Uncategorized

These millionaires hide their wealth behind shabby clothes and modest ways. Often, only death and generosity unmask them.

These millionaires hide their wealth behind shabby clothes and modest ways. Often, only death and generosity unmask them.

Gordon Elwood of Medford, Ore., kept his pants up with a bungee cord, accepted handouts from a food bank and refused to have a phone installed in his home because of the cost. When he died in October at age 79, he left a $10-million fortune.

Elwood was among a small fraternity of America’s upper class: the penny-pinching, often shabbily dressed wealthy who are almost as much a mystery to the people who know them as to the millions of strangers who read their stories and wonder, “Why?”

And their stories, while rare enough to make the headlines, are similar enough to sound familiar.

There was Emma Howe of Minneapolis, who left $1 tips but bequeathed $31 million to the poor and disadvantaged.

And Anne Schieber of New York, a former IRS auditor who wore the same frayed black dress every day, but built a $22-million fortune.

And Gladys Holm, a Chicago secretary who never made more than $15,000 a year, accumulated $18 million and gave it all to a children’s hospital.

All were buy-and-hold investors who rarely sold their shares. Each was shaped by the Depression, although none ever suffered extreme poverty. All left most of their money to charity, which helped bring them to public attention after a lifetime of secrecy.

Although the number of millionaires in America rises with each stock market uptick, no one really knows how many are hiding their wealth behind secondhand clothes and modest homes filled with old newspapers, twice-used tea bags and saved balls of string.

The inconspicuous rich are a tiny part of the largest generation of millionaires in American history; the Spectrem Group research firm in San Francisco estimates there are now 8.8 million U.S. households with a net worth of $1 million or more, more than double the number 10 years ago. Yet in a country where many purchase the accouterments of wealth by going ever deeper into debt, these anomalous millionaires refuse to spend what they have.

Experts struggle to explain their behavior, so out of sync with American norms.

Psychologists say that these lowest-profile millionaires are probably motivated by fear, guilt or habit: fear of economic catastrophe or of others’ reactions if their wealth were revealed; guilt over their good fortune when others have less; and the frugal habits of a lifetime.

“If one is used to living on a shoestring all of his or her life, these spartan habits may be so wellingrained that to change them would be stressful,” said Joseph Tecce, a psychology professor at Boston College.

People who know these millionaires grope for explanations as well.

Robert Hutchins, Elwood’s friend and stockbroker, is still at a loss to explain why Elwood continued to pick up bottles and cans along the roadside for the deposit money when he was rich enough to start his own charitable foundation.

Elwood set up the foundation just before he died, funding it with $1.8 million in shares from companies that had stopped paying dividends. Elwood always bought stocks that paid dividends and felt he was somehow being cheated when the dividends ended, Hutchins said.

Researchers who have studied millionaires say the practices of this handful of tightwads may be just an extreme example of the frugal habits shared by many of the truly wealthy.

Thomas Stanley and William Danko, in their seminal book, “The Millionaire Next Door,” found that most of the millionaires they surveyed were in fact relatively frugal. Few had ever paid more than $1,000 for a suit or $250 for a watch.

And in researching a second book, “The Millionaire Mind,” Stanley found that none of his wealthy subjects were given to extremes. They might get their shoes resoled rather than buy new ones, but the shoes themselves were likely to be of high quality–not thrift store finds.

People who pride themselves on their thrifty ways offer another explanation for such behavior: cheap thrills. The happily frugal extol the sense of satisfaction that comes from making do and doing without, from finding new ways to beat the system that fosters overconsumption and disposability.

Amy Dacyczyn, the self-described “frugal zealot” who published the Tightwad Gazette newsletter before retiring from the public eye four years ago, often described the glee she felt in determining whether homemade brownies were actually cheaper than store-bought mixes.

It’s ‘Thrill of the Chase’ for Many

Gary Foreman, who runs the Dollar Stretcher Web site, believes that many of his readers scour for money-saving tips as much for the “thrill of the chase” as for a pressing need to save money.

“It’s a game,” Foreman said. “Even among people that like to spend money, there are very few that don’t like to think they got something for less than everyone else.”

Elwood certainly was far from stereotypical of the miserable miser. Hutchins described him as sociable and garrulous, always ready to strike up a conversation with friend or stranger.

