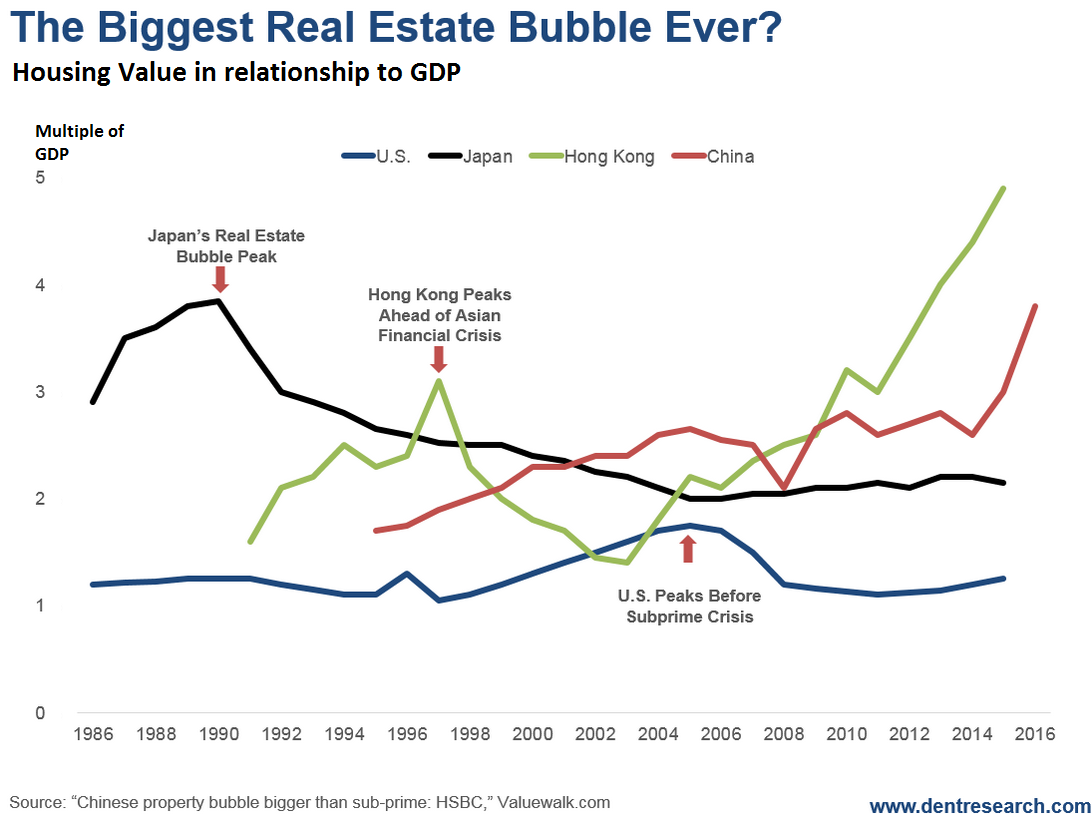

Property mogul: “The biggest bubble in history.”

No question about it. China definitely takes the cake when it comes to bubble creation. The government encouraged everyday people to speculate in stocks in late 2014 and 2015 to help offset the slowdown in its gargantuan real estate bubble. The stock market bubbled 160% in one year and then crashed 50% (and you can be sure there’ll be more losses to come after a year of propping up a market that has merely gone sideways…)

Then to cushion that 2015 stock crash, the government made loans easier for real estate again. Bank loans surged by 7.5 trillion renminbi (RMB) in 2015 and are on track to surpass 15 trillion RMB by the end of this year. About half of these loans are in mortgages.

So what happened?