Gold & Precious Metals

Ed Note: Make sure to read down to “Watch For Bond Market Troubles” & Commodities Entering New Bull Market

We’ve witnessed remarkable stock market performance in the last year and a half, with the Dow Industrials and S&P 500 not experiencing a 3 percent or greater pullback during this parabolic rally.

“This has never happened before in history,” Dorsch told Financial Sense Newshour. “There’s virtually no fear in the market for a pullback,” Dorsch said. “The only fear is the fear of missing out. This is a mania, which normally occurs at the tail end of a long-term bull market. Those who have missed the rally capitulate and begin to do things that they might not otherwise contemplate doing.”

Markets are psychologically driven, he noted, but from a policy perspective, central banks and corporations are certainly helping to fuel prices higher.

“We have negative interest rates wherever we look, either on a real basis discounted for inflation or in nominal terms,” he said.

Combined with stock buybacks by S&P 500 companies to the tune of $3.5 trillion over the last 8 years, retiring 18 percent of all floating shares in the market since 2009, it isn’t surprising stocks have marched higher.

Now, with the recent GOP tax cuts reducing the corporate rate and freeing $2.5 trillion sitting overseas for potentially more stock buybacks, we’re looking at a burgeoning mania in the works.

Watch for Bond Market Troubles

The consensus opinion is for the S&P to hit the 3,000 level, Dorsch stated.

With everything going well, only the Federal Reserve or an exogenous, unforeseen event can take the punch bowl away, Dorsch added. Barring these possibilities, we’ll see higher oil prices, faster inflation, and increased pressure on the Fed to raise interest rates.

However, there is one other possible villain in this story: that’s if the bond market begins to fall apart. If bond vigilantes raise 10-year bond yields to 3 percent, which is a good possibility, it could also hurt markets.

“If there’s going to be a correction, it’s going to be sharply higher interest rates caused by the bond market, forcing the Fed to take stronger action to fight inflation,” Dorsch said. “That would be the bearish catalyst. If that does not occur, if interest rates stay relatively low, then this mania will continue.”

Commodities Entering New Bull Market

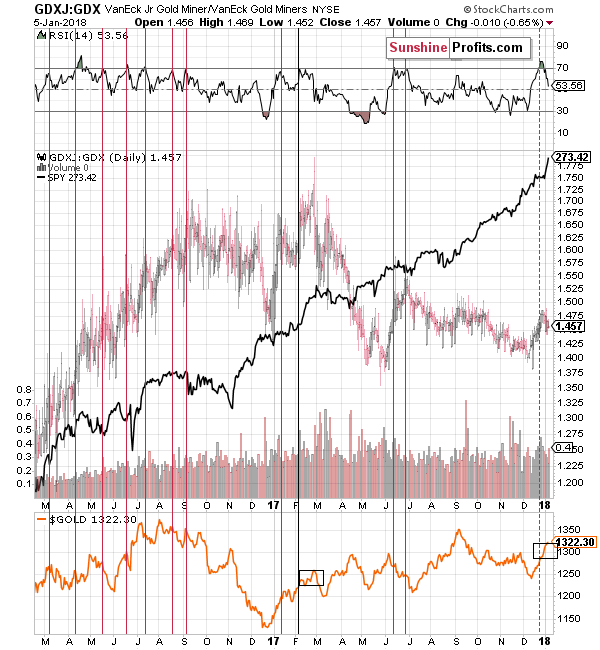

Dorsch expects crude to hit somewhere between $65 and $70 a barrel, and for gold to move higher with commodities generally to around the $1,400 level. His basic scenario for the commodity markets is that this cycle is turning, he stated, and the 4.5-year downturn is over.

He also expects that President Trump’s administration is reliant on the stock market and will, therefore, seek to continue to keep the bull going.

“The stock market now has become too big to fail,” he said. “His presidency may even hang on the direction of the stock market—he’s become so committed to it.”

….World Debt Is Rising Nearly Three Times As Fast As Total Global Wealth

Some nasty dark clouds are forming on the financial horizon as total world debt is increasing nearly three times as fast as total global wealth. But, that’s okay because no one cares about the debt, only the assets matter nowadays. You see, as long as debts are someone else’s problem, we can add as much debt as we like… or so the market believes.

