Strengths

- The best performing precious metal for the week was gold, holding in with a 1 basis point drop. According to the World Gold Council, global gold demand in the second quarter increased 15 percent due to a 141 percent rise in investment demand. The Royal Mint also commented on a “surge” in demand, specifically when the Bank of England cut rates – during that week the Mint saw a 25-percent increase in transactions on its bullion website, reports BBC. The Mint’s “signature gold” has also allowed buyers to purchase fractions of gold bars, causing sales to jump 140 percent.

- Japan is the “star performer” among smaller gold consumers, reports Bloomberg, with four straight quarters of positive net investment into bars and coins. Demand expanded to 5.8 metric tonnes in the second quarter. The World Gold Council cites distrust of Abenomics, negative interest rates and a rising yen for the investment boost. In China, vehicle sales in July gained the most in 17 months, sending palladium to touch a one-year high. Speculation is that supply won’t be enough to meet demand, reports Bloomberg, as the metal is used in the making of car parts.

- Gold prices jumped this week as investors reevaluated the likelihood that the Fed will raise rates this year, reports Investing.com. The Labor Department said nonfarm business sector labor productivity fell 0.5 percent in the second quarter (extending the longest decline since 1979). According to BMO Private Bank, economists surveyed expected a 0.4 percent gain for the three months ended June.

Weaknesses

- The worst performing precious metal for the week was platinum losing 2.03 percent, on what may have been profit taking following the very strong rally in the platinum group metal prices over the last two weeks.

- According to BCA Research, the U.S. labor market strength is a “conundrum.” Last week’s jobs report came in strong and although U.S. real GDP is up only 1.2 percent year-over-year, employment has grown by a stronger 1.9 percent year-over-year, the group points out. It is uncommon for GDP growth to be weaker than employment growth, and such a gap is “unsustainable as businesses will experience continued erosion in profit margins.”

- Following the U.K.’s vote to leave the European Union, gold prices soared to the highest level since 2014. The higher price is one reason that China, the world’s biggest producer and consumer of gold, cut purchases in July, reports Bloomberg. The People’s Bank of China increased its gold holdings by the smallest amount since it began disclosing purchases about a year ago.

Opportunities

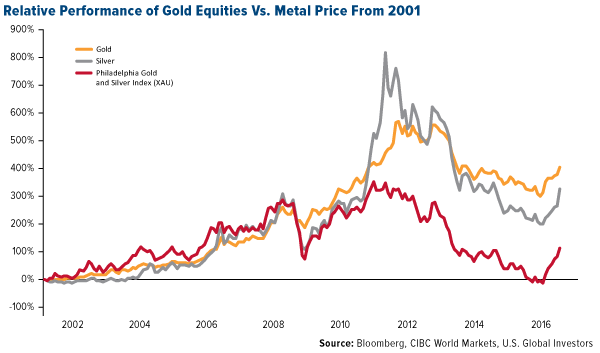

- David Haughton of CIBC says the gold rally we’ve experienced so far this year is sustainable. He points to three key factors: 1) Comparing this rally to five others over the past 40 years shows gold equities are still 40-50 percent off the previous high, while historical cycles reached around 20 percent of old highs in the same time frame. 2) Most companies are now demonstrating fiscal discipline that could support outperformance ahead. 3) Investors are mostly underweight gold equities and macro factors appear supportive.

- In its Gold Sector Review report, Credit Suisse points to several demand trend updates for the second quarter of 2016. The group explains that mine supply was flat year-over-year, as production from new streams was offset by declines in existing assets. They forecast mine supply to fall 7 percent by 2018 versus the 2015 level driven primarily by declining grades and a lack of new projects coming on-stream due to industry capex cuts since 2013.

- In the Financial Times this week, investment expert and precious metals analyst Diego Parrilla writes that the gains seen this year in gold are just the beginning of a new gold bull market. “My view that there is a perfect storm for gold is based on three closely interrelated dynamics, whereby central banks and global markets are both testing the limits of monetary policy and credit markets as well as the boundaries of fiat currencies.”

Threats

- Andrew Garthwaite of Credit Suisse published his opinion on gold and gold mining stocks Friday, pointing to three tactical concerns he has with the metal: 1) Gold moves inversely with real bond yields, and he thinks real rates will rise. 2) Gold moves inversely with banks, and he thinks financials will outperform if bond yields rise. 3) Gold is overvalued base on his model.

- With the probability of three rate hikes from the Fed through to the end of 2017, Picet Wealth Management believes that gold may have met its match after a stellar start to the year, reports Bloomberg. “With the dollar in a long-term uptrend, bullion isn’t likely to break the $1,430 an ounce level,” said Luc Luyet, a currencies strategist at the Picet.

- With a rally in gold prices so far this year, purchases in India (the world’s second-biggest consumer) will be reduced, reports Bloomberg, trimming import prospects amid high inventories. Historically, the second half of the year is normally better for gold demand from Indian brides, but so far this year a “rally of 25 percent in the first six months has hit the buffers,” continues Bloomberg, with higher costs deterring jewelry buyers.