By John Rubino on April 17, 2012

The in-laws own a gas station in Miami that they’ve wanted to sell for years. But they dithered when the market was hot and ended up being stuck with it when interest evaporated in 2009.

Lately, though, the phone has begun to ring again. It’s not exactly a feeding frenzy but real offers are coming from legitimate buyers for the first time in three years.

That’s actually a pretty good description of real estate in general, where low interest rates have convinced a growing number of people that it’s time to buy. See this upbeat story on the home builders:

Pulte, Lennar jump as survey shows housing rebound

NEW YORK (MarketWatch) — Shares of U.S. homebuilders rallied on Wednesday after a Wells Fargo analyst’s research report said data from 20 select markets nationwide are showing strength across the board.

“For the third consecutive month, our survey points to an improvement in orders suggesting 2012 may be the long-awaited recovery year for housing,” the note said.

PulteGroup PHM -1.39% added more than 8%, Lennar Corp. LEN -1.47% gained 5%, D.R. Horton DHI -2.44% rose 4.2% and Toll Bros. TOL -0.86% gained 3.8%.

The bellwether industry ETF, the iShares Dow Jones U.S. Home Construction Index Fund ITB rose 3.4%.

Wells Fargo’s monthly Neighborhood Watch Survey, which tracks 150 sales managers at housing tracts in 20 markets, showed that March results were strong across all measured metrics. In particular, the survey noted that March’s numbers surpassed poll participants’ expectations by the widest margin since the survey started, in 2001.

Wells said that pricing in the 20 markets also improved, both month-to-month and over year-ago figures. Sales managers’ commentary on market activity indicated that buyer confidence seems to be improving as inventory shrinks.

“Sales managers suggested there is a sense of urgency in the marketplace as buyers anticipate higher home prices and/or mortgage rates,” the report said.

Bidding wars are even returning to some markets:

Market squeezing homebuyers

Home shopper Dian Schneider was four houses in on a whirlwind tour of local homes for sale Friday when her real estate agent issued her a warning.

“Now if you like this one you’ll need to move today because there are already two offers on it, and they’re both above list price,” said Anna Hernandez of McKinzie Nielsen Real Estate. “They’re not crazy high, but you’ll have to go in high, too, if you’re serious about it.”

Schneider nodded knowingly as she peeked inside closets, flushed toilets and opened cabinet doors.

The 50-year-old single mom had already missed out on two homes she’d made offers on. She was outbid on one, and pulled out of a second over concerns about its dated electrical system.

“In hindsight, I probably should have taken that one,” Schneider said.

Almost all the available inventory in her price range is badly in need of repairs, and upgrading the electrical on the home she passed up wouldn’t have cost as much as she’d assumed, she later learned. But back then, she didn’t fully appreciate how lucky she’d been to find something.

The Bakersfield area had only 583 single-family homes for sale in March, about a third fewer than in March of last year.

Bidding war return

The result has been fierce bidding wars and almost immediate turnover for anything of quality that’s priced reasonably, whether it’s a modest starter home or a mansion.

“Everybody’s pretty much in the same boat right now, regardless of price,” said Robert Morris, who sells for Watson Realty ERA. “The supply keeps dropping and dropping and there’s nothing replacing it.”

Broker Nancy Harper of Nancy Harper Realty recalled listing a home the day before Easter. By Easter Sunday, it had six offers on it, and when she called the losing agents to tell them their offers had been rejected, two of them burst into tears.

“They told me they’d written something like 14 offers for clients and just couldn’t get one accepted,” Harper said. “When you have agents bursting into tears, boy, that’s low inventory.”

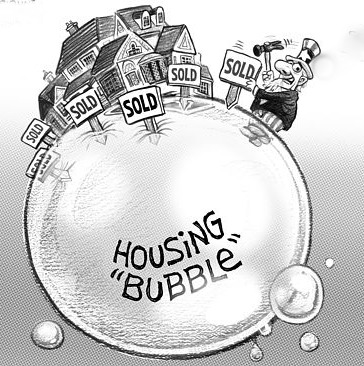

So is the housing bubble back?

To Read More CLICK HERE