Now, you don’t have to take my word for it that the market only focuses on the assets, this comes straight from the top echelons of the financial world. According to Credit Suisse Global Wealth Report 2017, total global wealth increased to a new record of $280 trillion in 2017. Here is Credit Suisse’s summary of the Global Wealth 2017: The Year In Review:

According to the eighth edition of the Global Wealth Report, in the year to mid-2017,total global wealth rose at a rate of 6.4%, the fastest pace since 2012 and reached USD 280 trillion, a gain of USD 16.7 trillion. This reflected widespread gains in equity markets matched by similar rises in non-financial assets, which moved above the pre-crisis year 2007’s level for the first time this year. Wealth growth also outpaced population growth, so that global mean wealth per adult grew by 4.9% and reached a new record high of USD 56,540 per adult.

This year’s report focuses in on Millennials and their wealth accumulation prospects. Overall the data point to a “Millennial disadvantage”, comprising among others tighter mortgage rules, growing house prices, increased income inequality and lower income mobility, which holds back wealth accumulation by young workers and savers in many countries. However, bright spots remain, with a recent upsurge in the number of Forbes billionaires below the age of 30 and a more positive picture in China and other emerging markets.

There are a few items in the Credit Suisse’s summary above that I would like to discuss. First, how did the world increase its global wealth at a rate of 6.4% in 2017 when world oil demand only increased 1.6%??

As we can see from the IEA – International Energy Agency’s Global Oil Demand table above, total world oil demand only increased 1.6% over last year. Thus, the rate of increase of global wealth of 6.4% in 2017 was four times higher than the 1.6% increase in world oil demand. I would imagine some readers would stand on their soapbox and emphatically claim that energy has nothing to do with wealth creation. Unfortunately, these individuals somehow lost the ability to reason along the way. And we really can’t blame them for making such an absurd remark because they probably believe their food magically appears on the Supermarket shelves.

Second, the financial wizards at Credit Suisse reported that global wealth also outpaced the population growth. What they are suggesting here is that the “Millenials” who (many) are becoming wealthier by sitting in front of a screen and clicking on a mouse than their grandparents (the poor slobs) who were mainly working in the manufacturing industry by producing real things.

Third, while the Credit Suisse analysts stated that the Millenials were facing some disadvantages, there was a bright spot with a recent surge in the number of Forbes billionaires below the age of 30. Well, ain’t that a lovely statistic. What once took an individual at the ripe old age of 55-70 years to achieve a billionaire status, now can be done right out of college. It’s probably not a good sign for the economy going forward that we are seeing more billionaires below the age of 30.

Global Debt Is Destroying Real Wealth

Okay, now that we know the global wealth reached a new record high in 2017, what about the other side of the story? You know… the debt. As I mentioned in my previous article, ECONOMICS 101 states:

NET WEALTH = ASSETS – DEBTS

Now, that equation above is a simple one… kind of like 2 + 2 = 4. However, the financial industry likes to focus on the assets and not the debts. But, according to a recent article on Zerohedge, Global Debt Hits Record $233 Trillion, Up $16Tn In 9 Months, the world added more debt in 2017 than total U.S. GDP:

As we can see, total global debt increased from $217 trillion at the beginning of 2017 to $233 trillion in the third quarter of 2017. That is a $16 trillion increase in global debt in just nine months. While U.S. GDP hit $19 trillion in Q3 2017, if we add another quarter for the increase in global debt, it could surpass $20 trillion for the entire year.

So, even if global wealth surged in 2017, so did world debt. According to the data, global wealth increased by $16.7 trillion in 2017 while global debt expanded $16 trillion… nearly one to one. However, this is only part of the story.

If we look at the increase in total world debt and total global wealth over the past 20 years, we can see a troubling sign, indeed:

Since 1997, total global debt increased from $50 trillion to $233 trillion compared to the rise in global wealth from $120 trillion to $280 trillion. There are two disturbing trends shown in the chart above:

- Global Debt has increased 366% vs. 133% for Global Wealth since 1997

- Net Wealth was $70 trillion in 1997 versus $47 trillion in 2017

If we compared the percentage increase in global debt versus global wealth, global debt is rising at nearly three times the rate of global wealth. Furthermore, doing simple arithmetic by substracting DEBTS from ASSETS, global net worth fell from $70 trillion in 1997 to $47 trillion in 2017.

