Most people are risk averse because it’s been bred in them from early childhood. Protective parents caution their children “Don’t climb that tree, you might fall.” “Be careful of that dog, it might bite you.” That caution carries over into early adulthood and then into the workplace, where “don’t rock the boat” makes the most sense. Is it any wonder that when it comes to investing people are subjected to two conflicting ideals? One is to make as much money as possible, and the other is to take as little risk as possible to achieve this. How can this be done? Well, it can’t. Many people resort to professional money management in their desire to achieve these diverse aims.

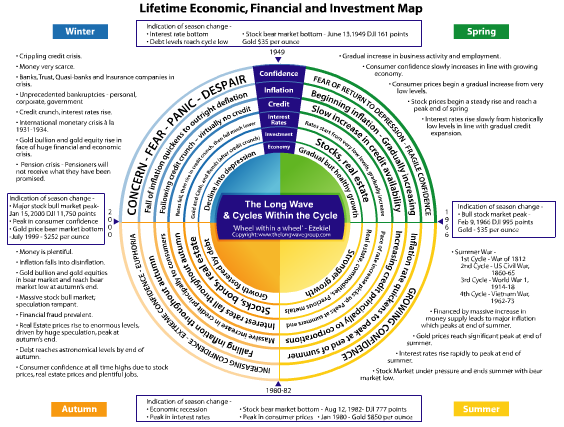

Even the best money manager will fail if the investment cycle is not with him or her. A major benefit of understanding the Kondratieff cycle is that it allows us to make lower risk investments in each of the four Kondratieff seasons. In each of the seasons there are appropriate and inappropriate investment mediums. For example, in the Kondratieff autumn, stocks, bonds and real estate make the best investments, whereas investing in gold and gold stocks are high risk. The opposite is true for the Kondratieff winter. The trick is recognizing where we are in the cycle. Fortunately there are events that provide us with that information. For example, we know when the great bull markets in stocks, bonds and real estate are about to commence in sync with the onset of the Kondratieff autumn. Four events precede this: the peak in interest rates, the peak in prices, a bear market in stocks, and a recession. These events occurred between 1980 and 1982 and similarly between 1920 and 1921. Following those events one could have invested in real estate, bonds and, in particular, stocks, with the confidence that these three investments were about to begin the biggest bull market of a lifetime.

Important: Click HERE or on image for functioning Chart below

……read more HERE