Reasonable places to buy a correcting Gold Market, the author makes the case for Predicting Major Turning points for Gold – Editor Money Talks

Gold Projection by the Golden Ratio

This article shows how Gold has been following the Golden Ratio which predicted all the major turning points with a high degree of accuracy for the past thirty years, and reveals the next possible major turning points. The Golden Ratio 1.618034… (also called the Golden Number, the Golden Section or the Golden Mean) can be found everywhere around us from mathematics to architecture, from nature to our own anatomy. But as you can see in the following analysis, it can also be found in the Gold Metal Charts.

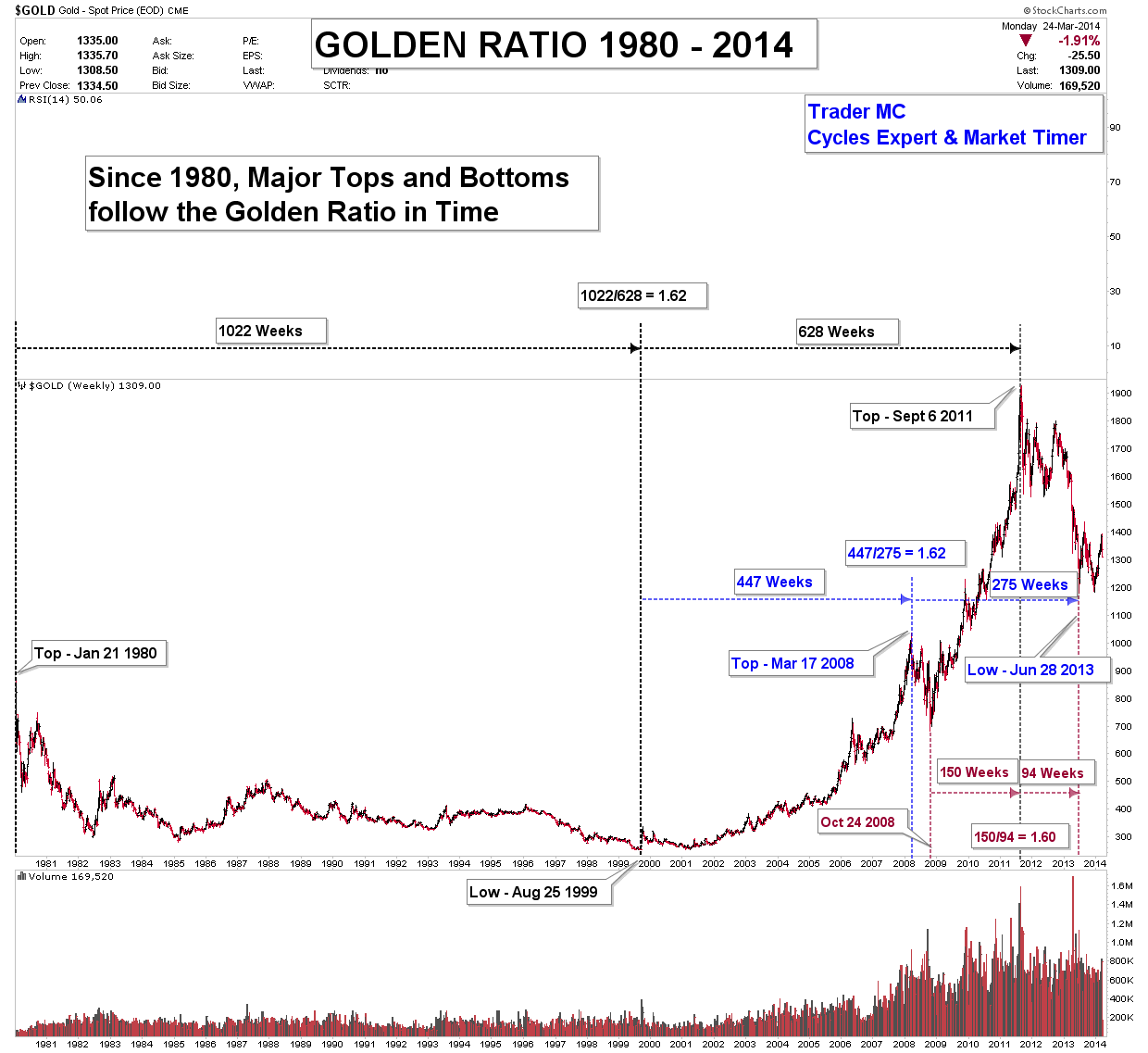

The first chart presents the Secular Bear Market from 1980 to 1999 and the Cyclical Bull Market from 1999 to 2011 and shows how they are connected to the Golden Ratio 1.618. Firstly, you can see that the three most important turning points (1980 top – 1999 low – 2011 top) had a time duration which is accurately connected to the Golden Ratio. It is also interesting to note that the Golden Ratio has an inverse correlation with the previous turning point (high-low-high).

Secondly, the first leg up of the Cyclical Bull Market from the low on August 25, 1999 to the top of March 17, 2008 predicted exactly the low on June 28, 2013. Here again, the Golden Ratio has an inverse correlation with the previous turning point (low-high-low).

Thirdly, the second leg up of the Cyclical Bull Market – from the low on October 24, 2008, to the top on September 6, 2011 – pinpointed also the low on June 28, 2013 and once again, the correlation is inverted (low-high-low). (click image for larger view)