By putting the numbers together, right in front of our eyes, we can clearly see that the world is going broke by adding debt. Basically, we erased $23 trillion in Global Net Wealth in the past 20 years. However, I believe the situation is much worse than the figures shown above. For example, I came across an article several months ago on Zerohedge that also reported the increase in global debt, stated it did not include FX Swaps, etc. According to their data, Foreign Exchange Swaps likely exceeded $13 trillion. FX Swaps are more short-term debt instruments, but they are still debt instruments.

Moreover, we have no idea what other nasty debts or obligations are hidden out of sight of the public. Regardless, if we were just to include the FX swaps worth $13 trillion, the estimated net worth of Global Wealth would only be $34 trillion ($280 – [$233 +$13] = $34).

The Percentage Of World Gold Investment To Global World Assets Is Much Higher Than We Realize

Now, here’s how the financial situation gets really interesting. If we go by NET WEALTH, then the value of global gold investment as a percentage of world assets, IS MUCH HIGHER. According to the typical financial asset allocations, precious metals comprise approximately 1% of total global assets. The following chart shows that total global gold investment is valued at $3 trillion and silver at $51 billion (based on $20 silver, last year):

Thus, $3 trillion in the value of world gold and silver investment equals a little bit more than 1% of the $280 trillion in global wealth. However, if we are clever and remove the debts, the real NET WEALTH is closer to $34 trillion. Thus, total world gold and silver investment comprises nearly 10% of GLOBAL NET WEALTH, or ten times higher than it is currently valued.

Furthermore, we must remember, physical gold and silver, purchased and held in one’s hand has no debt attached to it. Of course, this assumes that an individual didn’t take a loan out against their precious metals holdings. Thus, the precious metals have always been the highest quality stores of wealth for 2,000+ years… even though the Millenials forgot about them for the promise of millions of Crypto profits.

Unfortunately, the situation is much worse than what the figures in the charts above reveal. Why? Because, the only way that debts can be paid down is if we have another $233 trillion worth of profits from economic activity, correct? Now, I am not talking about $233 trillion in costs; I am talking about PROFITS. Big difference.

To pay back $233 trillion in debts, we have to burn one hell of a lot of energy… don’t we? That’s correct; we have to burn energy to create economic activity. And not just plain ole economic activity, PROFITABLE economic activity. Well, we are in BIG TROUBLE because we have been burning one hell of a lot of oil (95+ million barrels per day), but global debts are increasing faster than global wealth.

So, it’s just a matter of time before GRAND FACADE comes crashing down.

Here’s how I see the future unfolding…

- The Falling EROI- Energy Returned On Invested will continue to gut the oil industry, and in time the world will experience CLIFF LIKE declines in global oil production

- As oil production suffers massive declines, global debt will become unmanageable.

- As debt becomes unmanageable, it starts to collapse.

- As debts collapse, so will assets. Why? Because debts are the other side of the assets

- As assets collapse, so with the value of STOCKS, BONDS, & REAL ESTATE

- As investors watch their investments implode, some who still can think for themselves will buy gold and silver

- As investors flock into gold and silver, patience will finally pay off for precious metals holders

Please stay tuned for my first SRSrocco Report Youtube video to be out in the next two days. I have all the charts and graphs finished, just working on getting my mouth to work correctly for the voice-over.

Lastly, I wanted to thank all the newest and existing Patrons and SRSrocco Report Members who support the site. Your generous support has allowed me more time to start other projects (Youtube videos & new Forum.. coming this week) as well as the ability to write more detailed articles. I believe the Youtube videos will be able to explain some of the analysis that might be difficult to understand.

Check back for new articles and updates at the SRSrocco Report.

Last week, I asked, “What would make 2018 more productive for you? Please email me the first thing that comes to your mind.” Before I summarize the responses, a big thank you to the 800+ people who sent me personalized responses. Someone pointed out that asking the question itself already helped because it motivated her to review her plans and targets.

Last week, I asked, “What would make 2018 more productive for you? Please email me the first thing that comes to your mind.” Before I summarize the responses, a big thank you to the 800+ people who sent me personalized responses. Someone pointed out that asking the question itself already helped because it motivated her to review her plans and targets.

