Personal Finance

The on-going theme of government seeking every tax dollar possible is playing out as the federal government proposes to eliminate an “up til now” regular part of small business and professional tax planning. The Trudeau government proposes to target private corporations with family members as beneficiaries along with two other tax plan. CLICK HERE for more details

Yesterday I talked about how to build the first part of your personal Plan B– an impenetrable defense.

Today I’m going to show you how to build a strong offense.

Today I’m going to show you how to build a strong offense.

Once you have a strong defense that protects everything you have, a good offense positions you for gain.

It helps you move the ball down the field, grow your wealth and achieve exceptional investment returns… all while taking minimal risk.

Step #1: Invest outside of the mainstream

When I say outside the mainstream, I don’t mean weird or highly risky. I mean beyond conventional wisdom… in other words, beyond stocks and bonds.

In fact, I always look for smart investments that have high risk-adjusted returns.

In other words, I would prefer an investment with a 9% return and little risk of losing my capital over a super risky investment that could return 25%.

And the best way to ensure that is to buy:

(1) High-quality assets

(2) Managed by competent people of integrity

(3) At prices that are at/below intrinsic value

There are plenty of high-quality assets out there today. But finding anything at a decent price is next to impossible.

The stock market is at an all-time high. Companies are selling for huge multiples of their earnings – like Amazon, which trades at a price-to-earnings ratio of 180.

But if you look outside conventional investments, you discover a whole, new world of opportunities.

Things like… deeply undervalued international stocks, secured peer-to-peer lending, private businesses, agricultural real estate and even royalties of songs.

For example, our colleagues at Silver Bullion, the most advanced bullion depository in Singapore, have created a peer-to-peer lending platform where investors can loan funds against gold and silver, typically backed at a 2:1 margin, at deposit rates up to 6%.

In other words, you can lend $50,000, and earn a strong, 6% return while your money is backed by $100,000 worth of gold and silver.

If something goes wrong and the borrower doesn’t pay, the lender has substantial collateral to ensure his investment is made whole.

Again, 6% might not sound like a lot when you have stocks like Tesla returning around 80% this year along. But eventually Tesla’s valuation will come back down to earth.

And on a risk-adjusted basis, these types of investments are very strong performers and make sense for anyone to consider.

These are the types of safe, unconventional investments we look for at Sovereign Man. And we’ve found a handful of excellent opportunities for anyone looking to park some cash in a safe place and earn solid yields.

For example, our Sovereign Man: Confidential Members have access to a similar peer-to-peer opportunity that is paying 12% interest per year.

Step #2: Legally reduce your taxes

Remember this point…

Taking legal steps to reduce your taxes is the highest return on investment you’ll ever make.

Think about it– cutting your tax burden can “boost” your investment return by 10%, 20%, or more, without taking on any risk.

I know this is a bold proclamation, and maybe you think lowering your tax burden is immoral and unpatriotic.

If that’s the case, I’d encourage you to stay open-minded about this topic. I wont’ get into the details here, but I actually believe I have a moral obligation to reduce my taxes by as much as possible.

The truth is, governments all around the world have demonstrated over and over again that they are terrible custodians of money. They’re unable to manage it effectively and are squandering most of it.

You are much more capable at deciding how your money should be used – and where it will do the most good for yourself and the world.

It’s not immoral or unpatriotic. It is sensible and smart.

And I’m not talking about anything illegal here. Committing tax evasion or fraud is one of the worst decisions you could ever make, considering the harsh penalties and the abundance of legal, no-brainer strategies to reduce your taxes.

There are simple steps available to everyone, such as restructuring your retirement accounts (more on that below), but also more advanced strategies if you have your own business or are willing to move abroad (even if just temporarily).

Step #3: Liberate your retirement savings

Most retirement plans are confined to your backyard. If you have a US retirement plan, you’re allowed to invest in government bonds and the US stock market.

But what if US stocks are overvalued? What if you don’t want to loan money to the government?

With a more robust structure like a self-directed IRA or solo 401(k), you’ll be able to open up an entire universe of new investment opportunities…

Private investments. Cashflowing royalties. Cryptocurrencies. High-interest foreign bank accounts. Safe, secured lending opportunities.

All of these options are available with a more robust retirement plan, allowing you the chance to generate higher returns without the cost of paying some Wall Street firm to manage your account.

And at the same time you can significantly reduce your tax obligation– beating two birds with one stone.

