SIGNS OF THE TIMES

“Gold Goes Into a Death Cross” “Civilized people don’t buy gold.”

– Financial Times, February 20

– Charles Munger, Berkshire Hathaway, CNBC, May 4, 2012

If policymakers were civil in serving the public interest rather than ambitious, we would not seek the protection of buying gold.

“After a series of failed business ventures, Kwon Eui Moon decided to get rich in a more traditional way in South Korea by taking out a mortgage in 2002 and waiting for house prices to soar.”

– Bloomberg, February 20

It did not happen.

“There are widening divisions among Federal Reserve officials about the value of its efforts to reduce unemployment.”

– The New York Times, February 21

“Investors in asset-backed securities are seeking relief from record-low yields by snapping up riskier securities tied to jewelry loans and cars parked at dealership parking lots.”

– Bloomberg, February 20

“Bernanke minimized concerns that easy monetary policies has spawned economically-risky asset bubbles.”

– Bloomberg, February 22

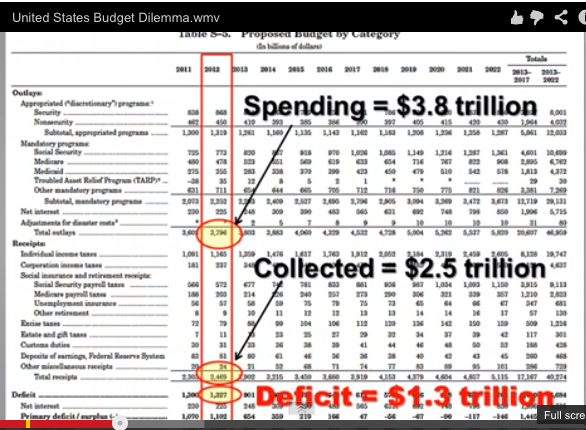

One problem is that Bernanke still thinks that throwing more credit at a post-bubble credit contraction will make it go away. Another is that too many interventionist economists still think that “inflation” is raising consumer prices. Stocks and lower- grade bonds soaring to dangerous levels, accompanied by massive credit expansion, does not register as inflation.

The classic definition is “an inordinate expansion of credit”. It works for inflation in both tangible and financial asset prices.

In the 1600s, Amsterdam was the world’s financial and commercial capital. The term “easy” credit dates to then, and the Dutch had a practical term for its consequent disasters – “diseased credit”.

*****

INSTITUTIONAL ADVISORS

FRIDAY, MARCH 8, 2013

BOB HOYE PUBLISHED BY INSTITUTIONAL ADVISORS

The following is part of Pivotal Events that was published for our subscribers February 28, 2013.

PERSPECTIVE

“What we have here is an attempt to communicate,”

Of course, this is a modification of the classic line by the “Captain” (Strother Martin) in the movie Cool Hand Luke and it refers to Bernanke’s testimony, this week. And his public utterances seem to be instructional, behind which have always been the intense desire that financial markets follow the textbook touts – puhlease!

In the movie, Luke (Paul Newman) responds to the Captain’s abuse with “I wish you would stop being so good to me, Cap’n.”

And this is what most critical minds would hope for – that central bankers would stop abusing financial markets with shopworn theories. But then, according to the academics is that their deliberate currency speculation does not force prices up. It is the public’s “expectations of inflation” that forces prices up.

As reported by CNBC recently, the Great Man exclaimed, “My inflation record is the best of any Federal Reserve chairman in the post-war period.”

He has been part of the interventionist bandwagon for a long time – initially as an academic and with the Fed since 2002. Our view continues that the Fed has been accommodating since it opened its doors in January 1914. Needless to say, but this has never curbed great speculative moves, nor prevented the consequent phases of forced liquidation. De-leveraging as it is now called has not been the result of Fed policy change, but due to Mother Nature and Mister Margin overwhelming the benighted desires of the central bankers who happen to be on shift when a speculation becomes excessive.

As we like to observe. The job description of central bankers has been corrupted to the point where it includes trying to get the speculative accounts “out of line”. The job description of the margin clerk is quite the opposite and that is to “get the accounts in line!”.

In Tuesday’s testimony Bernanke boasted “We know when to stop accommodation”. Sure, and bulls will always know when it is time to sell.

COMMODITES

Base metals (GYX) tried to break above resistance at the 406 level, made it to 404 at the first of the month and dropped to support at the 380 level.

Since April a year ago, the trading range has been between 406 and 350. The recent high was accompanied by considerable enthusiasms about “inflation”. And 406 was the best that could be achieved. Often March can see seasonal strength and it will be interesting to see how prices behave.

The dollar is approaching an overbought condition at 81.9.

Last week we noted that if agricultural prices (GKX) slipped below 439 it would indicate further weakness. The low on Tuesday was 433, which extends the decline that began last summer at the high of 533.

The action is moderately oversold.

Crude oil has declined from 98.24 late in January to 91.92 on Tuesday. As noted last week there is minor support at this level.

With this, the CRB has declined to support at 292. It is somewhat oversold at the daily RSI of 30.

Commodities could become stable to firm for some weeks. However, considering the desperate attempt at currency depreciation, the real issue is that they have not been soaring “to the moon”.

