Real Estate

Eitel Insights continues to outperform the competition. Not a single time have we suggested purchasing a detached home or condo property. On the contrary, we have been suggesting selling into this short lived reality of optimism. Most every other analysts said 2019 was the bottom. 2 months into 2020 they are running scared. Eitel Insights has never wavered from saying the market is going lower for longer.

Eitel Insights uses Technical Analytics to provide actionable intelligence to the market. Fundamental analysts will never catch a “Black Swan” because they need the event to occur before they see the ramifications. Technical Analysts use metrics to show that the market is at too lofty of a position and a correction is upcoming. Just like we did during 2017.

The latest Black Swan no one saw coming is the Stock Market recession and the Corona Virus. Now Eitel Insights did not have a name for these events, however we did state that the technical showed further losses upcoming.

The detached market currently sits at 1.6 Million on an average sales basis. Down 13% from the peak in 2017 or -$230,000. As we have advised our clients this current market cycle will test 1.4 Million in 2020 which would be a total correction of 23% or -$430,000 from the peak. If that does not hold firm the next echelon tested will likely be 1.225 Million.

Here is a quote from the Eitel Insights update last month “We advise to the sellers who will be in that need based situation begin to sell now before onslaught of similar stories hit the market. Need based selling will become necessary in 2020, propelling the market lower in price. Simultaneously the buyer’s trepidation will skyrocket. The only way to mitigate their pessimism will be time. Which is not something every seller will be able to afford in the upcoming market. ”

We certainly hope you took our advice in the last installment. If you disregarded it and purchased based on the recommendations of the “usual advisors”, looking at the chart notice the whipsaw effect you are in now.

The sales totals from February for the detached market were 686 in Greater Vancouver. We have projected a sales threshold which has an artificial top around 950. Given our new reality, we believe the artificial top will hold firmly in place until the market correction is over.

While inventory still came in on the light side with only 4100 active listings. The numbers are continuing to climb from previous months. Now with the stock market crashing and over 400 Billion dollars lost in the TSX. Expect to see hard assets begin to be sold off. The housing market will definitely feel this impact. We have been stating 2020 would begin the onslaught of foreclosures and to date there are 49 foreclosures. Expect that number to rapidly rise by the end of the year, as we predicted

The one shining light of this dreary market is that the properties that are selling, are selling in quicker time. Properly priced listings have been getting sold. We had said list before the onslaught. While the onslaught appears to be on us; listing sooner rather than later offers a chance to receive a higher priced sale. As the time continues to pass and the inventory builds up, prices will decline further. For some it could be list now or have the bank list it for you in the upcoming future.

Not all markets are created equal while some fall other rise. Become an Eitel Insights client and receive Actionable Intelligence on Real Estate across Canada, visit us at eitelinsights.com .

Watch Eitel’s latest video:

COVID-19 (novel coronavirus) hasn’t yet put a major dent in the Canadian commercial real estate or housing markets, but a great deal of uncertainty remains surrounding the potential impact of the global outbreak.

“We are already beginning to see the impact of the virus with international buyers,” Sotheby’s International Realty real estate agent Paul Maranger told RENX.

“Air Canada recently cancelled direct flights between Toronto and Hong Kong. With cancelled flights from Asia, and a possibility…Click here for full article.

Prices in February had an average sales price of $666,769. Signalling a 6th month in a row of a 1% price range. Prices have held in correction territory with prices down 11% from the peak which occurred January 2018 with prices at $751,632. We still expect volatility to impact the condo market in the upcoming months. Up first will be a retest of the lower middle threshold of $635,000, which would bring the market down a further 5% from current levels. Once that level fails the next price level test would be $600,000. Ultimately we forecast the bottom of the Condo market to occur in the early part of 2021 with around $525,000 a 30% correction from the peak.

Eitel Insights has heard that some condos have been receiving multiple offers. We are not surprised by this short lived reality. We have been stating that there is a great opportunity to sell. With low inventory in the market, there is a lineup of potential purchasers that are eagerly awaiting property priced listings. When one such listing has come to the market those buyers have entered into minor bidding wars. A warning though, as each listing is purchase that has the forced effect of lessening the potential buyer’s pool.

After this imbalance between supply demand is corrected prices will again decline to previously established prices. In other words continue lower in the current market cycle.

There were 1064 sold properties in Feb mirroring the number from December just a few months ago. A large portion of purchasing occurred in the 3rd and 4th quarter of 2019 that is in large part due to popular areas around Greater Vancouver had dropped 20% – 30%, which in turn brought the sidelined buyers back into the purchasing game.

The trend is your friend, there are powerful downtrends in play with the sales totals. While the sharp rebound uptrend has been nullified. Eitel Insights does believe a higher low has been put in place, however, the market also seems to have found an artificial top that the sales cannot overcome.

The Inventory increased roughly 700 listings from January. Totalling 3700 Active listings in Greater Vancouver in February. With spring rapidly approaching we anticipate a rather substantial jump in listings over the next few months.

Throughout spring and summer the inventory regain the 5000 active listing level, we are confident. A repeat test of 6000 is a likely possibility as well.

The frenzied presale market of 2016 is beginning to rear its ugly head. Those pre sold properties are just beginning to hit the market. Some buildings are seeing 25% of the building for sale while an additional 25% of the building is for rent. Meaning 50% of the building is available in one way or another. This does not bode well for the overall market as this is just one early example.

Major losses in the Real Estate portfolio could have been mitigated by all-time high levels stock markets. The Dow Jones (DJIA) recent decrease from 29,500 to under 24,000 which has a major impact to the bank account.

