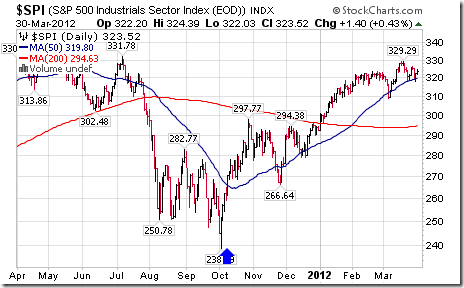

This column recommended accumulation of Exchange Traded Funds in the Industrial sector on October 11th for a seasonal trade lasting until Spring. Since then, the S&P Industrial Index has gained 23.9 per cent. What should holders of Exchange Traded Funds and related equities in the sector do now?

The industrial sector includes a wide variety of subsectors including industrial conglomerates, aerospace & defense, machinery, air freight & airlines, road & rail, electrical equipment, construction and engineering and building products. Investors can choose between 24 ETFs that track the sector or its subsectors. Largest holdings in the S&P Industrial Index are General Electric, United Parcel Services, United Technologies, Caterpillar, MMM, Boeing, Union Pacific, Honeywell, Cummins and Emerson Electric.

The industrials sector has a period of seasonal strength from October 9th to May 31st. Average return per period during the past 20 periods was 15.0 per cent. The current period has recorded significantly higher than average returns through actively traded Exchange Traded Funds. Excluding dividend distributions, the Industrial Select Sector SPDR Fund (XLI $37.42) has gained 21.0 per cent, the Vanguard Industrial Index Fund (VIS $69.54) has advanced 20.0 per cent, iShares on the Dow Jones Transportation Average (IYT $93.69) gained 15.5 per cent, the Dow Jones US Aerospace & Defense Fund (ITA $67.13) gained 17.4 per cent and Market Vectors Environmental Services ETF added 14.7 per cent.

On the charts, the S&P Industrials Index has a positive, but deteriorating technical profile. Intermediate trend is up. The Index trades above its 50 and 200 day moving averages. However, strength relative to the S&P 500 turned negative at the end of January and short term momentum indicators started to roll over from overbought levels last week. The Index at 323.52 currently has resistance at 329.29. In addition, several key stocks in the sector including United Technologies, Caterpillar and Boeing broke below technical support levels last week.

The sector is vulnerable to news from first quarter earnings report when they begin to appear next week. General Electric, United Parcel Services, United Technologies and Caterpillar are scheduled to report modest earnings gains on a year-over-year basis while MMM, Boeing and Honeywell are expected to report modest declines. Of greater concern, second quarter earnings guidance released with first quarter reports could be revised lower by several key companies in the sector. Most companies in the sector realize more than half to their earnings from operations outside of the United States. Currency translation into U.S. Dollars at a time when the U.S. Dollar Index is high relative to the same period last year will significantly dampen earnings expectations in the second quarter.

Preferred strategy is to take seasonal profits on Industrial sector Exchange Traded Funds and related equities at current or higher prices.

Don Vialoux is the author of free daily reports on equity markets, sectors,

commodities and Exchange Traded Funds. . Daily reports are

available at http://www.timingthemarket.ca/. He is also a research analyst for

Horizons Investment Management Inc. All of the views expressed herein are his

personal views although they may be reflected in positions or transactions

in the various client portfolios managed by Horizons Investment Management.