…..read page 2 HERE

The Good News Story of Our Lifetime

Let me start by saying that I have never felt more inadequate in trying to do justice to a particular financial or investment subject. No matter what I say it will not do justice to the revolutionary changes and opportunities that are taking place. It’s a story that will overcome the litany of bad news stories that threaten to overwhelm us like the sovereign debt crisis, youth unemployment, escalating social unrest, unfunded liabilities and incompetent government.

Where Do I Start

When I saw my first 3D printer operating just under 5 years ago my first thought was, “what the hell is that.” It reminded me of a slow motion version of the teleporter on the original Star Trek series. It was like presto – William Shatner just pulled a cup of coffee out of that box.

The printer jet was zooming back and forth and about 3 hours later – there was a coffee cup. I may not be the sharpest tool in the shed but it was pretty obvious something big was afoot. Flash forward to today and NASA has actually 3D printed small satellites that orbit the earth taking pictures. And they’re just one of 22,000 3D printed objects used by NASA today.

The enormity of the manufacturing revolution upon us is mind blowing.

This is what got me started reading everything I could get my hands on detailing the advancements in nanotechnology, biotech, telecommunications and artificial intelligence, all driven by the explosion in information technology.

Besides the fact that it’s so cool, with innovations like self driving cars and the phenomenal advancements in healthcare – it also provides today’s most important opportunity for investors.

Let me give you a quick example. Not that long ago I was told to look into Seattle Genetics. I didn’t know anything about the company but then it patented a treatment for Hodgkin’s disease, a rare form of cancer. As soon as the patents were granted, the stock went up over 1300%.

One more example. Late in November Puma Biotechnology got positive results for their breast cancer drug, which allows them to proceed to Phase 3 testing. Within a week the stock jumped 88% to $86.75.

How about a Canadian story. This week at the massive Consumer Electronics Show in Las Vegas Neptune, a Canadian smartwatch maker founded by teenager Simon Tian, is launching Pine, a watch that wants to lead the way in wearable computing. The Pine offers voice calls, video chat, a full keyboard, GPS, and more. Unlike other products already on the market, the Neptune’s Pine is cellular-enabled, which means it doesn’t require a smartphone nearby to work.

One of the most interesting aspects of this story is the fact that in November Neptune went onto Kickstarter (the internet fundraising site) and asked for $100,000 to help launch the Pine watch. One month later they had raised $801,224 (Eat your heart out Dragon’s Den).

The Bottom Line

There are literally hundreds of other examples of innovative companies changing our future in a huge variety of areas but that’s the point. The next 20 years will witness more technological change than the last 100 years combined. Investors are going to have a huge array of opportunities. Forgive the cliché but this is where the action is if you’re looking for growth.

Big Change At The 2014 World Outlook Financial Conference – Jan 31 & Feb 1

A few months ago, legendary analyst Jim Dines repeated his prediction that 3D printing is the next really big thing for investors. This year’s conference will give you a chance to see it in action. We have invited 3D printing expert John Biehler to demonstrate 3D printers that you can use in your own home to manufacture a variety of items. John will talk about the economic and social economics of this revolution, impacting not just traditional manufacturing and retailing but also regenerative medicine and industrial design.

As I said earlier – words fail me. So all I’ll say is that this is going to be great.

For Investors Looking For Huge Potential Growth

I am thrilled to announce that one of Canada’s premier technology analysts and investors, Brent Holliday, CEO of Garibaldi Capital Advisors has accepted my invitation (maybe more accurately put as begging) to speak on his rules for picking technology winners.

On a larger scale Brent is interested in the same things that we are – namely finding some potential monster winners. Last year Brent and his team may have done over $100 million in transactions but the rules of how to find companies with huge potential are the same for institutional and individual investors alike.

Finally

I am unequivocal in stating that investors must get familiar with these areas. The World Financial Outlook Conference is your chance to not only hear renowned analysts like Martin Armstrong, Mark Lebovit, Peter Grandich and to get Ryan Irvine’s 2014 World Outlook Small Cap Portfolio. It is also an opportunity to get familiar with the most important investment opportunities of the next generation.

It is going to be incredibly thought provoking – and a lot of fun.

Sincerely,

Mike

Host Of Money Talks

P.S. As you may know I am hugely interested in educating our younger generation and to that end we have a special offer – if you buy a ticket – you can bring a student absolutely free.

The only thing is that we ask you to let us know in the Order Notes that you want a student ticket when you purchase your ticket because we have a limited number of tickets set aside. And I might add that the students have really enjoyed the conference but it is also a great way to share/create a common interest with your children – no matter what their age.