The bottom line…

Investing outside the mainstream and reducing your taxes are no-brainer strategies to grow your wealth and take advantage of the opportunities the world has to offer.

To your freedom and investment success,

Simon Black

PS:

If you’re interested in building a strong defense, I’d encourage you to learn more about Sovereign Man:Confidential. We cover, in detail, all of the strategies we discussed in today’s essay.

Note: This commentary has been updated with the latest numbers from last week’s Employment Report.

Our earlier update on demographic trends in employment included a chart illustrating the growth (or shrinkage) in six age cohorts since the turn of the century. In this commentary, we’ll zoom in on the age 50 and older Labor Force Participation Rate (LFPR).

But first, let’s review the big picture. The overall LFPR is a simple computation: You take the Civilian Labor Force (people age 16 and over employed or seeking employment) and divide it by the Civilian Noninstitutional Population (those 16 and over not in the military and or committed to an institution). The result is the participation rate expressed as a percent.

For the larger context, here is a snapshot of the monthly LFPR for age 16 and over stretching back to the Bureau of Labor Statistics’ starting point in 1948, the blue line in the chart below, along with the unemployment rate.

“This week I have good news and bad news for you” – John Mauldin

Centenarians Everywhere

The $400 Trillion Gap

A Wedding and the Virgin Islands

“I often joke that 100 years from now I hope people are saying, ‘Dang, she looks good for her age!’” – Dolly Parton

“Just because you live 20 years or 100 years doesn’t make it less meaningful. They’re both short amounts of time. So all we can do is just live in that time, whatever time we’re given.” – Ansel Elgort

“If I had more time, I would have written a shorter letter.” – Blaise Pascal, 1657 (and a few score other later attributions)

Welcome to the new, improved, faster-to-read, better yet still-free Thoughts from the Frontline. My team and I have been doing a lot of research on what my readers want. The reality is that my newsletter writing has experienced a sort of “mission creep” over the years. Bluntly, the letter is just a lot longer today than it was five or ten years ago. And when I’m out talking to readers and friends, especially those who give me their honest opinions, they tell me it’s just too much. There are some of you who love the length and wish it were even longer, but you are not the majority. Not even close. We all have time constraints, and I wish to honor those. So I am going to cut my letter back to its former size, which was about 50% of the length of more recent letters. (Note: this paragraph is going to open the letter for the next month or so, since not everybody clicks on every letter. Sigh. Surveys showed us it’s not because you don’t love me but because of demands on your time. I want you to understand that I get it.) Now to your letter…

This week I have good news and bad news for you. The good news is that you and your children will probably have much longer lives than you currently imagine. The bad news is that you’ll have to pay the bill for them.

I’ll explain what that means in a minute. First, let me thank everyone who helped produce this year’s Strategic Investment Conference, as well as all who attended. I know it sounds trite to say that this one was the best ever, but it really was. Every speaker brought a unique and valuable perspective, which the panels then mixed into new and even more interesting blends. Attendees asked probing and sometimes uncomfortable questions. I think everyone left Orlando bearing loads of new ideas.

If you missed SIC, you can still get our Virtual Pass. It gives you audio recordings of all sessions, all the slides that accompanied them, and written transcripts. It’s the next best thing to being there. Click here for more information and to place your order. We will close this offer in early June, so don’t wait too long.

I’m also pleased to announce that next year we’re taking SIC back to our old home at San Diego’s Manchester Hyatt. The dates are March 6–9, 2018. That’s just a little more than nine months away, so now is the time to start planning your trip. We’ll let you know when early bird registration opens in the fall.

Now, on to this week’s main course.

One of my team members pointed me to a World Economic Forum white paper called “We’ll Live to 100 – How Can We Afford It?” Regular readers know I’ve been saying we’ll live that long – and asking how we’ll pay for it – for several years now. It is good to see Davos Man finally catching up with me.

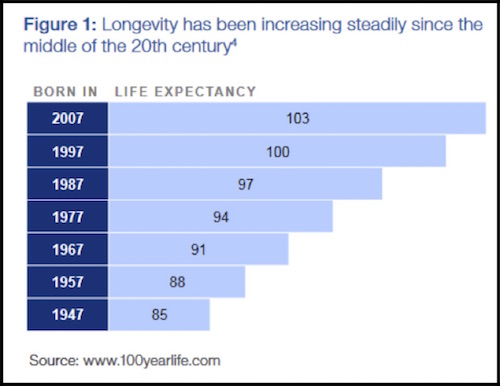

The WEF paper has some interesting data that I haven’t seen elsewhere. To begin, it breaks down life expectancy by birth year, showing a different picture than we see from simple averages. Here are the global numbers.

