Energy & Commodities

What would the worst scenario in fiscal cliff issue materialising means for gold, silver, crude oil and copper on the MCX.

The US is facing another potential recession if an agreement between President Obama and Congress regarding the fiscal cliff issue is not attained well in time before January; now one would say that is barely two months away.

Before one elaborates on how the fiscal cliff issue –the issue in itself and the slew of arguments-in-waiting that would be traded for and against spending cuts and taxes–would affect commodities, one should say what the issue is about.

The Origins

When the debt-ceiling debate in US was at its height pumping up pressure to stratospheric levels, President Barack Hussein Obama, a member of Democratic Party and various Republican Congressmen led by John Boehner agreed to a new deal or law in August 2011.

As per this law, a Joint Select Committee aka ‘Supercommittee’ would come up with a bipartisan legislation by late November 2011 that would decrease the government’s budget deficit by $1.2 trillion in a span of 10 years.

Now, if the Supercommittee failed in its endeavour, which it did, the law directed automatic initiation of across-the-board cuts that would be split evenly between defence and domestic spending, which would begin January 2, 2013. The cuts amount to $600 billion.

The Bush-era tax cuts of 2010 that was extended for another 2 years by another law –Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010—would also expire by the date when fiscal cliff issue would reach a crescendo aggravating the crisis.

Add to this the imposing of Affordable Care Act on new taxes on families who are making more than $250,000 a year ($200,000 for individuals) starting at the same time.

About.com says with some clarity:

“Among the laws set to change at midnight on December 31, 2012, are the end of last year’s temporary payroll tax cuts (resulting in a 2% tax increase for workers), the end of certain tax breaks for businesses, shifts in the alternative minimum tax that would take a larger bite, the end of the tax cuts from 2001-2003, and the beginning of taxes related to President Obama’s health care law. At the same time, the spending cuts agreed upon as part of the debt ceiling deal of 2011 will begin to go into effect.”

Unless the President and Lawmakers find some way out and agree to some austerity or discrete tax hikes or a mix of both and drive away from the cliff, it is a financial Armageddon that would bump into us.

Now, what would this mean for gold, silver, crude oil and copper on the MCX.

MCX Bullion and a fiscal cliff issue in mess

Gold and silver prices have always thrived on uncertainty. If US goes off the fiscal cliff, there exists no doubt that dollar would weaken by a huge measure thereby triggering a rally in bullion: gold and silver.

MCX gold prices would climb to Rs.33000 levels and silver to Rs.65000 levels, according to Amrita Mashar, Manager-Research, Commodity Online.

MCX Metals-Energy and a fiscal cliff issue in mess

The Congressional Budget Office has predicted a recession if fiscal cliff issue is not properly addressed. Clearly that would take crude oil prices downhill. Base metals too would take a beating.

Crude oil on the MCX can come down to Rs.4400 levels even as MCX Copper could come down to Rs.400. “if it breaks the 400 mark, then the next stop would be Rs.388”, Amrita added.

One should also watch out for volatility taking over the markets in the run up to January as fiscal cliff issue would spark debates; arguments and counter arguments that would swing the markets to and fro; widely and wildly.

The Dow plunged 313 points yesterday, but don’t believe news media reports that it was the nearness of the “fiscal cliff” that caused the selloff. What spooked investors is a bigger picture that recognizes the economically catastrophic implications of a second Obama term. To be clear, there is nothing Romney could have done to avoid the deflationary Depression that lies ahead. However, a Romney presidency might have at least served as a reality check, delaying the onslaught of hard times for perhaps long enough to allow Americans to put their financial houses in order before austerity hits with the force of an earthquake, as it has in Europe.

The Dow plunged 313 points yesterday, but don’t believe news media reports that it was the nearness of the “fiscal cliff” that caused the selloff. What spooked investors is a bigger picture that recognizes the economically catastrophic implications of a second Obama term. To be clear, there is nothing Romney could have done to avoid the deflationary Depression that lies ahead. However, a Romney presidency might have at least served as a reality check, delaying the onslaught of hard times for perhaps long enough to allow Americans to put their financial houses in order before austerity hits with the force of an earthquake, as it has in Europe.

…..read more HERE

Here’s What President Obama’s Win Means For

Your Money

by Keith Fitz-Gerald , Chief Investment Strategist, Money Morning

As was widely expected leading up to the election, all of the major averages got slammed in early trading on news of President Obama’s victory. Just over an hour into yesterday’s session, the Dow dropped 262.51, the S&P 500 tumbled 27.58 and the tech- laden Nasdaq fell 59.55. Oil tanked 2.95% and $2.62 per barrel to $86.08 while 10-year bonds saw yields plummet 6.20% to 1.63%.

