Personal Finance

The financial mania climaxed as a complete bubble in 2007. Virtually, this replicated the conclusion of all of the great bubbles since the first in 1720. As with the 1929 and 1873 examples, its culmination was anticipated by the treasury yield curve reversing from inverted to steepening. In 2007 this key reversal counted out to that June and the curve reversed in that fateful May.

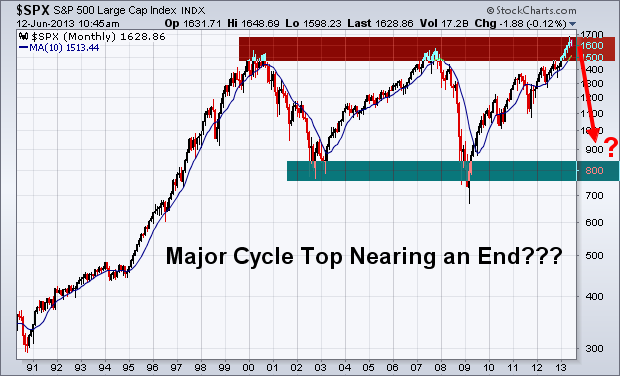

The features of the post-bubble contraction include severe recessions and weak recoveries. This has, indeed, been the case and the first business expansion and first bull market out of the Crash have become mature. The next cyclical decline for both could be discovered in the fall.

In which case, when will the “18-Year Bull Market in Commodities” resume its rightful course?

Another feature of the post-bubble condition has been the senior currency being chronically strong relative to most currencies and most commodities for most of the time.

We have been noting this possibility for some time and that it contrasts with central bank inflation ideology. It also contrasts with the main theme of gold commentators.

Policymakers also have a theory that implementation now becomes effective a couple of years later. This claim was difficult to discuss during the collapse of the 2007 Bubble. What policy change “caused” the collapse?

Inflation bulls remain convinced that all of the reckless “stimulus” injected into the markets since early in 2007 will eventually ignite a fabulous bull market in all commodities – particularly in precious metals.

Nowadays, as the title suggests inflation is instantaneous with policy. It is not something that is “bottled-up” and will erupt at a later date.

But, before detailing this there was a time when the possibility of inflation actually preceded a distinctive rise in the rate of inflation in consumer prices (CPI).

This writer started in the business with Canada’s premier investment dealer some 50 years ago. While working as an assistant resource analyst in 1965 CPI inflation was beginning to threaten the 2 percent level and the VP of the Bond Department was asked about this.

The measured response was that chronic and rampant inflation was only possible in lesser countries in Europe or in South America. Canada and the US had too much integrity to indulge in deliberate depreciation. What’s more, long-dated Canada bonds were trading at a 5.15% yield and would soon get back to levels below 5 percent. They reached 19 percent in 1981.

An early proponent of gold and soaring prices was James Dines who began publishing his letter in 1960. It took until the late 1960s before aggressive Fed policy began to drive prices higher. Perhaps institutional inertia contstrained the price advance due to dollar depreciation until later in the 1960s when the first “Operation Twist” was imposed. That was the US scheme to keep long rates from rising above 6 percent by buying bonds out of the market. Such rates soared to 15 percent in 1981.

To be methodical, there are particular aspects to rising prices that need review. One is due to demand pushing up price to prompt supply. This is not inflation. In the case of a relatively free market it is a very sophisticated conveyance of information.

And then there is the price rise due to currency depreciation. Interventionist policymakers believe that it causes a business expansion and vigilant gold bugs believe that currency depreciation causes inflation in commodities. Including gold which is not a commodity.

If such considerations of cause and effect were valid then prices would have soared, without interruption since the Fed opened its doors in 1914. However, there have been serious liquidity crises as over-speculation crashed. Besides that, there have been times when the Fed has been very accommodative and commodities did not go up. The lengthy bear market for the CRB that ran from 1980 until 1999 is one example and the bear that started in 1Q2011 is another. The latter is in the face of the most reckless central banking – ever.