As far as I can tell, these estimates don’t consider the kind of major life-extending breakthroughs that Patrick Cox writes about for us and that he and I both expect to be realized in the next few years. Rather, the methodology of the WEF paper seems to depend on extending current trends. So I believe the numbers above are conservative.

Note also, these are median life expectancies, not simple averages. Half the people in each group will live longer than the median. Most of today’s young children will live to see the 2100s. Some (many?) of the younger Millennials will see their lives span three different centuries. That’s astonishing.

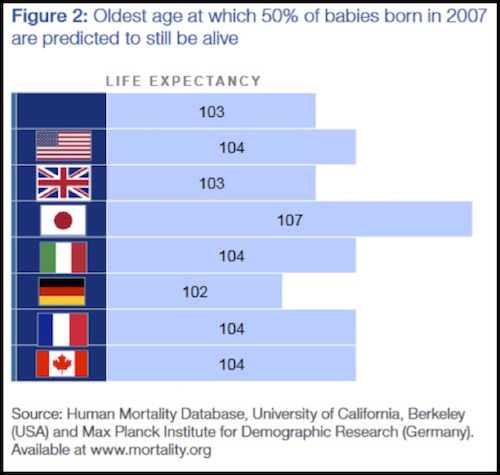

Here’s another table showing the differences among major countries for those born in the year 2007.

Again, this is astounding if correct. A Japanese child born in 2007, who is 10 years old today, has a 50% chance of living to 107. That will be the year 2114. Those in other developed countries are not far behind.

Better yet, the coming medical technologies will let us live to those ages or more without the decades of physical and mental decline that are now common. We’re not just increasing lifespans; we’re increasing “health spans,” too.

The good news is that many of those antiaging breakthroughs are going to be coming to a pharmacy near you in the near future – as in five to ten years. It is likely that you will live much longer and healthier than you are currently planning to. Most of us will be happy with that outcome. The bad news is that you will have to make your money last those extra years.

We had a panel at SIC with Patrick Cox and leaders of three of the biotechnology companies he follows. What they’re working on, from different angles, is almost unbelievable. It is entirely possible that we will see cancer wiped out in the next five years. Scientists are making huge strides with heart disease, dementia, spinal cord injuries, and the other great enemies of life and health. One by one, the dominoes are falling. Other companies we know about are working on the “Fountain of Middle Age,” whereby they intend to either delay or semi-reverse the aging process. It won’t take you back to your youth, but for many of us 50 years old sounds pretty good.

And there are groups like Mike West’s at BioTime, Inc., that are working on technologies like induced tissue regeneration (ITR), which will literally turn back your cellular clock. This was science fiction and a pipette dream 10 years ago. Today it is simply science, and it’s coming out of the theoretical stage and the petri dish and moving further up the experimental lab chain.

Some of you will object, “What will we do if everybody lives so long? Frankly, that’s a first-world problem. I see very few people who ask that question offering to die. If we live in a world that can figure out how to turn us young again, give us automated cars, and all sorts of abundant resources, you think we’ll have trouble figuring out how to feed everyone and keep them occupied? Malthus was so wrong in so many ways.

While this is wonderful news for humanity, it will bring some challenges, too. The world is not financially prepared to support as many retirement-age people as it will have to sustain in coming decades. We have some huge adjustments in store.

Specifically, we already have a huge retirement savings shortfall, both public and private. I discussed that problem at length recently in Part 4 and Part 5 of my “Angst in America” series. Adding millions more person-years to the equation will make the problem much worse.

The World Economic Forum’s white paper tries to quantify how much worse the personal retirement shortfall will be if current practices continue. The amounts presently earmarked for retirement income via government-provided pension systems (i.e., Social Security), employer plans, and individual savings fall far short of the mark.

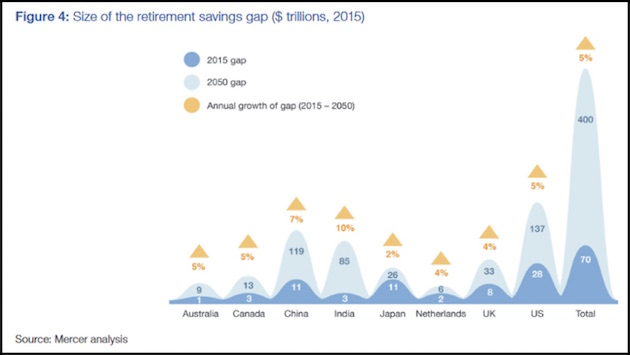

Here is the bad news in graphic form.