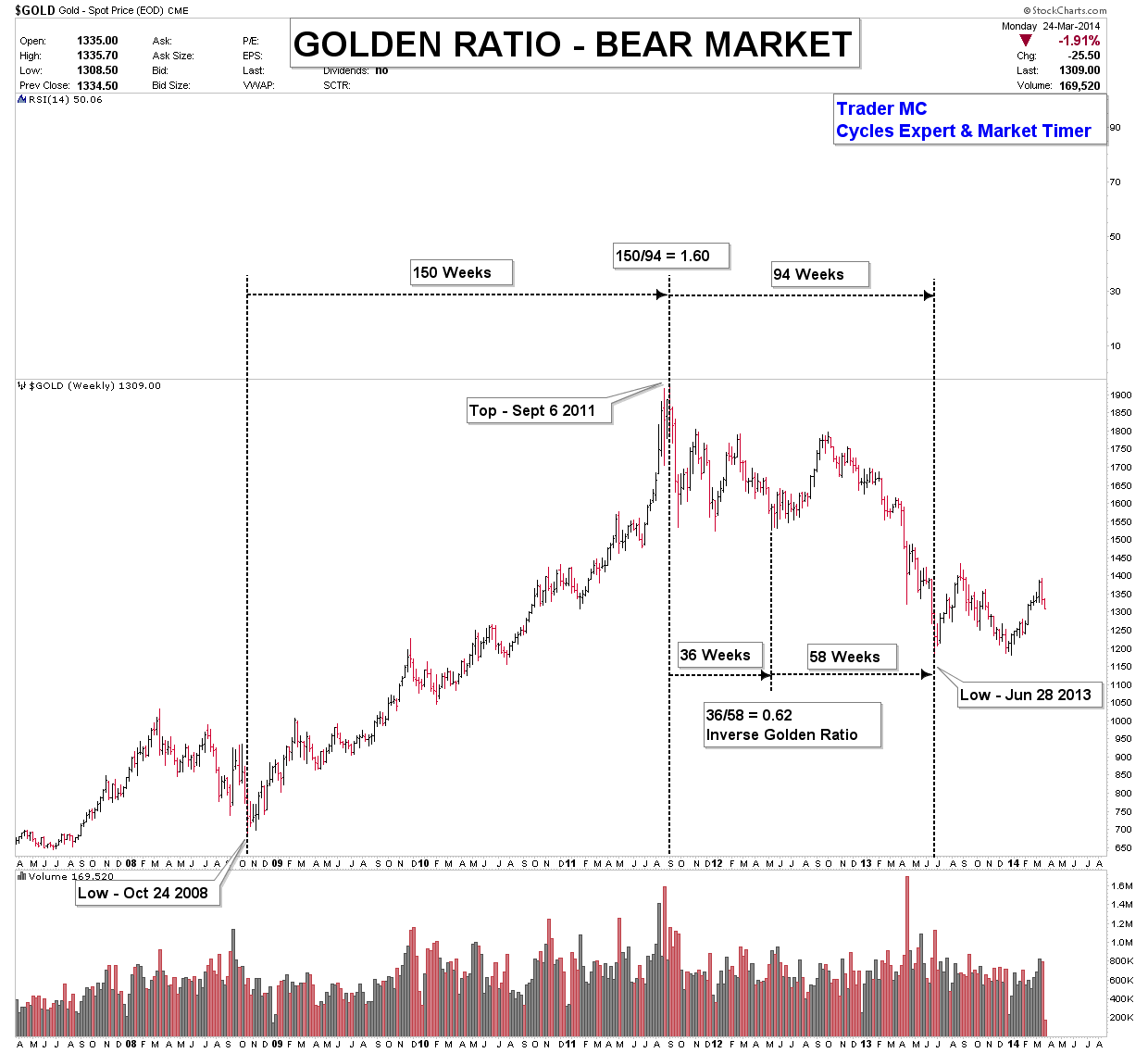

The next chart shows the Cyclical Bear Market from the 2011 top to the 2013 low. A look at the time duration of the tops and lows of this bear market reveals that it has an inverse correlation with the Golden Ratio. Contrary to the bull market, the bear market follows the 0.62 ratio which is the inverse of the Golden Ratio (1/1.618=0.62). We can also notice that the alternate relation between highs and lows is broken (high-low-low). (click image for larger view)

As we can see, every turning point has been predicted by the Golden Ratio for the last thirty years. The charts are showing that these turning points did not happen by coincidence but followed a precise Golden Ratio road map. This ratio can therefore also be used to project the next important market turning points.