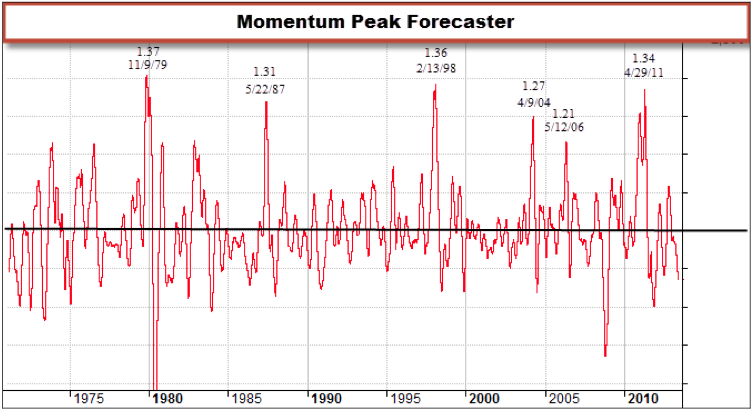

The attached update on our “Momentum Peak Forecaster” reviews that since the late 1970s the outstanding crashes have been due to speculative surges, not to Fed conspiracies, or blunders.

Financial history provides some explanation. The classical definition of inflation has been “An inordinate expansion of credit”. This has been and still is practical as soaring prices can involve two different asset classes. Tangible assets such as commodities and real estate. And never to be overlooked – financial assets.

Inflation in tangible assets has been around ever since governments learned to depreciate coinage. Financial assets have been around since the latter part of the 1600s when there were enough companies and players to create a stock market. The potential for “modern” depreciation started with the formation of the Bank of England in 1694. It had the power to issue currency.

Even over the long span of when the BoE was disciplined by gold convertibility great speculations in tangible and then financial assets were recorded and then lamented.

So, if that has been the pattern for some 300 years it is tempting to conclude that when the current inflation in stocks and bonds completes commodities will be the next big sector.

It is not as simple as that.

In 1981 we expanded our service from mining companies to financial institutions with the concept that commodity inflation had blown out and would be followed by inflation in financial assets. That was controversial and the way it was phrased may have been perplexing. By this time the investment establishment had finally concluded that the Fed was the culprit in “inflation”.

Using history’s reliable patterns the conclusion was that the Fed would continue to accommodate but the public would choose the new game. Stocks and bonds. The line was “No matter how much the Fed prints, stocks will outperform commodities”.

This has been the feature of each “New Financial Era” until it completes in a classic bubble, much the same as in 1929, 1873, 1825, 1772 and 1720, to list all of the great bubbles.

All were followed by post-bubble contractions that lasted for around twenty years.

Within the framework of the usual 3 to 4-year business cycle there are times when no matter how much the senior central bank tries to print both tangible and financial assets go down. The crash that terminates a new financial era is very severe, and followed by weak recoveries.

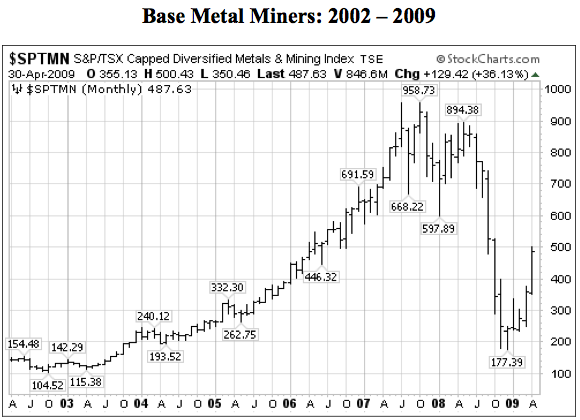

The action leading to a raging mania has included speculation in some commodities and real estate. The mania in residential real estate completed in 2006 and assisted by the tout about “Peak Oil” the CRB set its big high in June 2008. As that fateful month was completing our technical research on crude identified it as a possible cyclical and secular peak. The high for crude was 147 and the high for the CRB was 473.