The bumps you see there are the difference between what is necessary to fulfill obligations (defined as 70% of pre-retirement income) and what has actually been saved or set aside to do so. The darker blue is the 2015 gap, and light blue is a 2050 estimate.

WEF shows these eight countries, which are obviously not the whole world, simply because the data was available. They also excluded assets held by the wealthiest 10% of the population, in order to show the situation of non-wealthy citizens. (Their full methodology is described on page 22 of this PDF file, for those of you who want to take a deeper dive.)

By 2050, the total shortfall in these eight countries alone will be $400 trillion. That number is so absurd that I feel very confident we will never have to face it. One way and another, some promises will be broken. The only questions are, whose and to what degree.

Remember, this is just the personal savings shortfall. This is not the government and unfunded liability shortfall. Globally, that runs into the multiple hundreds of trillions on top of the $400 trillion savings shortfall.

The present standard of retiring somewhere between ages 60 and 70 is not going to be sustainable when half the population lives to 80 or 90 – which is already realistic today – let alone 100 or more. It’s just not possible. If you’re like me, you don’t intend to retire at 70 or maybe not at all, but it’s nice to know we have the option. Future generations won’t.

According to WEF, the global dependency ratio under current policies will plummet from 8:1 today to 4:1 by 2050. That means just four active workers for each retiree. And that’s including developing and frontier markets. Developed markets will see a global dependency ratio of about 2:1. I see no way that can work. WEF doesn’t either. Here is their advice to political leaders.

Given the rise in longevity and the declining dependency ratio, policy-makers must immediately consider how to foster a functioning labour market for older workers to extend working careers as much as possible.

There you have it, straight from Davos. We must “extend working careers as much as possible.” Your dream of hanging up the work clothes at 65 and going on extended vacation will remain a dream until some later date. Early retirement will survive only for the kind of people who go to Davos.

Again, for me this is fine. I’m 67 and I love my work. I plan to keep at it for many years to come. But I understand many people don’t have that option. They have health problems, or their professions are being automated, or they spent their career doing physical work that is no longer possible. The medical advances I foresee will help, but they’ll take time to become affordable to everyone. Some people are going to fall through the cracks.

Moreover, simply saving more money probably isn’t an answer, either. Interest rates are a function of supply and demand. You can’t invest your savings in a high-yield bond unless someone out there can borrow at that same yield. When so many of us want to lend and no new borrowers appear, supply and demand will keep yields low. We already see this in today’s near-ZIRP conditions, and they may not improve much.

Part of the justification for ZIRP was that it would force capital into risk assets, thereby stimulating the economy. It now appears that the only thing stimulated was asset prices, and by and by the risk is going to catch up with those taking unwise amounts of it. That unhappy outcome will likely widen the retirement shortfall even further.

And so the expectation of longevity is going to motivate people to want to save more money, except they’ll have to have jobs that pay enough to enable them to save money to flesh out the retirement plan. This headline appeared a few weeks ago:

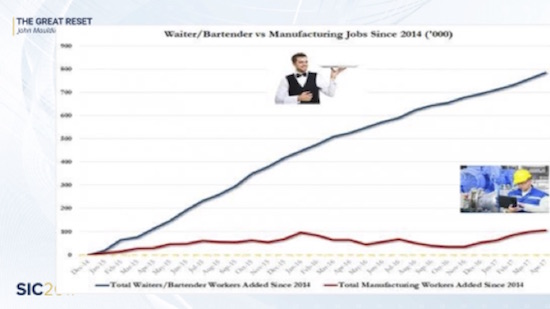

Oops. The Council of Economic Advisers now estimates that artificial intelligence will replace 83% of low-wage jobs. I’m not certain how they came up with that number – it seems high – but whatever is the figure turns out to be, it’s alarming. And the jobs we are creating today are not the high-paying manufacturing jobs that everybody wants to “bring back.” They’re not there to be brought back. There is actually a quite large “re-shoring” movement going on, but the companies that are coming back are doing so with automated technology and far fewer workers than before. The advantage of using inexpensive offshore labor has fallen before the advantage of being close to your markets and “employing” robots and artificial intelligence.