My question had been intentionally open, and as such, I received feedback on productivity ideas pertaining to both personal and professional life. In some ways, answers were all over the place, including numerous answers that I had no idea were somehow related to productivity. That said, as themes emerged, at times, I could sense some respondents have their productivity initiatives under control with others struggling. I’ll touch on the main themes below.

First off, to the classic definition of productivity. A lot of respondents mentioned they wanted more time:

My first thought was more time – but then I quickly realized that is the wrong answer – as it is not possible – and productivity is “return on time” not time itself

Well, there is no “wrong answer” and, as many indicated in their responses they were half joking about wanting more time in the day and/or week. The biggest time sucker judging by the lashing out by respondents appear to be social media enabled smart phones:

Great question and my answer is cutting back on my “time saving” devices, especially my phone. I’m dealing with teenagers spending too much time on their devices as well so I’m leading by example. I’ve found my productivity is up when I’m not checking it constantly and things are better in our family when we are unplugged.Warmer weather and cutting off social media. I already took the Facebook app off my phone. I’m hoping it helps me use my free time (including my 45-min commute) for reading books and magazines and listening to high-quality podcasts. Everyone putting their phones down! My main thought is more quiet time without interruptions, not any gadget.

To all those that indicated they want to get rid of their iPhone, I have bad news: someone responded he had an old flip phone and still received too many messages. High on the list was email management, with many hoping to receive fewer or more concise emails, less spam and, yes, fewer surveys such as the one I sent. But it’s not just in the INBOX, there is simply too much junk out there:

Making sure my emails don’t manage my day2018 would be more productive for me if I had a better strategy for taming my inbox.One work day without e-mail per weekIf I could get a “”bot”” to answer my email, I’d love it!An EMP attack would make a nice break from email for 2 or 3 yearsA better curating process for the information I consumeI think spending less time online would probably have the largest effect. …the multitude of various channels signaling “hey look here” today — it didn’t use to be like that. It’s getting too distracting even for a guy who’s been exposed to the net for decades.

A thoughtful response explained we are victims of our own success in being more efficient at many daily tasks:

…take business travel: 15 years ago, I called my travel agent and told her that I needed to go to Geneva on a specific date and needed a hotel. She would comply and come up with a complete (probably ridiculously expensive) itinerary. Who is using travel agents any more these days? I can do it myself and better, choose among the best flights etc and the whole package probably is a lot cheaper than a trip arranged by a travel agent.… admin work that used to be done by assistants … now is being done by a more and more limited group of people within an organization. It is more effective …, but ..in spite of digitalization and automation I spend more and more time doing “these admin” things and I have less time doing what I really should be doing: being creative and interact with clients

In that context, and going back to more traditional interpretations of productivity, there were calls to increase focus. There appears to be desperation to cut through the noise when it comes to any type of information:

Focus, Strategy and Discipline. More focused, less distracted…focusing on fewer thingsBe better at doing the important tasks first, instead of the urgentBetter filters to figure out what not to work on, including those areas of such general interest, that we are very unlikely to attain an analytical edge.More disciplined time management (stick to allotted times for meetings etc ). Having more time to think of really deeply about key issues, rather than just coping. Committing to a ‘mental reset’ session at least three times a week (sport, mediation, etc). Having a morning routine and end day routine (first hour, last hour) with no media, technology interference to allow focus The ability to tune out “noise” both societal and in the investment world.The confidence to pay less attention to Washington DC newsRegarding general time management:Give up some of things that I like in order to focus on the things that I love.Uninterrupted long-form blocks of time for reading and thinking. My goal is to read more books and have more patience with myself when working on bigger ideas that may take longer to deliver (and could fail), but will have more impact than a quick effort.Getting Things Done (GTD) philosophy from David Allen’s book of the same name

There were multiple calls for administrative assistants; some included the call for an assistant at home:

An administrative assistant would make my life more productive. A butler, a PA (home and office) and a personal trainer.

While many looked for ways to squeeze more time out of a day:

2018 would be more productive for me if I spent less time in bed.If I could get by with less sleep

Many more pushed in the opposite direction. The “mindfulness” bucket was large. More sleep was explicitly mentioned in many emails as a way to get more productive:

Productivity comes from a healthy brain, every decision comes from it. So cherish your brain and cut the sugars, alcohol and go to bed an hour earlier every day. And don’t forget to exercise.