In 1997 we developed an indicator based upon a series related to credit spreads. When it soars up to a spike it is close to the end of a surge of speculation. We’ve called it the Momentum Peak Forecaster. It doesn’t register that often and the last signal was in April 2011. As the big action was in commodities we concluded that when speculation exhausted it would likely set a cyclical high.

From a high of 502 in April 2011, the base metals index (GYX) set a series of lows such that the last one at 333 a few weeks ago set the bear market.

Agricultural prices (GKX) set their big high at 571 in March 2011. Even the worst drought in 50 years did not drive it to new high in 2012. That high was 533 and the index continued down to 413 in April. Taking out the 381 level set just before drought would set the cyclical bear market.

The main thing is that many commodities as well as precious metals have not been soaring “to the moon” with the most reckless central banking in history. Instead the “to the moon” action has been in financial assets.

And this is the big issue. But last week the esteemed Paul Volker expressed concern about “inflation”, meaning soaring commodities and CPI. The world is still fixed on the impractical concept of “inflation”. The practical description is that inflation is an inordinate expansion of credit.

Which makes “deflation” a credit contraction and this melancholy condition has been the feature of all post-bubble contractions.

And as with the pre-bubble world, both the private and coercive sectors need a business expansion to have credit expand. The theory that an arbitrary increase in central bank credit will “cause” a business expansion is another example of a primitive syllogism. The best-known one is that roosters crowing in the morning cause the sun to rise.

Before getting to our theme that “Inflation is Instantaneous” some additional discussion about the nature of credit is required.

Actually credit expands with business and one does not “cause” the other. However, at the end of a boom the relation between credit and prices becomes clear. Eventually, the rise in prices becomes compelling and too many become aggressively leveraged. Then Mister Margin forces liquidation of suddenly unsupportable positions. And, typically, this overwhelms arbitrary attempts to keep the boom going. Sadly, as in 2007, the establishment will insist that judicious manipulation of credit will keep the boom going, or at least, prevent a depression.

One of history’s ironies is that the esteemed editor of the The Econoomist, Walter Bagehot, provided the recipe right at the top of the 1873 Bubble. In reviewing the severity of the recessions that followed, in 1884, economists coined the term “Great Depression”. It was appropriate to the senior economy (England) and it lasted until 1895.

That was a lengthy contraction that overwhelmed the ability of the senior central bank to foster boom conditions. That was the case on the post-1929 contraction until World War II stabilized basic prices.

This fits financial history whereby, since the late 1600s, a dynamic business expansion culminates with sensational speculation in tangible assets. Following a severe recession the economy stagnates for a few business cycles when a huge speculation in financial assets erupts. That this has been accompanied by firming prices for most tangible assets including real estate is essential to the completion of a great bubble.

This was not the case with the mania in tech stocks in the Dot.Com Bubble that completed in March 2000. Action in basic commodities and real estate was minimal and one of the economists on CNBC keep touting that you had to be in the stock market “because there is no inflation”. That was a “new” discovery that expanding credit was not driving commodity inflation.

It is best to consider speculations as intense hoarding.

As history mandates, each long dynamic expansion matures with a period of inflation in tangible assets when “real” things are hoarded.

This segues into a “New Financial Era” when it becomes compelling to hoard stock and bond certificates.

In the US, the cycle for such certificates seems to have climaxed recently.

Those who have been banking upon a Fed-driven “inflation” in commodities may conclude that it is, once again, time for the action to favour commodities. The “Eighteen-Year Bull” market will resume. After all the Fed will never quit ambitious policies of dollar depreciation.

Regrettably, this is outside of the abilities of today’s central bankers. While they have always considered such a prerogative as constant, the truth is that the credit cycle permits the Fed to look good in a natural credit expansion and, then, to look hopeless and perplexed during the natural contractions.