The McKinsey Global Institute published a report last December that said: “On a global scale, we calculated the adoption of currently demonstrated automation technologies could affect 50% of the world economy’s 1.2 billion employees and $14.6 trillion in wages.” That is an astonishing statistic.

By the way, one of the subheads in that screenshot above points out that 61% of financial services positions are at high risk of being replaced. If you are in the financial services industry, maybe you should be thinking about how you can keep from being automated out of a job.

The jobs we are creating? Think 800,000 waiters and bartenders versus 100,000 manufacturing jobs. I have children who work in the food service industry, and I can tell you they are making barely enough to provide for themselves, let alone raise a family or save for retirement.

Officially, the US unemployment rate is 4.3%. There are 200,000+ manufacturing jobs that employers can’t find suitable, highly skilled candidates to fill. Last year, the labor force participation rate declined by another 0.2% to 62.7%. The employment-to-population ratio fell to 60%. Fewer of us are working and making enough to actually be able to save for retirement.

In other words, I don’t think we can invest our way out of this. The obvious answer – extend the retirement age – has the unwelcome side effect of reducing job opportunities for younger workers. At some point that might be okay if low birth rates create widespread worker shortages, but the adjustment will take time.

The solution may turn out to be something presently unimaginable. We don’t know where technology will take us and what opportunities it will create. We also don’t know what political alliances can create. What if the next time around we got not just President Bernie Sanders but a Bernie Sanders-compatible House and Senate? Could we see a wealth tax in addition to a whole slew of other taxes? Would our dear leaders be willing to tax your retirement plan so that people without adequate savings could enjoy a more pleasant retirement? Forget fairness to you as an individual, because they will be arguing about fairness to everyone in the country. Yet today the Republican majority refuses to consider instituting a value-added tax and lowering income taxes and corporate taxes to very low levels. They could do this, because they now have a majority. They are simply afraid of a VAT and are going to find themselves in far less sympathetic hands in a future crisis.

What we do know is this: An unsustainable situation will not be sustained. Retirement as we know it is unsustainable. It will give way to something else, and maybe soon. Frustration is building in America because of the problems I highlighted above, and we could well see an administration and Congress that will push through a much less friendly VAT plus income tax increases, not cuts.

Think it can’t happen? When your back is against the wall and you’re down to your last few bullets and the enemy just keeps coming, you start to very quickly consider all sorts of options. Within 10 years we are not only going to be thinking the unthinkable, we will be doing the unthinkable. And not just in the US but all over the world. The unthinkable will be coming to a country near you, along with unbelievable science-fiction-grade technology.

Count on it.

A Wedding and the Virgin Islands

I’m not doing much traveling this month until Shane and I go to the Virgin Islands the last week of June. On Monday, June 26, she celebrates her birthday. Since I asked her to marry me on her birthday last year, we are going to get married on her birthday this year. Just the two of us on the beach, and the rest of the week relaxing and thinking of the future together. While this approach does allow me to only have to remember one important day rather than two, I am informed by many friends that it does not relieve me of the responsibility to buy two presents.

Shane and I have lived together for four years now, and she has pretty much figured out how I operate. She has amazing forbearance and patience – she not only puts up with my peripatetic lifestyle; she even allows me to withdraw into my chair to read or to sit in front of my computer all day writing. Not exactly the most exciting of activities.

We will stay in the Virgin Islands for eight days and then come home to a full schedule. And I’m fully committed to begin to bring together the various chapters of my book, The Age of Transformation. That project will hopefully benefit from my new commitment to write fewer words per letter. Maybe I can do that for a chapter or two of the book as well. The reality is that each chapter could almost be a book of its own. I have to make sure I don’t get carried away. The book will not be a deep dive but rather a sweeping pass over the transformations that are coming to our world, not just technologically but also socially, demographically, politically, and especially geopolitically. The economic world will be turned upside down as we make decisions to do previously unthinkable things to get clear of the enormous debt burdens and bubbles we created.

And with that I must hit the send button. You have a great week.

Your determined to be more succinct analyst,

John Mauldin

subscribers@MauldinEconomics.com

Copyright 2017 John Mauldin. All Rights Reserved.

The other day, I was asked what my investment advice for a 65-year old would be? My reply: “Go to the gym and watch your expenses.” To create wealth and/or preserve it for a future generation, all too often do we lose sight of the big picture. Let me explain.

The other day, I was asked what my investment advice for a 65-year old would be? My reply: “Go to the gym and watch your expenses.” To create wealth and/or preserve it for a future generation, all too often do we lose sight of the big picture. Let me explain.