Talking about health, those with health issues (or knowing someone with health issues), realized that good health is key to productivity; here a selection of the responses:

Getting more sleep and staying healthy. Maintaining good health, in mind, and body.A healthy back.Continue maintaining good healthHealthier life style, (sleep better, eat healthier, exercise and channel positive energy)More trips in the running shoes and more trips to the Gym. Good health equals a clear head and an efficient means to focus on key concise nuggets of information and avoids delays in acting upon that information.Eating healthy foods and taking my vitamins regularly… it increases my energy, which allows me to be more productive. Health! Physical integrated with mental and is circular both ways!

Talking about health, lifestyle is on people’s mind:

A life partner!Finding myselfLoving things as they are would make me more productive in 2018 and beyond. When “bad” things happen, I can resist reality (“This can’t be happening!”) or I can accept that they have occurred and move on from there. When I take the latter path, I have a greater chance of learning how to prevent the “bad thing” in the future. And, even if that’s not possible, I can tackle the mess from a more reasonable perspective (“OK. This happened. Now what can I do?”). I’ve been working on this for decades, but there’s always more to learn. My solution is to focus on being more mindful – living in the momentBeing what I really love!My focus is on other matters such as personal growthHope for more peace than hateInvesting in oneselfMore time for myself, my family and my friendsIf I can become much more consistent about meditation.One small positive thought in the morning can change your whole day I think I should try getting an extra hour of sleep everyday for greater productivity. Currently get 6-7 hours. And some time to goof off.

While health in itself would get people to be more productive, several responded a job in healthcare would do the trick for them. A new job, a new challenge within a firm, a job at all, or more “gigs” for independent contractors were mentioned, with a few asking whether we had any job openings (no, we aren’t hiring, but if you have ideas how you can join us as a revenue rather than cost center, I’m always listening).

The “new job” bucket of responses was closely related to responses that suggested more revenue would increase their productivity; some sought to pursue specific marketing initiatives. And just as some asked me whether we had job openings, some smart cookies pitched their products to me as the appropriate response as to how they can increase their productivity.

For some, an increase in productivity requires an increase in revenue; many need cash for capital expenditures to make that happen. Indeed, many thought they could increase their productivity if they had a higher salary; several if they were able to raise money for a venture. And, of course, some suggest less conventional ways to raise money:

A winning lottery ticket so I could expand my business without debt.

My query went out to people with a variety of backgrounds; notably, my circle of contacts includes many investment professionals, but also many who are not, but for whom investing is on top of their minds (at least when they get an email from me). Staying on the topic of money, many investment professionals indicated they would be more productive if volatility in the markets were to go up and, with it, equity prices were to fall. For those not in the industry, the reason is rather straightforward: investment professionals have a difficult time adding value when indices go up in a straight line. When it came to non-professional investors, several had very specific requests for the performance of what they were invested in, with many requesting the price of gold or silver to go higher. Beyond that, there was significant disagreement. Some want Bitcoin to soar, others want it to crash. And there were also those that wanted equity prices to be higher and volatility to remain low.

Many suggested their productivity would increase if there was less government interference in the markets; this covered the whole spectrum from low interest rates distorting asset prices to outright government interference and alleged manipulation in markets:

What would make 2018 more productive for me would be for the markets to cease being a political tool and return to being a ‘free’ market. Let me know if you see this happening, ever. Otherwise, the markets will remain a … tool of the elite and participants in the Greater Fool School of investing.

In a multitude of ways, people requested to find clarity. There were lots of requests for high quality information, both for general news, but many specifically related to investing:

Improving the quality of my information sources. This means paying for the best research presented in the most intellectually clear, dense format. The free sources tend to be bloated with excess advertisements and coy “come ons” to join their pay service. I can understand that. I can relate to that. But it’s a time swamp that dissipates focus and distracts me from identifying core themes and crafting action plans to take advantage of the operational situation.For me, it’d be a comprehensive single-stop, source for news and analysis. There’s long been a bias in media, but after our most recent presidential election, it’s hard to really get an unbiased and analytical perspective on current events and even business-related news. An understanding of the Federal Reserve’s monetary policy roadmap for 2018.A service that makes specific sector recommendations on a regular basis (perhaps weekly or monthly?), along with brief rationale. I know lots of newsletters offer this, but I don’t trust them. I read a lot of macro analysis, but I have trouble putting it into action.A quarterly chartbook of key market/economic indicators would be helpful. We see lots of these data books but we are always open for another one – particularly one that focuses on the most relevant or key signals for asset allocators like us.More relevant market insightsAny insights you have on inflation, inflation data, or expectations in the coming yearInsight on the yield curve.It would help to be able to listen to your commentaries while driving, as podcasts, instead that having to read them, as I always do.Knowing the 10 best data points the most successful investors use (and how they combine them) to understand the global macro environment.Continued analysis of “if this happens, then do that” with respect to the market. No one can forecast the market but we can be prepared to respond to situations.Effective tail risk hedging.From an investment standpoint, more concise one stop summary of what market or stocks are high recommendationsHaving more all- weather strategies available (lower returns/risk profiles with ability to make money in different markets).

Some are working on or desire investment software:

Better investment technology.A better investment algorithmGetting my current trading systems completely automated and integrated is priority one right now.I’d be more productive if I could get my hands on some investment stochastic modelling software.

Talking about distractions: politics appears to be a major one. If our politicians stopped bickering, many respondents write they would be more productive. Some are genuinely concerned about North Korea and say they are less productive because of it. Some of the juiciest comments I received lashed out at President Trump, arguing that the noise created by his comments are a distraction; that said, as you might imagine, not everyone agrees, and others see their productivity increase through the President’s actions. Either way, please don’t shoot the messenger, I’m merely reporting.

Let’s take a step back and look and answers addressing general office efficiency:Quicker meetings.A limit on the number of meetings that can be scheduled in a week.Thank you for including me in this survey! My 2018 will be more productive as I streamline my onboarding process and clarify expectations with new and old clients.A better way to incorporate new tasks that arise when out of the office into the workflowLess bureaucracy and administration with our group of companies. Easier access to the relevant information and people to reduce the energy and time.For head hunters and lead selling companies to not bother me.I would have to say work on getting rid of unnecessary tasks on my to-do list or consolidating tasks!More efficient onboarding of new client accounts comes to mind first as my firm’s biggest issue. The biggest thing would be my own office. we have an open architecture plan, which is great for … communicating with each other but makes it hard for me to work…Spending more time with clients as a result of improvements in our service platform

Only one person chose what might have been a common answer some years ago: cleaning up his desk.

Learning new skills, or through technology, including:

I’d appreciate better productivity tools and software to help organize my thoughts better. Maybe a new notepadBetter use of technology, it’s always the best way to become more productive.New technology that works togetherIf I trained myself to use the technology I have betterCompleting the automation of the software on which my RIA is based.AI and searchBetter software (and a Bloomberg terminal)Better integration of my software. Access to my CRM via iPhone app.As an RIA, more efficiency from our custodian brokerage firm would help the most. RIAs are very dependent on their custodians and they are very helpful, the investing world evolves quickly and anything they can do to better keep up, helps immensely.Make better use of tech tools like EvernoteAdoption of a new laptop/tablet/device to increase capability of mobile updates and unchain me from my desktop. My request for 2018: Better telecommuting technology. I spend an hour and a half in the car everyday to get to and from work. I can work from home and complete all of my daily tasks from there, but I miss out on the ease of collaborating in person. I would love to be able to FaceTime my colleagues desk phones and to have cost effective video conferencing technology in every conference room.

Better infrastructure:

Better transport infrastructure in greater NYCA shorter commutebetter broadband

That said, more technology for the sake of it isn’t always wanted:

Less technology , not more … … … too clutteredSoftware vendors stop changing their formats/skins. I learn to do things quickly, then they change something and I have to relearn or find a work around.One thing that comes to mind is not having to cope with various web site “improvements.” The less time I have to spend on re-learning how to use a web site, the more time I will have in 2018 for other things.