Commodities and other hard assets as well as financial assets all played their key roles in building a great bubble. This completed in 2007 when the dynamics of a classic financial mania climaxed. The feature of five previous post-bubble contractions has been a financial crash () and economic collapse () followed by a weak business cycle () and rebounding financial markets () .

Inflation bulls may be perplexed and disappointed that the “juice” from reckless policymakers has not been driving commodities, or even gold and silver. Central bankers may propose but the markets dispose and over the past year the market decided that the big play will be in lower-grade bonds – around the world. This has been bubbled to a dangerous condition, with the problem likely to be “discovered” around mid-year.

Gold and silver rallied into September’s news that the Fed and the ECB were going to aggressively buy lower-grade bonds. These continued up and the “juice” did not go into precious metals.

The first global business expansion is maturing and as it rolls over commodities will weaken. The completion of the great bubble included the CRB soaring from 182 in 2001 to 474 in June 2008. The Crash took it down to 200 in March 2009. We still think that the high of 370 in April 2011 was a cyclical peak. The subsequent low was 266 in mid 2012 and the rebound spiked up to 321 in September.

Essentially, since November the CRB has been trading between 291 and the high of 305 at the first of February. Yesterday’s 292 is testing the low and with the RSI at 30 the action is moderately oversold.

PRECIOUS METALS

A few weeks ago we noted some research studies with titles “Five Compelling Reasons to Sell Gold”. One service’s convictions topped this with “Twelve Reasons”.

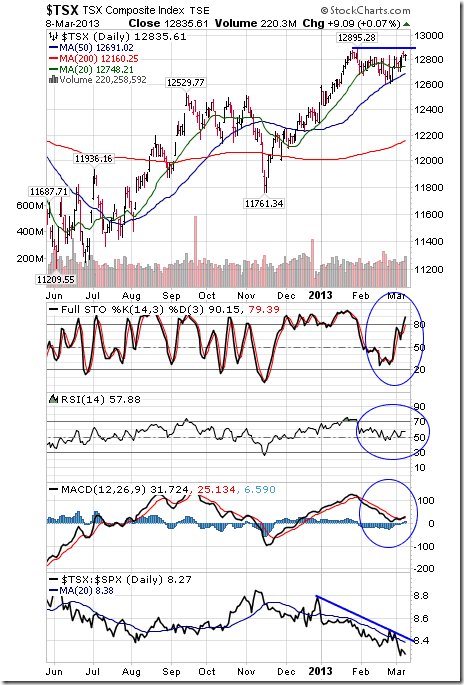

The mood is grim and it is appropriate to move from anecdote to measured sentiment. The following chart updates the one in our “Precious Metals Report” of February 15th. Quite simply, sentiment is now more, repeat more, bearish than at the depths of the 2008 Crash.

The February 15th “Special” noted that it could take a couple of weeks to clear the problems in the gold sector.

Are we there yet?

Let’s review how far we have come since the halcyon days of last September and with the fateful April-May of 2011.

In the spring of 2011 the Daily RSI on the silver/gold ratio soared to 92 when we noted that that level of speculation had last occurred at the sensational blow-off in January 1980. We noted that the action was dangerous.

Going into the dismal low of May 2012 the monthly RSI registered the worst oversold in twenty years.

With the rush up to September, the Daily RSI reached 84 when we again noted dangerous conditions.

It seems that these speculative thrusts were mainly discounting the evils of central banking. Particularly so for the surge into September, which was inspired by the ECB and the FED proclamations about reckless buying of lower-grade bonds.

The old story about “inflation” and gold has not been working. Gold and silver bugs may have had their last hurrah and could be looking for a new mantra.

Mother Nature seems to be providing it with the distinctive turn to the gold sector trending opposite to the orthodox sector. This is one of the features of a post-bubble contraction and it could run for many years. There will be cyclical swings with golds underperforming during business expansions and doing well on the recessions.

A transition to the gold sector “doing well” seems to be developing.

On the nearer-term, stability in the CRB could help as could stability in the dollar.

Beyond dismal sentiment numbers, relative valuations are at lows. The HUI/Gold has dropped from 62 in 2006 to 22. This compares to the low of 23 a year ago in May. The Daily RSI is as at 24, which was also reached then.

Since the crash into 2001 gold stocks have soared relative to the general stock market. HUI/SPX climbed from 0.026 to 0.56 (no typo) last September. The low last May was 0.28 at a weekly RSI of 30. Now the low today has been 0.23, with an RSI of only 22.

Clearly, the excesses of the speculative surges to May 2011 and to September 2012 are being fully offset. This is also a massive correction of the fabulous outperformance of golds relative to the big stock market.

The ChartWorks is watching for the trading opportunity and investors could continue accumulation.

Link to January 12, 2013 ‘Bob and Phil Show’ on TalkDigitalNetwork.com:

http://talkdigitalnetwork.com/2013/03/markets-metals-flat-as-vix-spikes/

BOB HOYE, INSTITUTIONAL ADVISORS

E-MAIL bhoye.institutionaladvisors@telus.net

WEBSITE: www.institutionaladvisors.com