By way of summary, the basic pattern has been to “hoard tangible assets”, get burned out. Then it is “hoard financial assets”, get burned out.

Then, and there are five previous examples since the start of modern markets and central banking, when the game changes to “hoarding cash”.

Back to our theme that “Inflation is Instantaneous”. Throughout market history Mother Nature has raised basic prices to prompt increases in supply and essentially that increase is not asset inflation. It is reasonable to conclude that the transfer of market information is instantaneous. Also, when not dislocated by arbitrary policy, this is also continuous.

Moreover, the ability of central bankers to raise prices is readily understood, now. No delays in this regard, but the ability to increase prices still depends upon the business cycle, which signals are instantaneous and continuous.

On the aspect of price increases due to deliberate depreciation it is best to consider that even with the most reckless senior central banking in history, a classic bubble developed and climaxed, as in 1929, The consequent collapse was the most severe since – the 1930s. The first business cycle out of the crash has been the weakest since the one that completed in 1937.

The instruction is clear, financial history is in a post-bubble contraction and outside of the typically weak economy, the other feature has yet to happen and that is the great bond revulsion. The world learns that in a poor economy it is virtually impossible to service the debt taken on in the raptures of a financial mania.

Naturally, the issue of debt during the frenzy that completed in 2007 was dauntingly immense. The amount issued during the vain attempt to make the contraction go away has been without precedent.

This great bond revulsion, which is becoming irresistible, could also be without precedent.

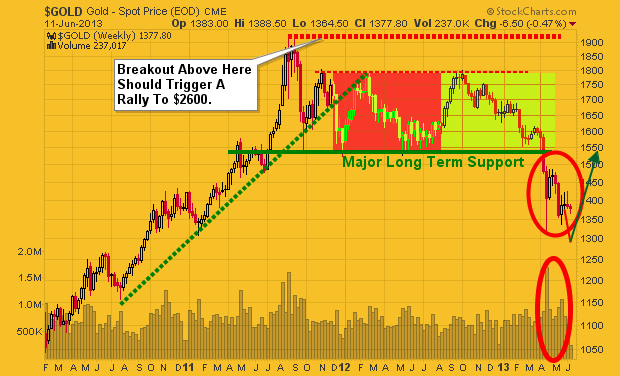

So will be the hoarding of cash, and gold is the best kind of “cash” that one can hold or find.

In real terms most commodities set an important high as a financial bubble completes. And gold in real terms sets an important low. Typically the contraction has prevailed for some twenty years and this has been accompanied by a bear market in the real price of most commodities. This translates into a long bull market for gold’s real price.

It seems that as the normal and abnormal instruments of credit contract Mother Nature works to provide real liquidity through significant increases in gold production.

Every time.

Momentum Peak Forecaster,

Updated (June 2013)

- The straight up occurs with increasing speculation.

- Rising through 1.20 indicates the action is becoming impetuous. The last peak reading was April 2011.

- In most instances the speculative frenzy peaked some 3 months later.

- That counted out to July 2011, give or take a few weeks. The “Forecaster” does not apply to major lows.

In July and August, 2006 we published a couple of articles on the Florida real estate bubble of 1926, as well as on the post-1929 real estate debacle.

On the pending discovery of another liquidity crisis, the investment demand for gold will soar.

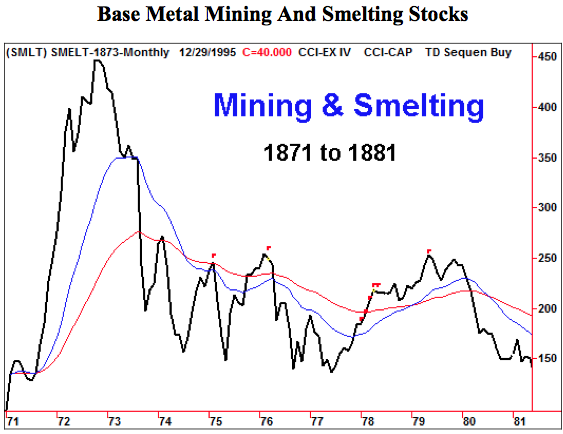

- Base metal prices boomed in the 1860s and rallied with the 1873 Bubble. Base Metal Mining & Smelting stocks were outstanding performers, as

- they were in 1929 and in 2007.

