Countless Moving Parts

One factor that makes investing such a difficult task is the almost infinite number of inputs impacting the value of any asset. For example, emerging market stocks could be negatively impacted by economic divergences between the United States and Europe. How can that be?

- Strength in the U.S economy may cause the Federal Reserve to raise interest rates in 2015.

- Higher rates in the U.S. make the U.S. dollar more attractive relative to the euro.

- Emerging market stocks tend to be negatively correlated to the U.S. dollar, meaning when the dollar strengthens, emerging markets tend to experience a currency headwind.

Fed May Raise Rates In 2015

Although economic data has been mixed recently, the trend has been improving over the last year. From Reuters:

Better U.S. economic data has boosted the view the Fed may be closer to raising rates, and the dollar’s gains have come at the same time as rising Treasury yields. Still continuing slack in the labor market is also viewed as keeping the Fed on hold for several more quarters. “People are more confident that the Fed is reaching its objectives,” Chandler said. He added, however, that “while the economy is healing, it’s not healthy.”

ECB vs. Fed

While the Fed is expected to rein in monetary policy in the coming months, the European Central Bank (ECB) has indicated a bias towards increasing their stimulative efforts. The diverging paths between the central banks are having an impact on the currency markets. From Reuters:

The dollar hit a 14-month peak against the euro on Tuesday, on optimism the U.S. economy is growing in line with expectations that the Federal Reserve may begin raising interest rates next year.

Investment Implications – The Weight Of The Evidence

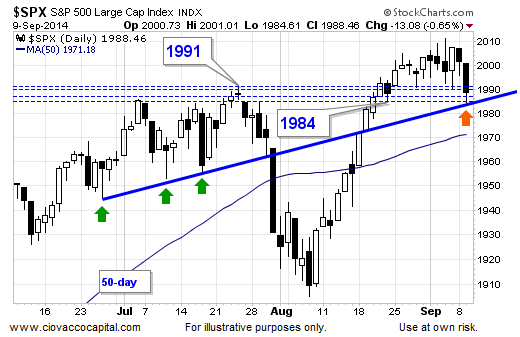

On Tuesday, the S&P 500 closed inside the support band shown in the chart below (1984 to 1991). Therefore, it is too early to get overly concerned about recent weakness in equities. The blue trendline in the chart below has acted as support on numerous occasions (see green arrows). The S&P 500 bounced near the blue trendline Tuesday (see orange arrow), meaning buyers stepped in at a logical level.

As noted via the tweet below, the chart above can be used in conjunction with other levels of possible support for the S&P 500.

Our concerns would increase with each level taken out. If support holds, we will err on the side of doing nothing in the short run. If support breaks, we will review the evidence and make any necessary adjustments to our allocations. For now, we continue to hold U.S. stocks (SPY), leading sectors (XLV), and a stake in U.S. Treasuries (TLT). We will enter Wednesday’s session with a flexible and open mind.

About Chris Ciovacco

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE.

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. CCM helps individual investors and businesses, large & small; achieve improved investment results via research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions.

Copyright © 2006-2014 Chris Ciovacco