Where: Westin Bayshore Conference Centre, Downtown Vancouver

When: Friday afternoon and evening, January, 31 and all day Saturday, February 1, 2014

To book Your Ticket: go to www.moneytalks.net/outlook or call toll free 1.877.926.6849

Cost: $119 for a two day pass

The irony of Canada Post announcing that it will be stopping urban delivery on the same week Amazon proposed private drone delivery was delicious.

But it also reminded me of how important the delivery of the Christmas box was growing up in Revelstoke. Our Montreal relatives would put everything into one big (I seem to recall it as huge) box which I’m sure rode the rails to get to us on time. It’s arrival was as good as Santa’s sack with beautifully wrapped presents spilling out, all our names on them, piled high under the tree creating exhilarating Christmas Eve expectations. I guess it will become another one of the “when I was a kid” stories I’ll tell my kids and grandkids – along with punch card main frame computer programming and week long production of cassette mix tapes.

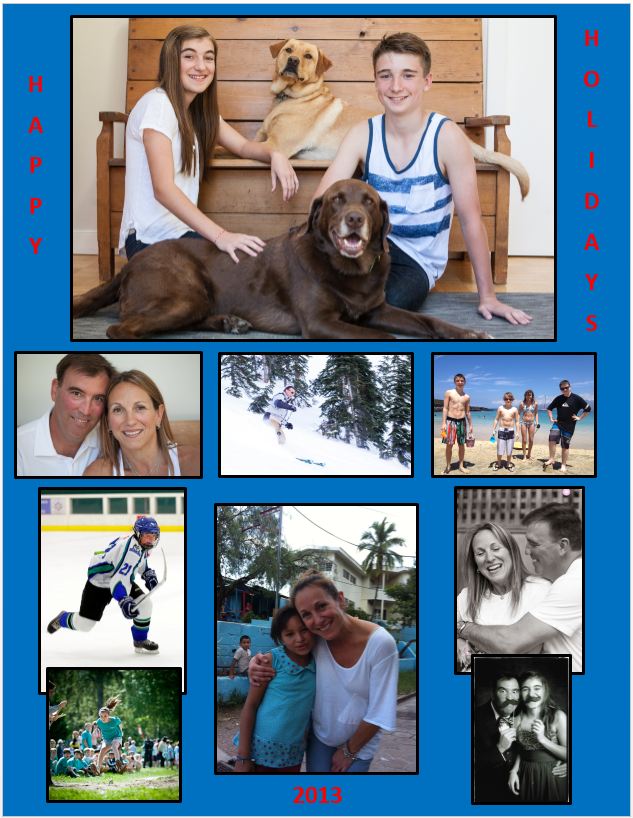

All is well in Longhurst land. Mark is having to “get real” in Grade 10 as academic results now have implications for the Gr 11 & 12 choices, which will in turn affect his post-secondary options. Mackenzie is in her last year of elementary school and has been looking forward to highschool since the 2nd day back. My inability to follow the “new” math processes continues to frustrate everyone and makes it challenging for me to share all the short cuts and cheats I always thought were the coolest part of the process.

Both kids are still active in sports (Mark – hockey, soccer, baseball / Mackenzie – soccer, field hockey, gymnastics, cross country) and Mark enjoyed another summer working as an instructor at the West Van Soccer Club camps. Nina had to dial back her running as anything over 90 minutes results in alot of foot pain. Years of wear have caught up but she seems happy to get out just as often, if over shorter distances. I’m still enjoying hockey and when it isn’t pitch black (I’m talking to you December) – my daily morning circuit class.

We enjoyed a great spring break on the Big Island of Hawaii and another glorious week up at the cabin on Shuswap in the summer with Mom. Cousin Max joined us for the 3rd consecutive year and we enjoyed the wonderful company of Julie Walker as well.

Of perhaps greater interest, Nina spent two weeks in Honduras in October as a member of a Service Team helping at an orphanage in Tegucigalpa. The experience was profound and raised alot questions about how, what and where we can best contribute going forward.

On the decadent side, after years of discussion we finally pulled the trigger and bought a place in Whistler in partnership with some good friends. We’re looking forward to alot more skiing this year and plenty of time up in the summer months too. If you have plans to be in Whistler please don’t hesitate to ask about using the place. It is a two bedroom townhouse in the Upper Village.

All the best to you and yours in 2014.

Grant, Nina, Mark, Mackenzie and the hounds