Most of us invest because we pursue long-term goals, even if the means of achieving them differ greatly. This long-term goal tends to be saving for retirement; for those who can, it might extend to save for a future generation; or, for institutional investors, there might be an infinite investment horizon.

To serve investors, we have a massive industry paid in basis points of assets serviced or commission on products sold. In my humble opinion, our industry is ill equipped to provide advice that falls outside of those parameters. Here are a few of those:

Go to the gym. Seriously. You don’t need to be a wizard able to dissect financial statements to appreciate that your own earnings potential is the one you might have most control over. You have more income options at your disposal if you stay healthy until an old age. While there are limits as to how much we can control our health, it is an aspect of our lives that many of us could easily improve. If you want “diversification” in your portfolio, investing in your own health is something you might want to add to your list. If you manage an endowment, this may not apply, except that sending your board of directors to the gym may not be such a bad idea either.

Watch your expenses. Even more seriously. In an industry offering services on what to do with your hard-earned money, there is too little emphasis on reducing expenses. Businesses and people typically don’t go out of business because of a lack of revenue; they typically go out of business because their expenses are too high relative to their revenue. College students can live off barely any income, but somehow, we all pick up a boatload of recurring expenses as we grow older. The same applies to institutions: for example, donations may lead to new buildings, but those buildings need to be maintained. Most institutions, at least, have formal budget plans.

When an individual goes to a financial planner, they may be asked about their retirement spending habits. I allege that just as many have very little appreciation of what “risk” in a portfolio means, few know how their expenses will evolve once they retire.

May I propose that you analyze your current spending habits to better understand how your spending may evolve? Your current spending discipline may speak volumes about your future spending discipline. To give an example: a good fifteen years ago, I discussed spending habits with two investors: both had a family, both lived in affluent neighborhoods; one of them had about four times the income of the other one. Yet, the person with the more modest income saved more each year than the high earner. And guess what: today, the high earner continues to splurge most of his money while the more modest person has continued to prudently build his retirement nest egg.

There are plenty of models on how much you might be spending in retirement. Adjusting one’s expected future expenses based on a frank assessment of one’s own character might make the exercise more realistic. And the more seriously one takes the exercise of assessing one’s spending habits, the more likely it is that one can actually learn to manage those expenses.

Be a role model for your kids. Financially that is. If you want to save for the next generation, live by example. How can you expect your children to live within their means if you don’t? Financial education is good for everyone, including children. Let’s assume for a moment you are fortunate enough to be able to leave something for the next generation, wouldn’t you want them to also preserve the wealth for the following generation? A good starting point to raise them without feeling entitled may be to teach them about the value of money; and while a lesson on monetary policy wouldn’t hurt, such knowledge doesn’t matter if children do not understand how to keep their expenses in check. And that, in turn, may be difficult if their parents can’t do this.

What does this all mean for your portfolio?

In the context of health, expense management and being a parental role model, can one draw conclusions about what one should invest in? The one takeaway may be that investing is not about bragging rights at cocktail parties. If you can afford it and can afford the risk that comes with an investment to “show off,” I don’t have a problem with anyone investing in a pet project or going along for the ride in a tech startup, be it through private equity or a fashionable stock. Let me just guess that if you are the type to go for the hot stock tip, the fashionable idea, you may also be the type of person who fails the Marshmallow Test; coincidentally, I allege it means your long-term investment returns are more likely to be disappointing. In my view one should treat their portfolio like a serious business.

None of this is rocket science. What makes this worth writing about anyway is that I see so many people not adhere to these simple concepts. I also see many parents struggle to help their children learn about finance and to respect the value of money.

Once those basic concepts are understood, one can start talking about portfolio construction. In our industry, we differentiate between financial planners, asset allocators and portfolio managers. A do-it-yourself investor might be wearing all these hats simultaneously. To make it clear, I have nothing against do-it-yourself investors because they are engaged. I would much rather see a do-it-yourself investor who is engaged than someone who has lots of advisors, but doesn’t listen to them or manage them. Just like any outsourced relationship, hiring an investment professional requires management.

In this spirit, please register for our June 22 Webinar entitled: “Invest in Yourself – What Your Advisor Doesn’t Tell You” where we shall expand on the discussion. Make sure you subscribe to our free Merk Insights, if you haven’t already done so, and follow me at twitter.com/AxelMerk. If you believe this analysis might be of value to your friends, please share it with them.

Axel Merk

President & CIO, Merk Investments