Add it all up and you shouldn’t be surprised to see prices decrease a few levels lower than they are currently selling for in the not too distant future.

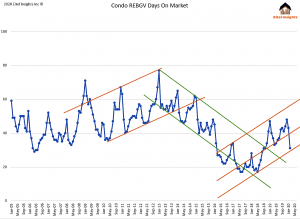

We have stated the past few months have been a great opportunity to sell. Here is some proof we were correct again. The Days on Market of sold properties dramatically decreased month over month from 43 days in Jan to only 31 in February. We anticipate this trend will continue for the next few months until the inventory levels surpass 5000 active listings. This opportunity to sell with less competition is rapidly closing. Eitel Insights urges those thinking of selling to act now before you become another casualty of this upcoming chaos.

Click here for more info on Eitel Insights.

Watch Eitel Insight’s latest video:

Our friends over at Green Mortgage Team sent us this Op-Ed on how the recent BoC rate drop will affect you and mortgage rates in general. ~Ed

Today, the Bank of Canada dropped the overnight lending rate by a whopping 0.5%.

This is the first rate cut the Bank of Canada has had since 2015, when falling oil prices caused the Bank of Canada to take precautionary measures. This move comes one day after the US, Canada’s largest trading partner, called for an “emergency” meeting and reduced their overnight lending rate by 0.5%.

Why did this happen?

There are a number of reasons, although it seems like many of these events have been fueled by the Coronavirus scare.

- Oil prices are $10/barrel less than expectations set only two months ago in January. Canada is very export-dependant and dropping oil prices will negatively affect Canada.

- With Canada being so export heavy, maintaining a low dollar is important. When the US fed decreases rates by 0.5%, it weakens the US dollar to the Canadian loonie. This makes it more expensive to import our goods, which could have a negative impact on exports. By following the US, we are weakening our dollar to stay on par and not letting our exports get more expensive relative to other countries around the world.

- Coronavirus is having an impact on manufacturing in China, which has lowered both their exports and imports. China is buying less raw materials to manufacture goods, and is also buying less high-end goods (sorry Gucci, but now is not a good time to be selling $2,000 handbags to China).

- Stock markets have been in a bit of a free-fall (this is why we invest in real estate, right!?), and it was interesting to see that some of the reasoning behind the US Feds’ decision was definitely stock market-driven. While I don’t agree with this (the role of the Fed is to use interest rates and other means to support macro-economic factors like economic growth, jobs, inflation, currency, among others), lowering interest rates should at least lessen the blow a bit.

Canada is one of many countries who have already dropped rates this year, and we are only two months in.

How does this affect you?

It’s important to note that a drop in the overnight lending rate does not automatically mean that the banks will follow suit and drop by the same amount. Banks set their Prime rates on their own (TD Prime for instance is 4.15% and others are 3.95%), and there has been precedent for the banks to not follow suit with a full drop. Here is the takeaway from this information:

- The banks probably will not drop a full 0.5%. Expect something closer to 0.25% of a drop.

- Remember that this drop will only affect those who are in variable rate mortgages. Fixed rate contracts are unaffected.

- Fixed rates are 98% correlated with bond yields, which have also been falling. Just in the past two weeks approximately, bonds have fallen 0.5%. A lot of the past drops were built into the current rates being offered, but there is currently downward pressure on fixed rates; therefore, expect some drops in the next week or so.

The Condo Market’s average sales price has not moved in the past 5 months. The initial portion of 2019 tested the middle threshold of the Condo market current market cycle. After a successful defense, property values rose in September for the first time in over a year. That resulted in the market average rising to $673,328 in September 2019. January 2020 prices came average came in at $665,190.

Lower highs, and higher lows in pricing since September 2019 have created a divergent trend that needs to be resolved. A market cannot sustain itself inside of a 1% range, expect some volatile movement upcoming to the condo market. The Condo Market has remained 11% off the peak in pricing since the September data point.

Inventory is inextricably linked to the sale prices. Since the September data point the inventory broke out of the uptrend, which had pushed inventory to 6000. Simultaneously instigated the divergent trend in the price chart. After Septembers break to the uptrend the inventory seemed to be in free fall. The inventory bottom occurred in December with only 3025 active properties while January came in with 3390 active.

Now would be an excellent time to take advantage of the nominal inventory level for sellers. Why wait until the market is again flooded with listings. Just as Eitel Insights guided sellers to take advantage of the stress test mitigation in the detached market. Which resulted in the detached average price increasing by $163,000.

The current opportunity to sell at higher prices will not last, as the completion of many newly built building begins. The market will flood with new units for sale that will debilitate the resale market. Take advantage of the calm before the upcoming storm.

Sales have broken out of the aggressive uptrend that had been prevalent in the latter half of 2019. In January 2020 the total for the Condo market came in at 815 sales. The sales numbers are quite higher on a year over year basis, and likely at the lower third of the newly forming market cycle in the Condo sales chart.

Eitel Insights suggests that buyers hold off until the inventory levels return. Once the inventory returns you will see the competition amongst sellers intensify. Resulting in more negotiating power and an abundance of listings to enjoy perusing during the weekends.

The Days on Market for sales in January was 43 signalling a lower DOM than December, which is to be expected. Eitel Insights believes that that DOM will continue to lower as we head into the spring market. Properly priced listings will be purchased. Again our advice to sellers is to take advantage of the current absence of competition before the wave of listings ensues.

Not all markets are created equal while some fall other rise. Become an Eitel Insights client and receive Actionable Intelligence on Real Estate across Canada, visit our website. www.eitelinsights.com

Watch Eitel’s latest video: