Stocks & Equities

Pretty much since the beginning of the stock market, and certainly over the last century and a half, dividends have been a substantial component of overall investment return. However, there have been some periods; the most notable during the 1990s tech boom, when investors not only lost their appetite for juicy dividends but actually came to view them with negatively. The appetite during these short-lived periods was for growth, not a paltry few percentage points income return, but double-digit, triple-digit, and even quadruple-digit growth. The perception from the market was that a dividend was a sign of slowing growth and this sent many investors out of the respective stock in search of the next big growth story.

Pretty much since the beginning of the stock market, and certainly over the last century and a half, dividends have been a substantial component of overall investment return. However, there have been some periods; the most notable during the 1990s tech boom, when investors not only lost their appetite for juicy dividends but actually came to view them with negatively. The appetite during these short-lived periods was for growth, not a paltry few percentage points income return, but double-digit, triple-digit, and even quadruple-digit growth. The perception from the market was that a dividend was a sign of slowing growth and this sent many investors out of the respective stock in search of the next big growth story.

As we saw with the tech bubble, the arrival of this flavour of investor mentality typically results in a massive contraction of overvalued prices of growth stocks. Often it can take many years for a bubble to finally burst but the when the investors turn their backs on “tried and true” methods of investing in favour of what anyone should know to be unsustainable, then that is a signal for the intelligent investors that the market is treading on unstable ground.

The truth is that in any healthy market dividends are a primary source of investment return. In fact, over the last 20 years, it is believed that dividends and income distributions have accounted for approximately 70% of total stock market returns. So by this logic, an investor who does not have a significant portion of their portfolio invested in dividend paying securities is essentially limiting themselves from assessing over half of potential returns. In an environment where market indices are posting anemic returns, the adoption of dividend stock investing has become a basic requirement for reaching financial goals or even generating a positive investment return at all.

But in the current market, many investors believe we have come full circle since the tech boom of the 90s. Interest rates are at historic lows, which have almost eliminated investment-grade bonds as a significant source of investment income. The global economic picture remains shaky which has resulted in back and forth volatility in the major stock indices, limiting or eliminating capital appreciation potential. And the result is that dividends and stocks that pay them have come back into vogue with a vengeance. So understandably many investors are now questioning whether the same type of stocks that were viewed with apathy in previous market bubbles have now become the bubble of the present day.

In many ways we encourage this line of thinking because it acts as a counterbalance to greed. However, we would also argue against the notion that dividend stocks in general have delivered such substantial performance over the past two years. In fact, if you were to take a quick look at the S&P/TSX Dividend Stock Index you would see that the price return in 2011 was negative and the price return year-to-date in 2012 is still in the low single digits. Although the Dividend Stock Index has outperformed the TSX Composite Index in both years, the level of outperformance has actually been fairly limited at less than 4% in 2011 and only about 1% so far in 2012. So it is actually pretty clear that the simple act of paying a dividend is not propelling stocks to unjustifiable prices.

Nevertheless, it is absolutely indisputable that numerous dividend stocks have produced outstanding returns over the past 3 years. So what is it that the index isn’t showing? The answer lies in a concept that has made many a great investor very wealthy and that we have been expounding for years – individual stock selection. While dividend stocks have indeed produced decent overall performance over the past 3 years, it is the individual outperformers that have been getting most of the buzz. The truth is that the payment of a dividend itself doesn’t really say anything about a company. Dividends are nothing more than a method of returning capital to shareholders. But companies that pay a dividend supported by strong free cash flow and that are able to retain and reinvest a significant portion of this free cash flow for growth have indeed exhibited very impressive performance in this largely lackluster market. In KeyStone’s research we call them Dividend Growth Stocks and as much as the income, it seems to be the growth that is infatuating investors.

For readers who are interesting in learning about the dividend growth stocks coverage in KeyStone’s Income Stock Report (ISR) research service, please visit www.keystocks.com.

KeyStone’s Latest Reports Section

Hopes and fears related to the “fiscal cliff” issue in the U.S. made for mixed performance in commodities this week. Only natural gas moved significantly. Prices for the heating fuel plunged on warm-weather forecasts. Stocks, as measured by the S&P 500, edged up half a percent in the period, taking their year-to-date gain to 12.5 percent.

Macroeconomic Highlights

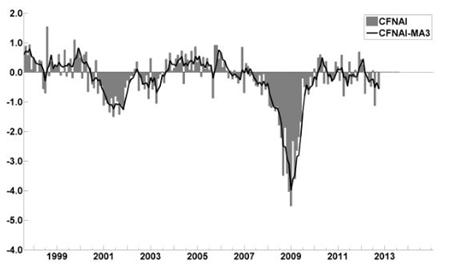

Economic data in the U.S. was decidedly positive this week, but markets couldn’t look past the fiscal cliff risk. With only a month remaining before automatic tax hikes and spending cuts go into effect, politicians have yet to move toward anything resembling a bipartisan compromise. Various meetings between leaders this week have yielded nothing of substance, according to several sources.

Still, hopes are that the two parties, Democrats and Republicans, will eventually come together and strike a deal to avert the fiscal cliff given that the economic stakes are so high.

That said, for now, economic data remain encouraging. The holiday shopping season kicked off with a bang. Retail sales over the four-day Thanksgiving weekend totaled $59 billion, up 13 percent from a year ago.

Another bright spot continues to be the housing market. The S&P/Case-Shiller home price index rose by 0.39 percent in September, the eighth-straight monthly gain. Prices were up 3 percent year-over-year.

Meanwhile, pending home sales rose by 5.2 percent in October to the highest level in six years.

Finally, the Bureau of Economic Analysis reported that the U.S. economy grew by 2.7 percent annualized in the third quarter, up from its initial 2 percent estimate.

….read page 2 HERE

Produced by McIver Wealth Management Consulting Group

Mark Jasayko, CFA,MBA, Portfolio Manager with McIver Wealth Management of Richardson GMP in Vancouver.

Waterfloods: The Next Big Profit Phase of the Shale Oil Revolution:

The Shale Revolution has turned many retail investors into millionaires. It’s one of the few long-term trends where Wall Street didn’t make ALL the money!

New tight oil plays are still being discovered—especially in Texas, with the Eagle Ford, Eaglebine and Cline shales.

But everybody is now starting to understand that these shale plays/tight oil wells decline really fast. Whenever you hear about an eye-popping flow rate of 3,000-4,000 barrels a day from a well in the Bakken, consider that these wells can decline 80% in the first year!

That got me thinking: How long can companies grow with those declines? When I started researching this, I discovered what will be Phase II of the Shale Revolution—and it’s a lot more profitable than what we’ve seen so far.

It is arguably the cheapest and most profitable oil North America has ever seen—and in Canada, it’s now “flooding” into the market, as producers once again use old technology to create a wave of new profits. The U.S. will be three to five years behind because producers are—as I said— still finding new plays.

Canadian producers are using “waterfloods”—pushing water into underground formations to flush a large amount of oil out to nearby producing wells—to increase production and profits.

It’s the next big money-making phase of the Shale Revolution.

Waterflooding has been around for 70 years or more, but the Big Question over the last five years has been, can you do it effectively with tight oil?

The answer is a big “Yes,” and waterflood potential has become so important that institutional investors now see them as major share price catalysts for junior producers in Canada—and track them closely.

Waterfloods start one to two years after drilling the well, in a time window producers call “secondary recovery.” (Drilling is primary recovery.) Waterfloods are cheap to try and cheap to run (with most operations costing just $5-10 per barrel!), and now the industry is seeing that they are sometimes doubling reserves from a well.

“Secondary recovery is where you really make all your money in this industry,” says Dan Toews, VP Finance and CFO of Pinecrest Energy (PRY-TSX.V).

Pinecrest is very vocal about their waterflood potential. They say they can double the amount of oil they recover (called the Recovery Factor, or RF) from a well—at less than $15/barrel—half the price of primary recovery costs, which are over $30/barrel.

“Everyone is trying to find a new resource play,” says Toews. “First you find a resource, and then you drill it like crazy. But the second stage is to go in for your secondary recovery, through waterflooding of some kind if possible.”

To date, Pinecrest isn’t yet flowing even one barrel of waterflooded oil — so their powerpoint slide is just projections. Toews and his team expect to be waterflooding all of their operations by the end of this quarter. But analysts are already seeing the waterfloods as a share price catalyst.

“Just about every investor and institution we talk to wants to know the status with our waterfloods,” says Toews. “The buyside (fund managers= buyside, brokerage firms=sell side — ed.) is very savvy on waterfloods. Once we apply the method, this is what has the potential to shoot up our share prices.”

Realistically, the effects can be seen within 2-3 months, but it’s best to give them a year — or more — of operations before judging their impact. Waterfloods can last up to 20 years or more.

Another Canadian oil junior, Raging River Exploration (RRX-TSX), also explains the waterflood potential in their powerpoint. They expect to be swimming in 1 million EXTRA recoverable barrels of oil per square mile, courtesy of waterfloods — at an even cheaper cost of $5-10 barrel, vs $30 barrel for the first 600,000 barrels.

Raging River is developing the Viking formation in SW Saskatchewan — a large, tight oil play that since the 1950s has had an improved outlook from 2 billion barrels of oil to an estimated 6 billion barrels of oil in place, all thanks to horizontal drilling.

Raging River expects waterflooding to increase its RF from 8% from primary recovery methods (drilling vertical and horizontal wells) using 16 wells/section, to 16-20%. The simple math says that will increase the number of barrels recovered from 480 million at 8% to 1.25 billion at 20% RF.

If Raging River — or any producer — can show a steady RF for over a year, I would suggest to investors those barrels will be worth $10-$15 each — creating huge value to shareholders on a buyout.

Some Viking waterfloods have even seen results as high as 30% RF.

“A small change of recovery over a large oil field is significant and adds a tremendous amount of value,” says Scott Saxberg, President and CEO of Crescent Point Energy (CPG – TSX), arguably seen as the industry leader in the waterflooding revival.

“A lot of these unconventional plays (tight oil) are in high decline. By implementing waterfloods, we can lower the declines in the field, and increase reserves. There’s huge value to that.”

Crescent Point started waterflooding its properties five years ago when multi-stage fracking (MSF) was new on the scene. Now they have five years of knowledge that the method works, and that they can use it across all of their fields.

“We recognized right away to implement a strategy to increase the recovery factor on a multi billion barrel pool,” says Saxberg. “If you change even 1%, that ends up being huge.”

“Waterflooding is the next step past in-fill drilling (ie. drilling more holes in less space to increase ultimate recovery). It takes a lot of time to accrue knowledge and data on how to properly implement it. The sooner you start, the better data you have.”

According to Saxberg, waterflooding is more than just a cheap way to float balance sheets.

Over the course of Crescent Point’s five-year waterflooding program, they’ve developed hundreds of different combinations of waterflooding techniques coupled with fracking techniques, well spacing and plenty of other factors.

“Water flooding is basic, in that you pump water into the ground,” says Saxberg. “So to enhance that, you have to look at what type of patterns are in your reservoir. Now these are unconventional tight reservoirs, so the question was, can they actually be water flooded?”

Again, the Big Answer is Yes, and management teams are now using the promise of waterfloods as a cheap way to float their balance sheets earlier in a resource play. But Saxberg says waterfloods are truly more long-term value.

“They are a long term day-after-day technical grind and process. So it’s not the same as drilling a well and seeing 100bbls/day. It’s a lot of ups and downs and a lot of long term view.”

There’s only one negative here that I see — how will all that cheap oil affect North American pricing, when the continent is already swimming in the stuff?

In the short term, the pro-forma economics of waterfloods are making a splash with both management teams and the market.

But medium term and beyond, it will create a quandary for juniors — the easy money comes after huge capital spending.

I’ve done the research on the top Canadian juniors that will be poised to benefit the most from waterfloods.

Click here to download this free stock report, while you can!

– Keith

About Oil & Gas Investments Bulletin

Keith Schaefer, Editor and Publisher of Oil & Gas Investments Bulletin, writes on oil and natural gas markets – and stocks – in a simple, easy to read manner. He uses research reports and trade magazines, interviews industry experts and executives to identify trends in the oil and gas industry – and writes about them in a public blog. He then finds investments that make money based on that information. Company information is shared only with Oil & Gas Investments subscribers in the Bulletin – they see what he’s buying, when he buys it, and why.

The Oil & Gas Investments Bulletin subscription service finds, researches and profiles growing oil and gas companies. The Oil and Gas Investments Bulletin is a completely independent service, written to build subscriber loyalty. Companies do not pay in any way to be profiled. For more information about the Bulletin or to subscribe, please visit: www.oilandgas-investments.com.

But there’s more, a lot more to costs than most realize.

But there’s more, a lot more to costs than most realize.