By Dave Gonigam

Gold is ending the week doing a little more backing and filling. After yesterday’s run-up, the spot price has pulled back to $1,665.

$2,000 looks far off in the distance. To say nothing of last September’s $1,900 high.

Then again, it could happen with the snap of a finger.

“A push on toward $2,000 is definitely on the cards before the year is out,” says Philip Klapwijk, “although a clear breach of that mark is arguably a more likely event for the first half of next year.”

Mr. Klapwijk is global head of metals analytics at the consultancy Thomson Reuters GFMS. The catalyst for $2,000 might well be, in his estimation, Spain. A meltdown there — coupled with continuing strong demand from China — could give gold a whole new “safe haven” glow.

That said, he also sees a short-term dip to the year-end 2011 level of $1,550 within a couple of months. You’ve been warned.

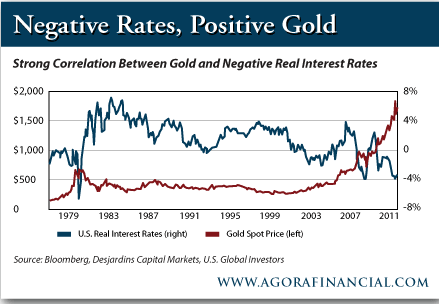

“U.S. investors might sleep better at night with an allocation to gold in the face of continued negative real interest rates,” says U.S. Global Investors chief and Vancouver stalwart Frank Holmes.

“The chart below shows how gold has historically climbed when interest rates fell below 0%, with a ‘strong correlation from 1977-84, and again recently when rates turned negative in early 2008,’ according to Desjardins Capital Markets.”

Read More HERE