Bonds & Interest Rates

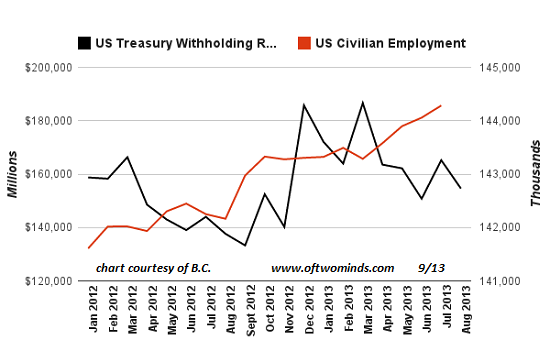

Since unemployment statistics are either suspect or blatantly bogus, we must look for other less manipulated statistics for some modicum of truth. Key statistics of employment, income and production are vital propaganda tools for the status quo, and the temptation to adjust them to manage perceptions is apparently irresistible.

Since unemployment statistics are either suspect or blatantly bogus, we must look for other less manipulated statistics for some modicum of truth. Key statistics of employment, income and production are vital propaganda tools for the status quo, and the temptation to adjust them to manage perceptions is apparently irresistible.

Wall Street play’a

“Straight out of Compton” Not really, more like straight out of Queens NY! Carl Celian Icahn (born February 16, 1936) is an American businessman and investor. He is the majority shareholder of Icahn Enterprises . Carl’s family name was Jewish in name, but his father was a “dogmatic atheist”, also a frustrated opera singer who settled on being a cantor (lead worship in the Jewish community)and eventually a teacher. His mother also worked as a schoolteacher. He graduated from Princeton University with a Bachelor of Arts degree in philosophy in 1957 and then joined New York University School of Medicine, but he dropped out after two years to join the army.

Carl made headlines in 1985 with his ruthless take-over of TWA and set the stage for his role as a vicious and often malicious corporate raider. This Asset stripping model became his modus operandi for corporate take-overs to come. