Stocks & Equities

While we expected the gold stocks to correct and test GDX $22 and GDXJ $35, we did not expect it to happen so quickly. It literally took only three days! Gold stocks rebounded on Friday and managed to close the week above those key levels. While gold stocks could bounce or consolidate for a few days, we would advise patience as lower levels could be tested as spring begins.

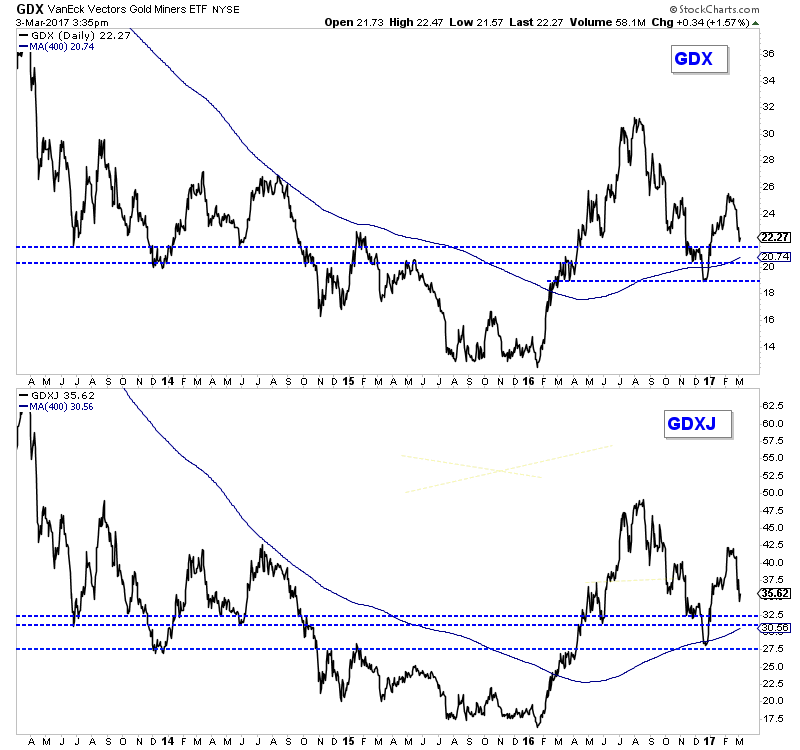

The weekly candle charts of GDX and GDXJ are shown below along with their 80-week moving average. For the entire week, GDX and GDXJ declined 8% and nearly 12% respectively. Although miners recovered Friday, the weekly candles signal the kind of selling pressure that do not exactly mark “higher lows” within an uptrend. In other words, while miners could recover for a few days or even a week or two, I would expect lower levels to be tested. That essentially includes the 80-week moving averages and the December lows.

GDX & GDXJ Weekly

In order to get a sense for the strong support levels, I use a daily line chart which helps to smooth out the volatility. The miners essentially have two points of strong support. The first is a wide area that includes $20-$21 for GDX as well as $31-$32 for GDXJ. That target area includes the 400-day moving average for both GDX and GDXJ. If that target area fails to hold for a few days or even a week then look for strong support at the December lows.

GDX & GDXJ

In short, the next quality buying opportunity figures to be at a retest of the 400-day moving average or perhaps a retest of the December lows. A weekly close above GDX $25 and GDXJ $40 would invalidate our cautious view. We expect the next several months could be a grind as the sector oscillates between support and resistance. It’s hard to do but the way to play that is to buy weakness and avoid chasing strength.

Jordan Roy-Byrne, CMT, MFTA

Jordan@TheDailyGold.com – For professional guidance in riding this new bull market, consider learning more about our premium service including our current favorite junior miners.

1. Rate Hikes – Trump – Disappearing Pensions

by Michael Campbell

Trump may not be liked by 1/2 the US but after his speech to Congress even the press gave him a credit. Rate hikes on the agenda and so are solutions to the iceberg of unfunded pensions.

2. It’s Crash Awareness Week

2. It’s Crash Awareness Week

by Bill Bonner

A Los Angeles spec house is on the market. It has seven bedrooms and 20,000 square feet of living space. It comes with a gold Lamborghini Aventador and a gold Rolls-Royce Dawn. You also get a wine cellar, a pool, and the usual claptrap amenities to which rich people are easy prey.

The price? A hundred million dollars.

3. Gold Stocks’ Enormous Daily Slide

by Przemyslaw Radomski

Feb 27th was just another period of back-and-forth movement for gold, silver, the USD Index and even the general stock market – but not for precious metals mining stocks. Gold stocks and silver stocks plunged very visibly – there are very important implications of this move and they are not bullish

Rather than immediately wonder how the main stream media became corrupted, it is appropriate to recall when only the tabloids were suspect.

