Commodities have underperformed in the past year as the US economy gained traction and the need for inflationary and stimulative measures abated, though only temporarily. At the same time, Commodities had embarked on a tremendous advance and a pullback was to be expected. Interestingly, the past can tell us something about the future path of Commodities. The resource sector has been following a very similar path as the equity market did from 1987-1991. This comparison is one of several reasons why we expect commodities will make a major low within the next few months.

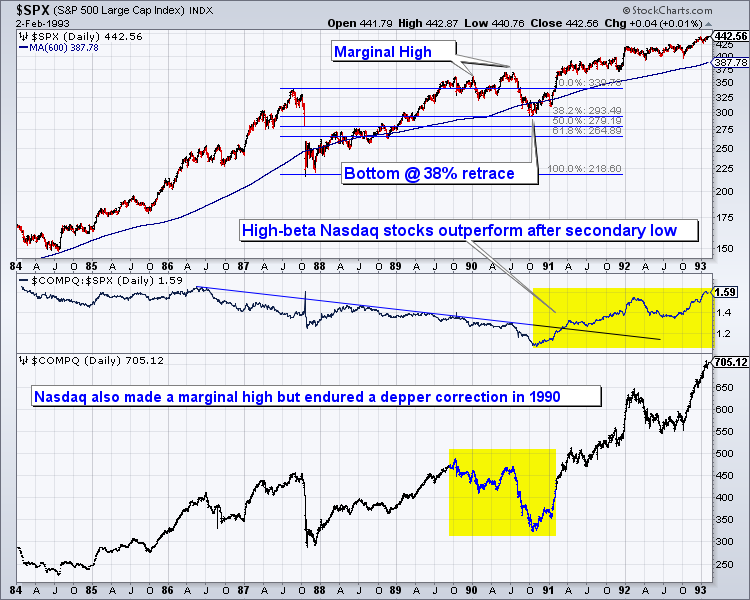

In the chart below we plot the S&P 500 and the Nasdaq with the Nasdaq/S&P ratio in the middle. Both markets made marginal highs several years after the 1987 crash and both markets corrected significantly in 1990. The Nasdaq’s correction was much deeper but it soon would begin a period of strong outperformance that lasted for nine years.

To Read More CLICK HERE