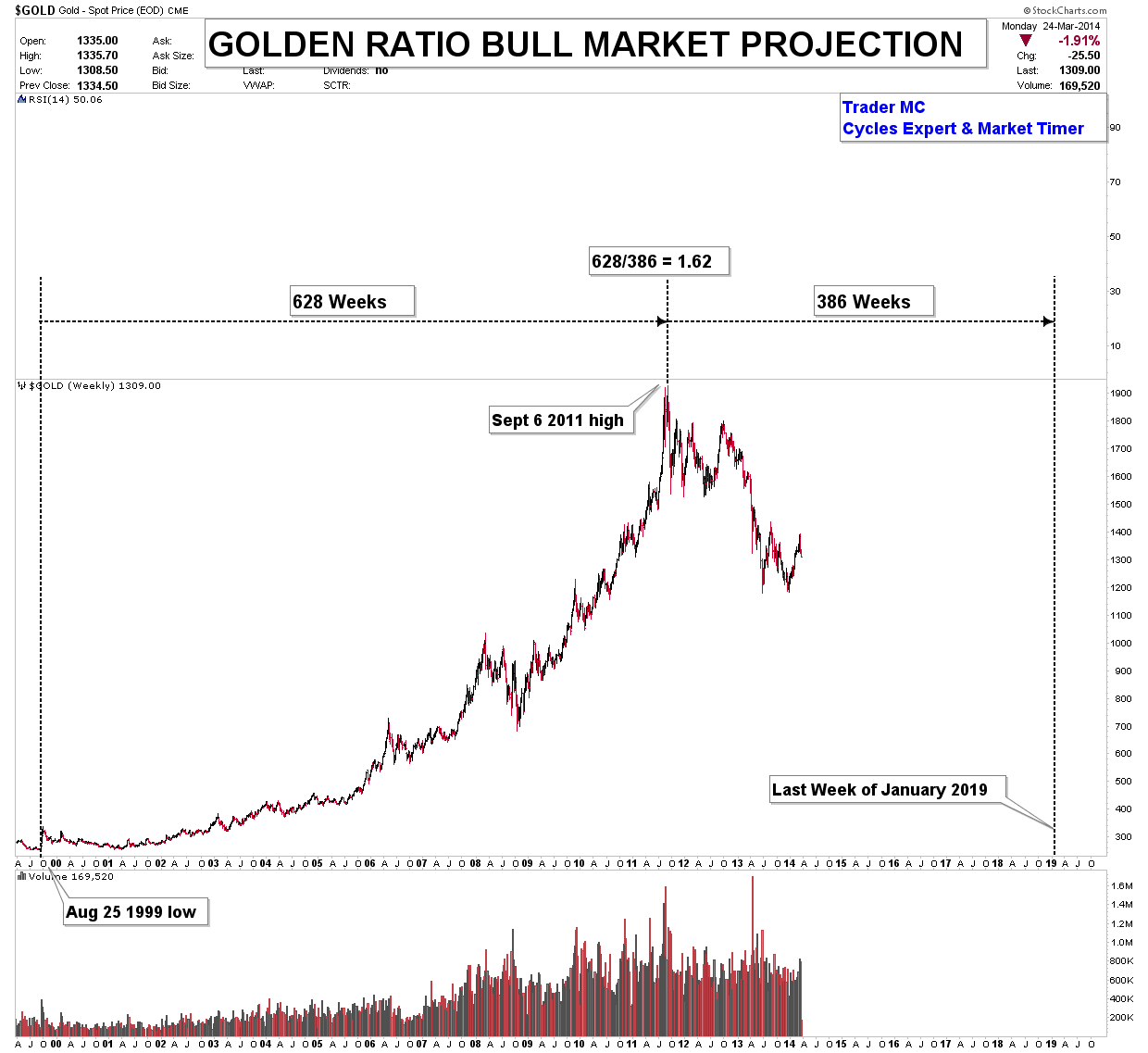

On the following charts you can see a projection upon studying the tops and lows of the previous bull and bear markets. The entire leg up of the Cyclical Bull Market from the low on August 25, 1999 to the top on September 6, 2011, is pinpointing an important market turn date during the last week of January 2019.

(click image for larger view)

As for the Cyclical Bear Market from the 2011 high to the 2013 low, it is forecasting two possible turning points, as I also take into account the Inverse Golden Ratio which pinpointed the highs and lows of the previous bear market. We can see that the first turning point could happen during the first week of August 2014 (Golden Ratio) and the second one during the third week of May 2016 (Inverse Golden Ratio).

(click image for larger view)