- The Index soared from 150 to over 450 in a year and a half.

- At the top of the bubble, the leading New York newspaper editorialized that nothing could go wrong. The US did not have a central bank and was not on a gold standard.

“True, some great event may prick the commercial bubble of the hour, and create convulsions; but while the Secretary of the Treasury plays the role of banker for the entire United States it is difficult to conceive of any condition of circumstances which he cannot control. Power has been centralized in him to an extent not enjoyed by the Governor of the Bank of England. He can issue the paper representatives of gold, and count it as much as the yellow metal itself. [He has] a greater influence than is possessed by all the banking institutions of New York.” – New York Herald, 1873

- In the long decline in the real price of base metals, the Index eventually declined to 20 in 1895.

- Base metal mining stocks have been outstanding performers in a number of Great Bubbles.

- We have charts on the 2007, 1929, 1873 and 1825 examples.

- The 1825 and 1929 examples have yet to be digitized, but they were straight

- up and straight down.

- Typically, gold mining and exploration companies have been outstanding performers during the lengthy post-bubble contractions.

Written by:

BOB HOYE, INSTITUTIONAL ADVISORS

BOB HOYE, INSTITUTIONAL ADVISORS

bhoye.institutionaladvisors@telus.net

WEBSITE: www.institutionaladvisors.com

Free One Month Trial

Bob Hoye, bio and other interests..

With a degree in geophysics and a number of fascinating summers in mining exploration, one winter in “the bush” quickly led Bob into the financial markets. This included experience on the trading desk and in the research department of a large investment dealer, which led to institutional stock and bond sales.

Bob’s review of financial history provided the forecasting models designed to anticipate significant trend reversals in the sometimes alarming volatility typical of the transition from rampant speculation in tangible assets to fabulous speculation in financial assets.

In anticipation of the latter opportunity, a monthly publication for financial institutions was started in January 1982. This competently covered the stock market, the yield curve, credit spreads as well as metal and energy prices.

In 1998 the Institutional Advisors website was started as a forum for unique and reliable financial research. Bob, as editor and chief financial strategist, writes the weekly overview – PIVOTAL EVENTS as well as historical essays and presentations that inform the work. Contact Bob.

Notable Interviews:

- Weekly Friday audio interviews at www.howestreet.com and www.talkdigitalnetwork.com

- The Mining Stocks PDF “Why You Should Own Gold AND Dollars” interview of Bob Hoye by J. Taylor FEB 10th 2005

- The Barron’s PDF “A Rally for the Buck?” interview of Bob and Ross Clark by Sandra Ward DEC 20th 2004

- The Financial Post interview of Bob Hoye “Market In An Awful Stew?” by William Hanley NOV 18th 2000

More than $2.5 trillion in Global Equity Value has been erased since Federal Reserve Chairman Ben S. Bernanke said May 22 the Fed could scale back stimulus efforts should employment show “sustainable improvement.”

More than $2.5 trillion in Global Equity Value has been erased since Federal Reserve Chairman Ben S. Bernanke said May 22 the Fed could scale back stimulus efforts should employment show “sustainable improvement.”

What’s Inside:

What’s Inside:

Energy Correction Underway -‐ Remain Defensive

Maison Universe High Impact Drilling Watch List

Research Updates:

Delphi Energy Corp. (DEE-‐T)

Gran Tierra Energy Inc. (GTE-‐T)

Long Run Exploration Ltd. (LRE-‐V)

Tamarack Valley Energy Ltd. (TVE-‐V)

Top Picks: No Top Picks This Month

Recommended Buy List

Coverage List

The two most popular investments a few years ago have been dormant and out of the spot light. But from looking at the price of both gold and oil charts their time to shine may be closer than one may thing.

