“Those of us who have been in combat during any war know the idiocy and tragedy of a world where man is pitted against man. My feeling is that at some future time, we will look back at the current age and shake our heads at its savagery and stupidity … The changes coming, I am convinced, will be harsh. And in the end, for the better of mankind.

The Godfather of newsletter writers, 89 yr old Richard Russell who has never taken a day off since he began writing in 1958 went on:

A few thoughts about gold. Never buy gold for a profit, gold is a measure of wealth. Count your gold holdings in the number of ounces, not the current worth in dollars. You don’t price the home you live in every day, or with each passing week. Nor should you price your gold holdings in dollars with each passing day. Gold is a timeless wealth asset; an asset that will have a value with the passing of time.

Remember this: Of the original issues that made up the Industrial Average, only one remains. And that stock is General Electric. And what happened to all the rest? In investing, nothing is permanent except gold. But remember, do not buy gold with the idea of making a profit. Buy gold because it is pure wealth, and may be the last man standing.

Late Notes — With gold down 3 points today, the gold mining stocks were all down. This is tax loss selling. Keep your eye on the bullion price. The Dow continues to push up as expected, although warnings are coming out of the woodwork from every direction. Money managers are afraid to leave the festivities so they will stay with the market until the bitter end.

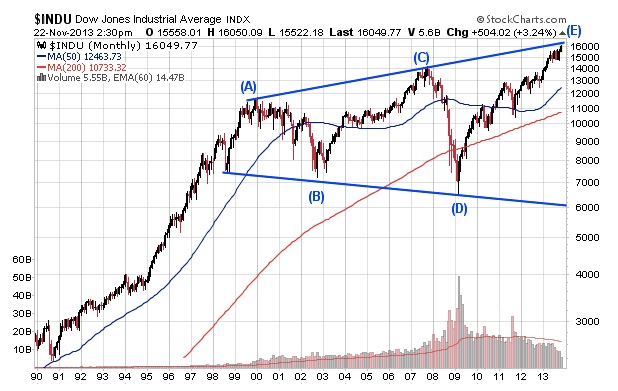

Remember that megaphone pattern in the Dow? We’re now at the upper trendline. This could take the Dow as high as 17,000 to complete the pattern.

Between the technical position of the market and the uncertain position of the fed, we can expect erratic and hard to analyze action in the coming weeks.

At such a crucial area, I expect the market to be irregular and unstable. Also, the Dow has just closed above 16,000 and this can act like a high wire. The main trend continues higher and the melt-up that I expect still lies ahead. Speculative positions in the DIAs can be held.

………………………………….

Russell added: “The watch on watches. The ads are loaded with announcements for expensive watches. It seems that every big designer has his own brand of watch for sale. Why? The mark-up on watches is absolutely huge. They can be made in Switzerland, Japan or China.

Only two brands are worth anything — Rolex or Patek Philippe.

Do yourself a favor — send for the Stauer catalogue and look it over. I’ve bought dozens of watches (gifts) from this outfit, and they are eye-openers. They sell for around $200 and they compete with the multi-thousand dollar watches that you see advertised everywhere. A designer can order 500 watches and mark them up hugely. Then if they don’t sell, he can dump his unsold inventory and recoup his losses. Buying expensive designer watches is a sucker’s game.”

To subscribe to Richard Russell’s Dow Theory Letters CLICK HERE.

About Richard Russell

Russell began publishing Dow Theory Letters in 1958, and he has been writing the Letters ever since (never once having skipped a Letter). Dow Theory Letters is the oldest service continuously written by one person in the business.

Russell gained wide recognition via a series of over 30 Dow Theory and technical articles that he wrote for Barron’s during the late-’50s through the ’90s. Through Barron’s and via word of mouth, he gained a wide following. Russell was the first (in 1960) to recommend gold stocks. He called the top of the 1949-’66 bull market. And almost to the day he called the bottom of the great 1972-’74 bear market, and the beginning of the great bull market which started in December 1974.

Letters are published and mailed every three weeks. We offer a TRIAL (two consecutive up-to-date issues) for $1.00 (same price that was originally charged in 1958). Trials, please one time only. Mail your $1.00 check to: Dow Theory Letters, PO Box 1759, La Jolla, CA 92038 (annual cost of a subscription is $300, tax deductible if ordered through your business).