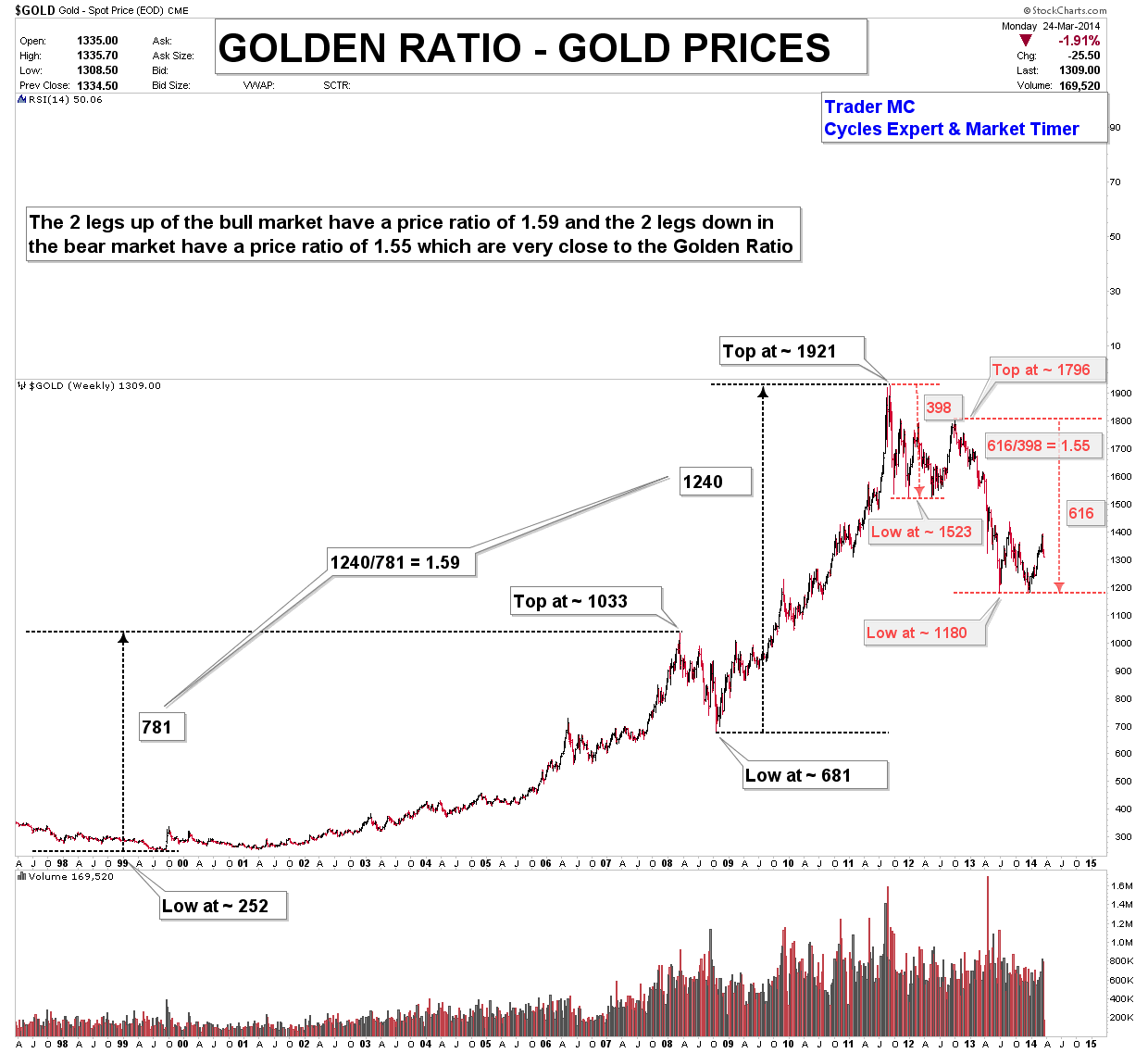

If the Golden Ratio has an important role for the time period, my analyses on Gold prices also reveals that prices of both legs up of the Cyclical Bull Market and of both legs down of the Cyclical Bear Market are connected to the Golden Ratio 1.618.

The Correlation of Price is a little less accurate than the one for Time Duration but it is still very relevant. A measure move with round numbers of the first leg up and the second leg up of the Cyclical Bull Market presents that both legs up have a price ratio of 1.59 which is very close to 1.618. The two legs down of the bear market are also very close to the Golden Ratio (7 points less than 1.62).

(click image for larger view)