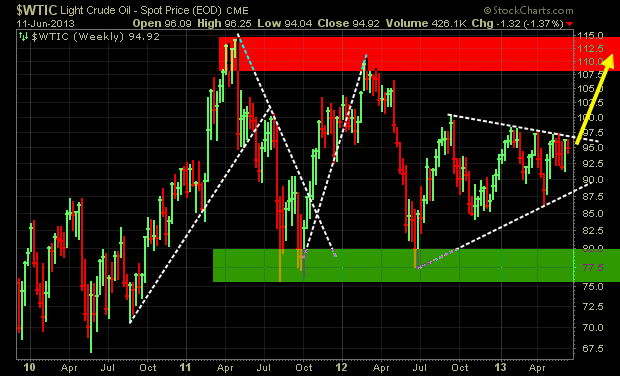

Seasonal charts allow us to look at what the average price for an investment does during a specific time of the year. The gold and oil seasonal charts below clearly show that we are entering a time which price tends to drift higher.

While these chart help with the overall bias of the market keep in mind they are not great at timing moves and should always be coupled with the daily and weekly underlying commodity charts.

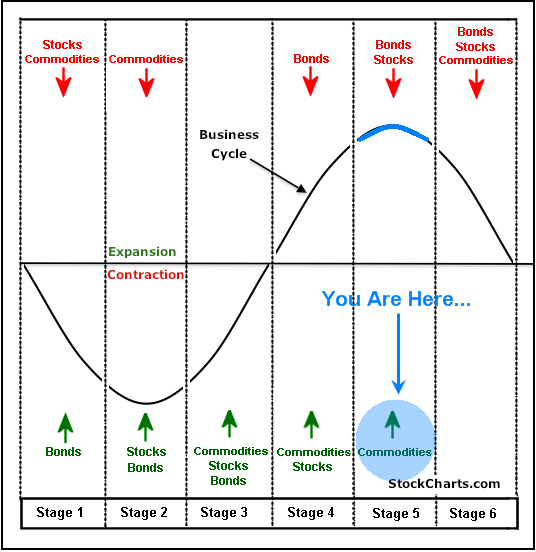

Now, let’s take a quick look at what the god father of technical/market analysis shows in terms of market cycles and where I feel we are trading… As I mentioned last week, a picture says a thousand words so why write when I can show it visually.

John Murphy’s Business Cycle:

MATURE STOCK MARKET

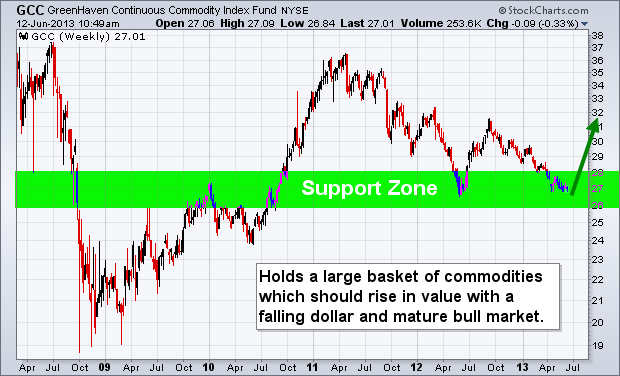

COMMODITY INDEX LOOKS BULLISH & SHOULD RISE:

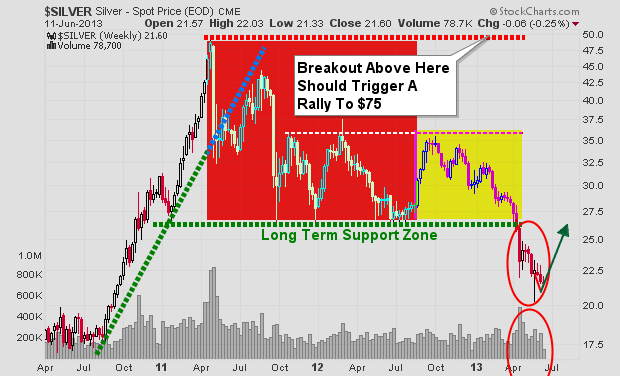

Precious Metals like gold and silver are nearing a bounce and possible major rally in the second half of this year.

