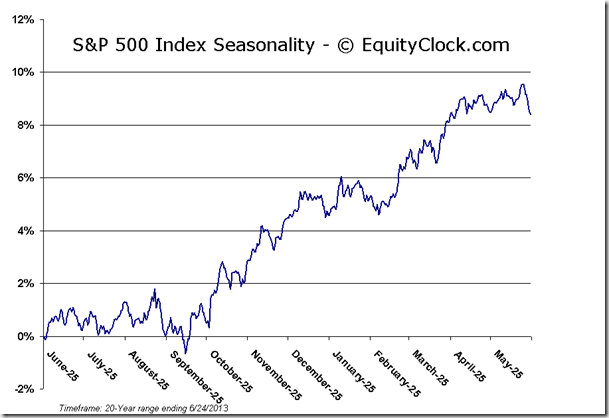

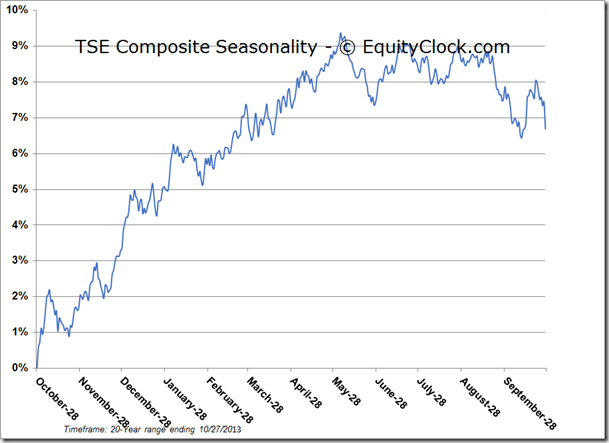

Equity markets and most sectors entered into a brief period of weakness last week. Economic news (ISM and Employment reports) will drive equity prices this week. Beyond this week, seasonal influences turn strongly positive (possibly due to anticipation of good news released by CEOs at annual meetings when they release “difficult” first quarter results e.g. stock splits, share buy backs, dividend increases). Preferred strategy is accumulate seasonally attractive economically sensitive North American and internationals equities on weakness this week for a seasonal trade lasting until at least May and possibly into July.

Seasonal influences are weak during the last two trading days in March, but turn strongly positive in April. In fact, the two strongest periods for U.S. equity indices during the year are the two week Christmas rally near the end of the year and the first two weeks in April. Average gain by the Dow Jones Industrial Average during the first two weeks in April since 1955 is 1.22% per period.

…below is commentary plus seasonal and price charts for the S&P500 & the TSE composite. To continue reading and viewing all 45 charts including commodities, currencies and interest rates go HERE

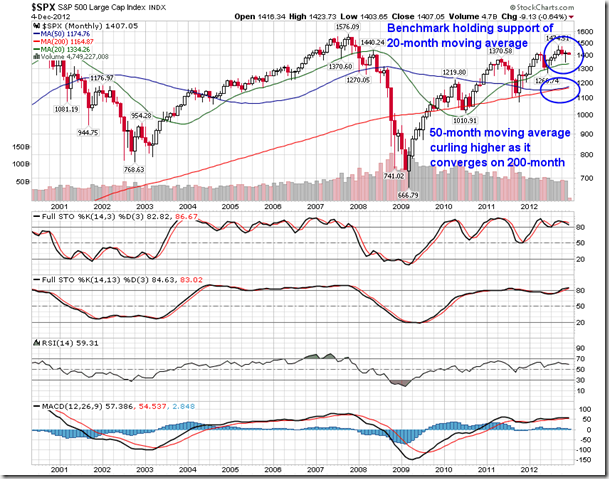

The S&P 500 Index lost 52.96 points (2.23%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average. Short term momentum indicators are trending down.

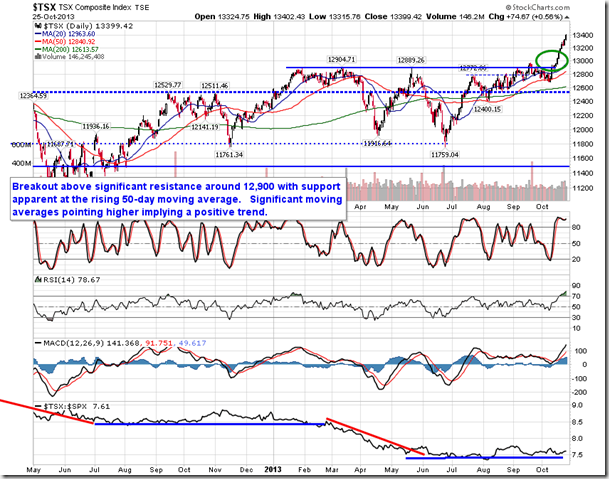

The TSX Composite Index lost 129.99 points (0.87%) last week. Intermediate trend remains down (Score: 0.0). The Index remains below its 20 day moving average (Score: 0.0). Strength relative to the S&P 500 Index changed to Neutral from Negative (Score: 0.5). Technical score improved last week to 0.5 from 0.0 out of 3.0. Short term momentum indicators are trending down.

…continue reading and viewing 45 charts including commodities, currencies and interest rates HERE