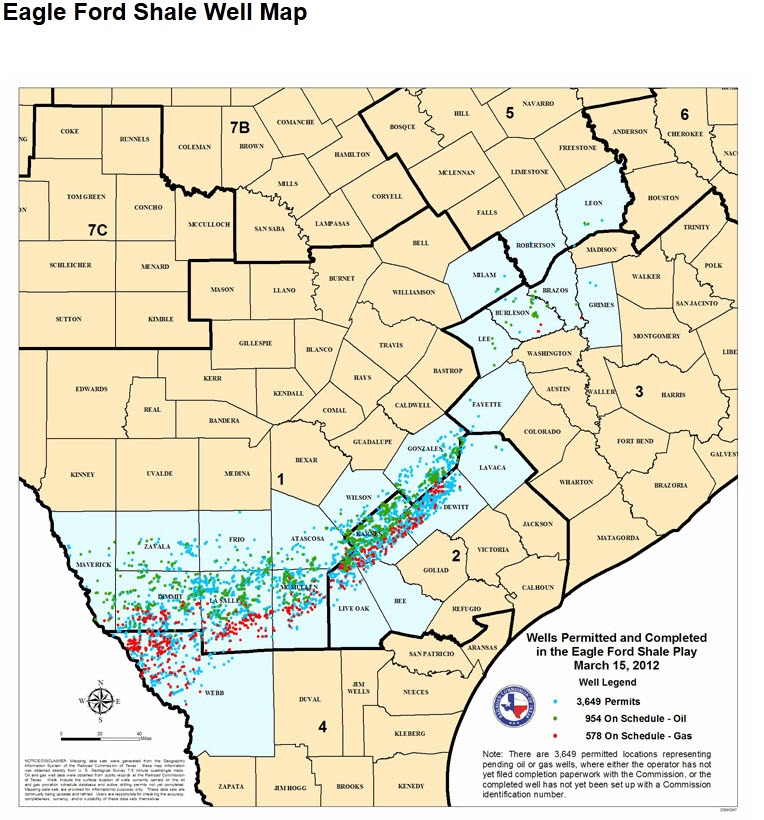

THE EAGLE FORD

The Eagle Ford has gone from obscurity in 2008 to now being the #3 play in all the United States (based on number of rigs drilling), after the Permian Basin in southwest Texas and the Bakken.

Pioneer Natural Resources (PXD-NYSE) says they get a 70% pre-tax rate of return at Eagle Ford. EOG Resources (EOG-NYSE) says it’s 80% for them.

Marathon Oil (MRO-NYSE) says it’s over 100% for them on some condensate wells (condensate is a Natural Gas Liquid that’s really more like a very light oil and often gets a better price than oil).

The formation is 400 miles long and 50 miles wide with an average thickness of 250 feet—thicker than the North Dakota Bakken. It is estimated that the Eagle Ford formation has a total recoverable resource of roughly 3 billion barrels of liquids (that’s oil and some NGLs) with a potential output of 420,000 barrels a day (bopd).

In the western part of Eagle Ford, oil is dominant with about 78% oil, 11% natural gas liquids and 11% dry gas, while the eastern part has a higher percentage of dry gas.

This high oil and liquids content (think propane that goes in your BBQ, or butane that goes into a cigarette lighter) make the Eagle Ford a very profitable play.

…read more HERE, including the list of Energy Companies operating in the Eagle Ford/Eablebine