Crude oil has been a tough one to trade in the last year. The recent 15 candles have formed a bullish pattern and with the next few months on the seasonal chart favoring higher prices it has been leaning towards the bullish side.

In short, I feel the equities market is nearing a significant top in the next couple weeks. If this is the case money will soon start flowing into commodities in general as more of the safe haven play. To support this outlook I am also factoring in a falling US dollar. Based on the weekly dollar index chart it looks as though a sharp drop in value is beginning. This will naturally lift the price of commodities especially gold and silver.

It is very important to remember that once a full blown bear market is in place stocks and commodities including gold and silver will fall together. I feel we are beginning to enter a time with precious metals will climb but it may not be as much as you think before selling takes control again.

Final thought, This could be VERY bullish for the Canadian Stock Market (Toronto Stock Exchange) as it is a commodity rich index. While the US may have a pullback or crash Canadian stocks may hold up better in terms of percentage points.

FATHERS DAY SPECIAL: 25% Off Membership Today!

Get My Daily Video, Updates & Alerts Here: www.TheGoldAndOilGuy.com

Chris Vermeulen

Global bond manager Pacific Investment Management Co. (Pimco) sees a 60% chance of global recession within three to five years.

Global bond manager Pacific Investment Management Co. (Pimco) sees a 60% chance of global recession within three to five years.

“The global economy,” says Pimco analyst Saumil Parikh, “experiences a recession every six years or so.” The last certified global recession was four years ago.

Vancouver veteran Dr. Marc Faber went on record last year saying he believed the chance of a global recession in 2013 was “100%.”

Last week, Faber told CNBC that recent Dow highs were “not to be trusted.” Jim Rogers, another Vancouveralum, with whom we just recorded the Zero Hour scenario has also been forecasting a recession. “You should be very worried about 2013-2014” Rogers warns…

In the markets, traders are worried central banks will ease their “support.” Likewise, individual investors face a catch 22: even good economic news may be negative if it causes central banks to tighten.

“Repeated doses of fiscal and monetary stimulus,” cautions The Daily Reckoning’s Dan Amoss, ”are what make the economy even more fragile over time,” he said. “And yet, during the next slump, you can expect more shrill calls for stimulus.”

And so it goes.

P.S. If you haven’t signed up for The Daily Reckoning email edition… what are you waiting for? It takes only a minute and is completely free. Click here now to sign up today.

“Deficits Do Matter”

Sometime after the election — it must have been mid-November — there was a meeting of the Economic Policy Group, including the vice president. As we sat at the table in the Roosevelt Room, we talked about where we were and where we were going. If I remember right, Glenn Hubbard made a presentation that was displayed on the screen at the front of the Roosevelt Room and showed where we were going and what different tracks looked like and GDP growth and the rest, including the effects of the proposed third tax cut.

I made the argument, which I had been making over and over again since maybe June or July, that it was not advisable to have another tax cut because of the need to fix Social Security and Medicare and to have some money to smooth the fundamental redesign of the tax system. We needed to have in effect rainy-day money in the event that we had another 9/11 event — and at that point it looked like maybe we were going to go to Iraq, and it was not going to be cheap to do that.

So I argued that we should not have another tax cut because the economy was going to be in positive territory and doing okay through the next couple of years anyway without another tax cut, and there were all of these other compelling reasons not to risk a deficit and not to risk adding more to the national debt. And the vice president basically said, “When Ronald Reagan was here, he proved that deficits don’t really matter and so it’s not a consideration or a good reason not to have an additional tax cut.”

