By Marin Katusa, Chief Energy Investment Strategist

I recently gave an interview on Business News Network (BNN) about natural gas. BNN is Canada’s largest news channel dedicated exclusively to business and financial news, so all kinds of market players rely on BNN to provide them with comprehensive coverage of global market activity from a Canadian perspective. Like similar news channels in the US, BNN intersperses real-time news coverage with economic forecasting and analysis, company profiles, and tips for personal finance.

I have been interviewed on BNN numerous times over the last five years, quizzed on the impacts of fracking, the forecast for uranium following Fukushima, the potential of new frontier oil regions, and the future for coal. This time, the topic was “Five Tips for Natural Gas Investors.” You can watch the interview if you want; I highly recommend it – the education is worth the time.

On-air interviews are usually pretty speedy affairs, so my BNN interview didn’t give me enough time to discuss each point in depth. The Dispatch gives me that opportunity, so here are my five tips for natural gas investors in a bit more detail.

1. Watch for Looming Reserve Writedowns

A resource estimate is a geologic best guess of how much of a commodity exists within a particular deposit, be it ounces of gold, barrels of oil, or cubic feet of natural gas. A geologist gleans information about the deposit’s size and grade from drilling results and then creates a statistical model of the deposit. From that model he or she can estimate the commodity count.

However, the amount in the ground is not the amount that can be produced. That’s where the reserve estimate comes in. Reserves are an estimate of the amount of a commodity within a deposit that can be extracted economically, which means reserves are a whittled-down subset of total resources. That whittling down process has two steps. First, geologic and technologic factors determine a resource’s recovery rate, reducing the resource to the parts that are “technically recoverable.” Then, economic considerations further reduce the resource to only the bits that are “economically recoverable.”

With natural gas, the advent of horizontal drilling and multi-stage fracturing altered the first parameter dramatically, ballooning North America’s technically recoverable gas resources to many times their earlier volume. And while gas prices held, reserves counts ballooned too.

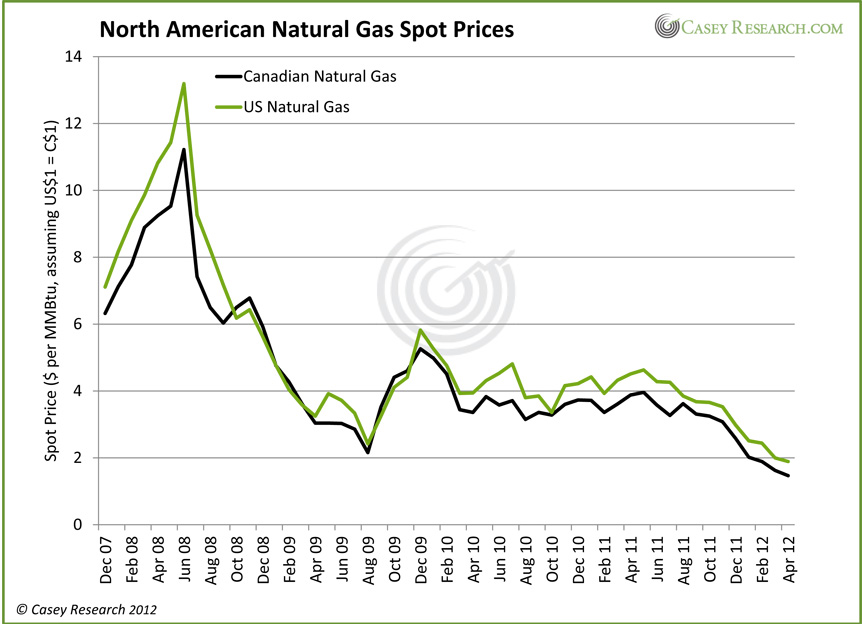

The key bit there was “while gas prices held” – that honeymoon is over. Natural gas prices in North America have declined roughly 35% this year and are down approximately 60% over the last 12 months. Compared to the unsustainable highs reached prior to the recession, gas prices have fallen more than 80%.

To Read More CLICK HERE