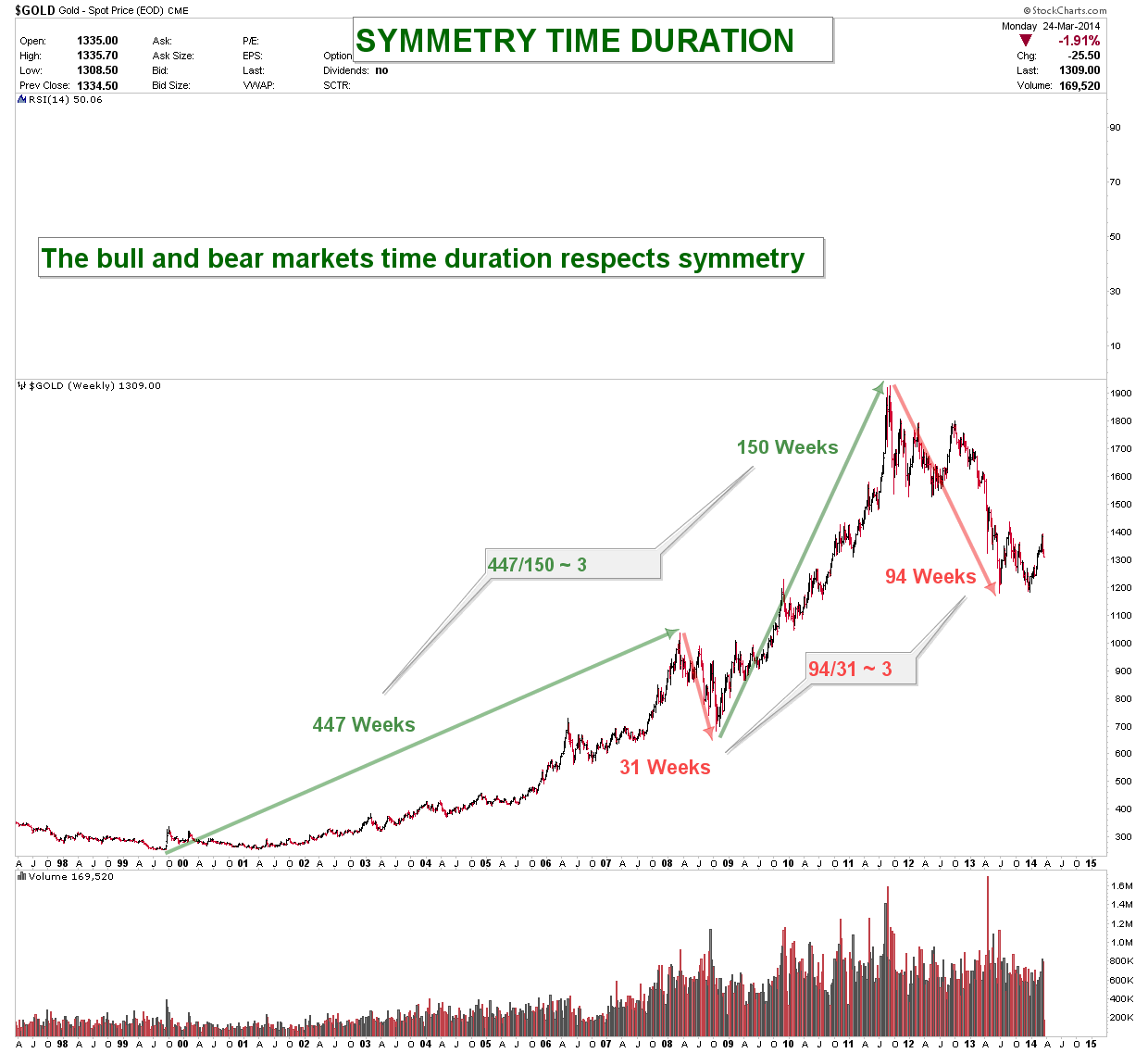

As all the major turning points were predicted by the Golden Ratio both in terms of Price and Time, we can also note that Gold Time Duration is well balanced. The second leg up of the bull market lasted three times less that the first leg up, whereas the second correction lasted three times longer than the first one. The dynamic symmetry is therefore completed. The geometry of Time Dimension has an important role in the market structure, as the market likes geometry both in Price and Time.

(click image for larger view)

The Golden Ratio has accurately predicted all the Gold major turning points these last thirty years and it seems reliable for making future projections. It is one of the techniques that can be used but the most important is to understand the structure and the rhythm of the market to forecast future developments not only in terms of the dimension of Price but also of the dimension of Time. Studying the history of the market is essential to bring superior returns.

LEGAL DISCLAIMER: