More from Peter Grandich:

- What he lacks in actual performance, he more than makes up with in showmanship.

- Ignoring #1 threat to stocks?

- Currency cold war and can gold benefit from it?

- Worst investment for next decade!

- Why Obama’s big government plans will hinder, not help, the middle class.

- Is the junior resource market dead?

And the Opposing Point of View on the Stock Market:

The greatest moment in two decades’… Three reasons stocks will soar

by Porter Stansberry

“Right now is the greatest moment to be an investor in my nearly two decades in this industry,” Steve Sjuggerud wrote in the most recent issue of True Wealth.

That’s because of what he called the “Bernanke Asset Bubble.”

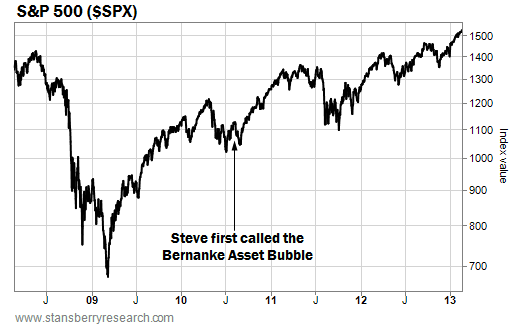

Steve has been writing about the Bernanke Asset Bubble since August 2010. In short, he predicted Federal Reserve Chairman Ben Bernanke’s easy-money policies would boost all asset classes. And if you put your money into the market back then, you’ve made a fortune…

As you can see in the chart below… the stock market is up since Steve’s call. So is real estate up? Agriculture and farmland are up as well…

Since Steve originally wrote about the Bernanke Asset Bubble, the Fed chairman has gotten even more aggressive with his money printing… Bernanke will add $1 trillion to the Fed’s balance sheet this year – bringing the total debt to $4 trillion. And the Fed won’t raise interest rates “as long as inflation isn’t forecast to rise more than 2.5% in the future and as long as unemployment remains above 6.5%,” according to the Fed’s statement last December.

![]() Steve believes the stock market could rise 95% from current prices in the next three years… And that would only put stocks at fair value. He sees three reasons stocks are set to soar today. From the March issue of hisTrue Wealth newsletter…

Steve believes the stock market could rise 95% from current prices in the next three years… And that would only put stocks at fair value. He sees three reasons stocks are set to soar today. From the March issue of hisTrue Wealth newsletter…

1) U.S. stocks are the best value they’ve ever been during my investing lifetime. The upside potential in U.S. stocks over the next three years could be the biggest in my near-20-year career. And all stocks have to do is return to their average.

2) Zero-percent interest rates are here to stay. Low interest rates are the real “rocket fuel” to this boom. The good news is there’s no chance the government will raise interest rates over the next two years. Meanwhile, we have perfect “Goldilocks” conditions for investing… not too hot, not too cold – JUST RIGHT. THIS is the investing sweet spot… This is where the biggest gains happen over the longest stretches.

3) Lastly, today’s zero-percent rates will force Mom and Pop America to “migrate” into the U.S. stock market… pushing the stock boom into “bubble” territory, possibly in 2015.

In short, stocks remain cheap. And the low yields available in bonds will force investors, en masse, into stocks. This trend is just now beginning… But Steve believes it will reach epic proportions.

To sign up for True Wealth and see exactly how Steve recommends playing this trend, click here… You can readTrue Wealth at zero risk. We offer a 100% money-back guarantee on the product, no questions asked.