I should not forget to mention compliance overhead. Given that many of my contacts work in the investment industry, one of the key impediments to their productivity is complying with regulatory overhead – if you haven’t heard of the acronyms used below, consider yourself fortunate:

Less regulation burden frees resources that are very expensive.Less regulation…Dodd Frank, EMIR, now MIFID II have created an enormous drain on resources. No new regulation will allow us to focus on the business once again.More changes in DOL requirements for 401K and IRA etc. accounts-so far small accounts$25m or less are disadvantaged, paperwork for others is too cumbersome and investment guidelines are wrong.Repeal DOLMy 2018 would be more productive if we could reach a final decision/outcome on the “fiduciary rule” for financial advisors (i.e., is it ever going to be fully implemented or not?).Clarity around regulation would increase my productivity.Less compliance documentation requirementsA removal of the barriers that stand between products and buyers to allow all ETF providers to be on equal footingGovernment clarity! More regulatory clarity in our industry, which could include a re-visit to Glass Steagall. It feels like the Wild West again coupled with redundant documentation required by regulations. Glass Steagall might clear the ever rising financial ambiguity in financial regulation by reducing the investment banking money flow to banks with depository accountability, as the gambling in housing etc continues. Regulation only mucks it up, and never clears up or enforces the root bad behavior, but a law dividing the banking industry into depository and investment banks again would reduce overlapping regulation, and give me more time to work with my clients.Less bureaucracy (read: stupid regulations from Mifid II). Less paperwork!Reduction in the overwhelming regulatory oversight from government and it’s trickle down and interpretation at firm level.

Some emphasized working less to achieve more:

Get rid of difficult clients – Get rid of them quickly – Oil and water does not mixA reduction of my work load/stressMore vacationGive up a couple of titles!Less travel!!! More productive for me would be less time spent on business travel.Longer holidays6 hour workdays….it works for the Swede’sTake all my paid leave

I had four respondents reference religion to improve their productivity. And some pushed back altogether, arguing that increasing their productivity is not on their agenda for the year.

Finally, some think big:

A flying carA teleportation deviceHere you are; maybe there’s a suggestion or two in here to make your year more productive. If so, consider sharing this with your friends. In the meantime, follow me on LinkedIn and Twitter.

Axel Merk

President & CIO, Merk Investments

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Merk Investments LLC makes no representation regarding the advisability of investing in the products herein. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice and is not intended as an endorsement of any specific investment. The information contained herein is general in nature and is provided solely for educational and informational purposes. The information provided does not constitute legal, financial or tax advice. You should obtain advice specific to your circumstances from your own legal, financial and tax advisors. Past performance is no guarantee of future results.

As I scan the papers, and the web, I have noticed bank analysts and newsletter writers are becoming increasingly bearish on the US dollar. Effectively, the dollar downtrend will continue in 2018 is the view. This seems the consensus thinking to justify a dollar bearish view:

• All good news is already priced in the US dollar, for instance:

-

Three rate hikes by the Fed in 2018

-

Tax cut legislation will have only a minimal flow-through beneficial on the US economy in

2018.

• Given the synchronized global recovery, other central banks will start to play catch-up on interest rates and that will be bad for the dollar.

It makes sense. But lots of things make sense in the investing world until Mr. Market decides to prove rationales flawed.

If we use net bullish positioning in the Euro-USD CME futures contracts as a proxy for dollar bearishness, you can see we may be near some type of extreme:

At +113.9k net bullish Euro-USD positioning, it represents the highest on record going back to the beginning of 2009. Hmmm…this represents lots of potential selling pressure should dollar bearish rationales prove wrong; let’s take a look at what might do just that.

As it relates to the tax cut; the more one looks at that animal the better it appears. But the mainstream media would never give Trump credit for anything good. So, for the most part, the public is exposed to sniping and cherry-picking on the tax cut from the mainstream media. But there is lots of good in there, granted it’s not perfect. It is always odd to me when others complain about keeping more of their own money.

“I am in favor of cutting taxes under any circumstances and for any excuse, for any reason, whenever it’s possible.

The reason I am is because I believe the big problem is not taxes, the big problem is spending.

The question is, ‘How do you hold down government spending?’ Government spending now amounts to close to 40% of national income not counting indirect spending through regulation and the like.

If you include that, you get up to roughly half. The real danger we face is that number will creep up and up and up.

The only effective way I think to hold it down, is to hold down the amount of income the government has. The way to do that is to cut taxes.”

–Milton Friedman

From The Wall Street Journal today:

Besides tax reform, one of President Donald Trump’s most cherished goals is reducing the gaping U.S. trade deficit.