Rather than immediately wonder how the main stream media became corrupted, it is appropriate to recall when only the tabloids were suspect.

Perhaps there was a time when any town that was big enough for two newspapers one would favor the Democrats and the other the Republicans. That would be by editorials going into an election. For most of the time, the goal was accurate reporting. That was back when most small towns were right out of a Norman Rockwell painting. On the outskirts of respectability were the tabloids with sensational headlines about UFOs everywhere and Area 51, specifically. A standing joke was what would happen if a real alien landed at the doors of the National Enquirer?

Much has changed since. In 2010, the “Enquirer” was considered as “legit” by the Pulitzer Prize Board and an almost monolithic Main Stream Media has deteriorated into the fantasy world of tabloids.

Sensationally scary headlines were once limited to tabloids. In the early 1970s, headlines about “global cooling” and “Nuclear Winters” began to be included in the main stream media. Over the past twenty years, today’s form of yellow journalism has heralded the horrors of “global warming” and biblical rises in sea levels, not to overlook the violence of “climate change”.

More hysteria than science, it sells newspapers and gets TV eyeballs, which is business. It also enabled a formidable expansion of state power and wealth, which is control.

How did it happen?

Media and big government found each other.

British Columbia, where this writer lives, provides a colourful political history. Perhaps a micro-model for much of the Western world.

Since the 1950s, it has been a struggle between power-mad socialists and the party that tries to approach sound government. The latter provided some guidance on the US election. Under the name of Social Credit, it was a pro-business and socially-conservative party. It was so non-urban, that no sophisticated person would ever admit voting for the party. But the “Socreds” won majorities for almost 30 years. Currently in the US, the smart set would never admit to supporting the new Republicans. Come to think of it, neither can some old Republicans.

British Columbia’s first socialist government failed dramatically in 1975, defeated by Bill Bennett, a small-town businessman. The winning campaign platform was “Restraint”, which meant cutting excessive government expenditures. This was disquieting to the Left, that had thrived for 4 years at the public trough, while unloading their personal passions on the taxpayers.

Premier Bennett’s first press conference was fascinating. He reviewed “Restraint”, which was refreshing to the taxpayer. This was opposite to the media’s response. Instead of asking for clarification or elaboration, reporters began arguing against the policy points. It was a surprise and in retrospect the start of the unhealthy combination of big government and media. Quite likely this was taking place in many jurisdictions.

In the 1980s and 1990s, articles about journalism schools were published. When asked why students took journalism, the response was “To change the world”. This continues, with The Guardian in 2015 headlining “Would-be journalists still want to change the world”.

Reporting the world’s news seems secondary.

The result has been an unhealthy combination of powerful politicians, government agencies that are working for their own interests, an activist judiciary and FBI all promoted by a highly-politicized media. There is no sophistication about international socialists or national socialists. The Hegelian Dialectic has been corrupted to “You must do this!”. “Why?”. “Because!”.

The governing classes have become, well, ungovernable. Finally, the public is beginning to protest “in-your-face” and “in-your-pocket” bureaucracy. This fits the classic model of a popular uprising. The establishment lives the good life while peddling promises about how good things are to a public that know they are not doing well.

The last successful uprising took down the Berlin Wall and Communism. Beginning in 1989, ordinary citizens overwhelmed the threats of murderous police states. In the West now, all the governing classes have is a propagandizing media.

The popular uprising is the carrying event and is beginning to rank with the great ones in history. Now having an able executive, its success will continue. An uncorrupted media will report it – straight up.

“We are now living through the mother of all financial bubbles. We’ve been living with it so long now that we have to take three giant steps backwards to even detect its broad outlines.

“We are now living through the mother of all financial bubbles. We’ve been living with it so long now that we have to take three giant steps backwards to even detect its broad outlines.

As a reminder, a bubble exists when asset prices rise beyond what incomes can sustain. Florida swampland in the 1920’s, tech stocks in the late 1990s, or Toronto real estate today — all are fine examples of this.

The US government and the private banking cartel known as the Federal Reserve, in cahoots with a very compliant and complicit mainstream media, are doing everything in their vast and considerable power to convince us that we are living in an golden era of risk-free prosperity. And that tomorrow will be even better.

Now, regular readers of PeakProsperity.com’s reports will know there’s a mountain of evidence contracting this. But it’s critical to understand that this is the same public perception management style as we’ve recently seen at Oroville: Deny, deny, deny… and then finally admit the obvious.

So let’s take those three giant steps backwards and see if we can spot the flaw in the ‘everything is awesome!’ meme that the Fed et al are trying to paint for everyone by flooding the “markets” with so much thin-air liquidity (between $150-$200 billion a month) that nobody has any clue what anything is truly worth anymore:”