O-bummer.

There is a bright side, though. Now that all the hoopla is over, investors can get down to business.

Here’s what I’m expecting:

……read it all HERE

US stocks will fall 20-50% after Obama re-election warns Dr Marc Faber

Marc Faber, publisher of the Gloom Boom, & Doom Report, told Bloomberg Television’s Trish Regan and Adam Johnson on ‘Street Smart’ today that ‘Mr. Obama is a disaster for business and a disaster for the United States’ and that he ‘thought that the market on his reelection should be down at least 50 per cent.’

Faber also said ‘I doubt [Obama] will stay at the presidency for another four years. I think there will be so many scandals’ and that investors should ‘buy themselves a machine gun.’

…..read the 8 paragraph article HERE

As noted earlier, I will use this blog and likely interviews of me to expand on my thoughts on the markets I follow. For now:

U.S. Stock Market – Currently down over 300 points, I believe it shall make up this loss and then some between now and when Bernanke makes a critical speech on November 20th. But remember, from this point going forward to no later than the spring/summer of 2013, America shall be well into an economic, social, political and spiritual crisis unlike anything else in its entire history. And make no mistake about it, the America I and many grew up in disappeared late last night.

Gold – Like I said last night, $2,000 gold is now cheap. Obama may be bad for a lot of reasons but his win has all but assured a new, all-time inflation-adjusted high well within his next term. Down several dollars as I type, I look for it to make up all the losses and move higher later today and/or for the rest of the week.

Special Note – I’m literally sick to my stomach. I’ve made the mistake of engaging whacko’s and ignorant people from the “other” side (it amazes me that they write to me saying how wrong I am yet they continue reading the blog). There will be a post- election depression for some of us so keep in mind raw emotions are the worse conditions to make important decisions from.

….so much more on Grandich.com (3) things….

Over the past two months shares of gold (NYSE:GLD) and Apple (NASD:AAPL) have had a sizable bite taken out of their share price. Active traders along with the longer term investors have had a wild ride this fall watching these investments slide to multi month lows. The big question is when will gold and apple shares bounce?

Here we are again with another election behind us and Barack Obama in the White House again. Many think this means four years of the same thing… Printing, Inflation and higher stock prices.

Is this good or bad for Americans or the world for that matter? I doubt it, but who really knows and who cares because there is nothing anyone can do about it now. So buckle up your seat belt and focus on trading and investing with major trend both within the United States and abroad using exchange traded funds.

Currently the broad stock market and commodities are in a full blown bull market so the focus should be to buy the dips until proven wrong. Below are some charts showing the important breakout levels for Apple, metals, oil and key indexes like the Russell 2000.

Be aware that during pullbacks which last more than a month which is the market has done, some of the biggest drops in price happen just before prices bottom… Scaling into positions is the key to minimal draw downs.

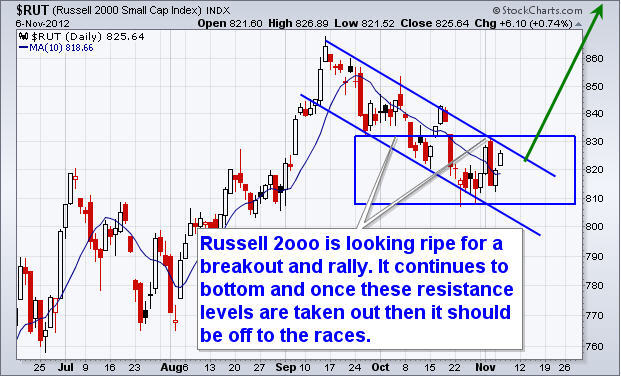

Russell 2000 Small Cap Index – IWM

Small cap stocks typically lead the broad market in both directions. They are the first to rally and the first to rollover and sell off. The major indexes like the DOW, SP500 and NYSE have not formed clean chart patterns which is why my focus is on the Russell 2000. Small cap stocks are now showing a rising relative strength compared to the SP500 large cap stocks and this is very bullish for stocks in general. The best way to trade this index is through the exchange traded funds IWM and TNA.

Ed Note: Click HERE to view 4 other charts and the Post-Election Trading Breakout Summary