In a little-appreciated way, the tax bill expected to pass Congress this week may do just that. This wouldn’t come by making businesses and workers more productive or changing other countries’ trade practices, but by curbing the incentive for multinational companies to artificially shift profits abroad.

Independent research suggests this could reduce the trade deficit by half, or roughly $250 billion a year, and deliver a one-shot 1% or greater boost to annual gross domestic product. This would be an accounting effect rather than a change in actual business or worker income. (It would also be independent of any increased work or investment from lower tax rates.) Nonetheless, some analysts think the positive optics might curb some of Mr. Trump’s protectionist instincts, which are heavily driven by the trade deficit.

Analysts at Deutsche Bank are even more optimistic. They estimate the deficit could be reduced by $150 billion to $270 billion a year, with a corresponding one-off boost to GDP of as much as 1.4%. They think this effect could materialize in as little as year, judging by a similar tax change in Britain in 2009.

Hmm…a one-off potential jump in GDP of 1.4% and shrinking trade deficit. Sounds good, and may mean those expecting only three hikes and moderate-benefit from tax reform may want to get their forecast erasers ready.

The chart below shows the US Current Account (current in deficit of -112.82 billion) versus the US Dollar Index since 2000. The current account deficit started improving in mid-2006 (just before the credit crunch and likely a contributing factor—see Triffin dilemma) and the US dollar has followed. So, if the current account improves further as the WSJ and others suggest, does it make sense to be dollar bearish, at least longer term?

And of course, there is more in the President’s bag of tricks. This excellent summary, “Trump offers a daring program to restore US dominance,” from David P. Godman, writing in the Asia Times, of the latest US national security report in which President Trump spoke briefly about yesterday. Some excerpts [my emphasis]:

• According to a preliminary copy of the president’s 2017 National Security Strategy obtained by the Asia Times, Trump envisions a radical upgrade in the US industrial base, large- scale support for scientific and technical education, and rebuilding of infrastructure, in response to China’s economic and strategic challenge. [Thinking that might be growth positive.]

-

The contrast with the two previous administrations is stark. The Trump report praises American values and institutions but betrays no ambition to remake the world in America’s image after the fashion of George W. Bush. Nor does it accept the slow decline of American influence into a geopolitical mush of multilateralism per the “soft power” conceit of the Obama Administration. It is centered on the American economy, the American homeland, and American interests, but it proposes a rough-edged activism where American interests are threatened that will make the world a less predictable place during the next several years. [Hoping this isn’t a green-light for neo-cons of course.]

-

The report embraces the term “America First,” by which Trump means that national security depends first of all on fixing what is wrong in America: a shrinking industrial base, disrepair in infrastructure, sagging innovation, inadequate scientific and technical education, and an excessive federal debt burden. [Bingo! Work on the problems here first before we tell others what they should be doing. This is exactly why we “deplorables” voted for him.]

-

Early press coverage already has misrepresented the report as a trade-war screed. It is nothing of the sort: on the contrary, it repudiates the complacency of the past several administrations who presided over a gradual deterioration of America’s competitive and strategic position. [Bingo! Tilt!]

- The Trump strategy does not blame America’s competitors for its economic problems, let alone propose a trade war. The term “tariff” does not appear at all in the draft copy reviewed by this publication; ostensible currency manipulation is nowhere mentioned; and the term “dumping” appears only once. Instead, the report takes aim at the industrial policy of Asian nations who “subsidized their industries, forced technology transfers, and distorted markets. These and other actions challenged America’s economic security.” But the next sentence makes clear that America’s injuries for the most part were self-inflicted: “At home, excessive regulations and high taxes stifled growth and weakened free enterprise – history’s greatest antidote to poverty. Each time government encroached on the productive activities of private commerce, it threatened not only our prosperity but also the spirit of creation and innovation that has been key to our national greatness.” [Mana from heaven.]

I have linked the full article above. Lots of interesting stuff in there and well worth the read.

The point in sharing this is to suggest just maybe the US will grow a lot faster than expected in 2018. The framework is there for a self-feeding virtuous flow of money into America.

Granted, words on a paper and implementation are two different things; especially in a world where US politicians have so many conflicting interests they put ahead of the general welfare of the country. But, stranger things have happened.

So, if you are a long-term US dollar bear, you may want to be a cautious one.

Jack Crooks, President,

Black Swan Capital

772-349-6883/ Twitter: bswancap