GOLD – ACTION ALERT – BUY

Continue to look to take delivery of the physical metals on further weakness. The gold/silver snake is coiling. The ‘gangsters’ at the Plunge Protection Team, JP Morgan Chase, and the CME will do their best to drive prices lower, but will get ‘bit’ by a venomous and revengeful market. There will be no tears here.

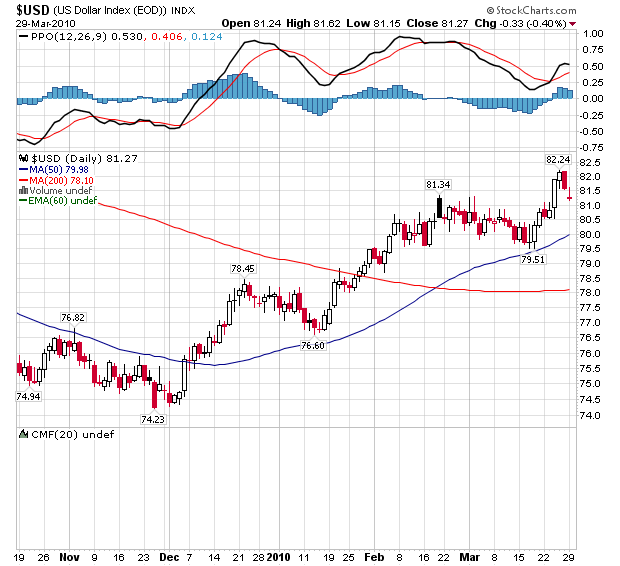

Gold and silver were recently knocked down to distract from the Greek bond default and that there is a huge movement away from the U.S. dollar as a trade settlement currency. The United States is waging economic nuclear war against Iran and threatening to do the same against India and is likely to suffer similar counterattack against its own vulnerabilities, and a lot more.

We may have hit support levels in both gold and silver, but I am awaiting further confirmation that lows are in place. Such lows may only be trading lows. Recall, we’ve entered a negative ‘seasonal’ time of year for gold and silver that could carry into the summer. There is, however, the possibility of another shot higher into May, but I would hope upside volume would confirm the advent of that move. Except for those of us who are long-term holders or for those who have no positions whatsoever, there is nothing to do here without a renewed upside trigger.

I urge you to subscribe to my VR Gold Letter for much greater detail at www.vrgoldletter.com. Call our office, we can offer you a discount for subscribing to more than one service.

For now, I am as psychologically prepared to see silver at 20 as to see it at 60 in the next twelve months. The big numbers for silver are 26 support and 37.60 resistance. The big numbers for gold are 1521 support and 1792 resistance – above which we could see 2500. As Ed Hart used to say on the old Financial News Network in the 1980s, ‘we will know in the fullness of time’.

VRTRADER.COM Trial Signup:

THE RENEWAL OF YOUR SUBSCRIPTION IS AUTOMATIC. YOUR CREDIT CARD WILL CONTINUE TO BE BILLED UNLESS YOU NOTIFY VRtrader.com SEVEN DAYS PRIOR TO SUBSCRIPTION EXPIRATION EITHER VIA EMAIL POSTING THE WORD ‘UNSUBSCRIBE’ IN THE SUBJECT BOX OR TELEPHONE US AT (928) 282-1275 OF CANCELLATION. NO REFUNDS ARE AVAILABLE ON SILVER, PLATINUM OR VR FORECASTER (ANNUAL FORECAST MODEL) SUBSCRIPTIONS.

Welcome and congratulations on choosing VRTrader.com as a source for your stock market commentary, information and analysis for the U.S. Stock Market. Needless to say we are very happy that you are joining us for AT LEAST the next 30 days days and look forward to providing you rewarding and inciteful information that will help you toward your goal of succeeding in the markets.

Here is the Special Trial Offer: Use this month to kick our tires. Pay 50% for the first 30 days (No refund) and sample our Silver or Platinum service and then decide what works best for you. If you aren’t 100% ready to move forward, simply email us to cancel one week before your 30 day 50% off trial subscription ends and it will be canceled and you will not be charged ANY FURTHER, no questions asked. Just send an email to mark.vrtrader@gmail.com” data-mce-href=”mailto:mark.vrtrader@gmail.com“>mark.vrtrader@gmail.com or call 928-282-1275 to cancel. You will receive an emailed confirmation of your cancellation at that time.

The 30 day trial is allowed one time only. By taking this 30 day 50% trial, you agree to be charged the full cost of the monthly Silver or Platinum service (choose one only) at the end of the 30 day trial subscription period, unless you cancel first. The regular Silver monthly rate is $49.40 and the Silver quarterly rate is $133.50. The regular Platinum monthly rate is $129.95 and the Platinum quarterly rate is $350.85. The special trial 50% off trial rates are listed below. Sign up today!

There are no refunds or pro-rata refunds offered at VRTrader.com for any subscription. You are being offered a 50% discount for trying our service for the first 30 days only!