I was honestly stunned by the idea that anyone believed that Ronald Reagan proved in any fashion, certainly not in conclusive fashion, that deficits don’t matter. I think it is true on a temporary basis that a nation can have a deficit and have a good reason for having a deficit. I think during the Second World War there was no way we could avoid having a deficit. But when we came out of the Second World War we started running budget surpluses again and did that through the ’50s and into 1960. It’s interesting, it’s really only been in the last 40 years or so that we’ve accepted the notion that it’s a bipartisan thing that we don’t have to have fiscal discipline.

A year ago there was this signing ceremony in the Rose Garden for the new Medicare prescription drug entitlement, and it’s going to cost us trillions of dollars. This event was not unlike any of the others in the Rose Garden on a nice sunny day, with the president sitting at the signing table with a bunch of grinning legislators behind him taking credit for this “great gift” they’re giving the American people. But none of their money was going to get given to make this happen, because the federal government doesn’t have any money that it doesn’t first take away from the taxpayers.

There was no mention of the fact that this in effect was a new tax on the American people, and we didn’t know how we were going to pay for it. It was only grinning presidents and legislators taking the credit for a gift, which strikes me as a ridiculous continuing characteristic of how we do political business in our country.

If you can get 51% of the people in the Congress to agree with the President’s leadership initiative to say we ought to do this, that’s all it takes. And I think it’s regrettably true there are a lot of people who don’t understand that when they get a gift from the American people, it’s from the American people and it can only be paid for with taxes over time.

I think the confusion is aided and abetted by the fact that it doesn’t feel like we’re paying for it. It’s a lot like running up credit card debt: As long as you can pay the interest charges on your credit card debt, you can live way beyond your means. In fact, we as a nation are living way beyond our means, and for a period of time, there’s no doubt we’ve demonstrated you can get away with it. But I think we only need to look at the fate of other countries that have lived beyond their means for a long time to see you inevitably get into trouble.

If you look at Germany in 1923, they got to a point where their currency was so worthless that you needed a wheelbarrow to haul the currency that was needed to buy a loaf of bread. You get inflation where people stop investing in your national debt, when they say, “We’re not going to loan you money because you’re not going to be able to pay it back.” It’s the same thing that happens to individuals and families.

When you get extended to the point that you can’t service your debt, you’re finished. So you go through a calamity — you go through a terrible inflation, which is a way of having a national bankruptcy, and you destroy accumulated income and wealth. In fact you take from all the people, because suddenly their financial assets are worth nothing.

Are we going to have that right away? No. But should the people who are in positions of political leadership know that and anticipate it and do something about it for the American people? You bet. And now is the time to begin doing something about it.

One of the difficult aspects of this debt problem is that it’s not very transparent to people who are unschooled in fiscal and monetary policy. In a way, this problem’s a little bit like the famous example of throwing a frog into boiling water. If you throw him into the already boiling water, he jumps out right away. But if you put the frog in the pot of cold water and turn the heat on under it, the frog will let itself be boiled because it doesn’t respond to slow increase in temperature.

Our debt problem is something like that. If we wait until we have a calamity and financial markets shut us off because we’ve exhausted their belief that we can service additional debt, it’s too late. This is a problem that we need to deal with without letting the heat be turned up some more.

I would hope we can demonstrate we’re intelligent people that don’t wait until they create a calamity in their country before they deal with problems that are obvious to anyone who’s ever studied economic policy and fiscal policy and monetary policy. You only need to look around the world to see places like Argentina, Turkey, and Germany after World War II whose governments have effectively achieved a meltdown condition. Knowing this can happen to modern nations, we should not let it happen to ours.

Regards,

Paul O’Neill

for The Daily Reckoning

Ed. Note: This essay was featured prominently in the Daily Reckoning email edition, which offers a detailed, often irreverent view of the markets at large, every day to over 300,000 subscribers. If you’re not receiving theDaily Reckoning by email, you’re missing out on at least 2/3 of our best analysis and commentary. Sign up today, for free, right here.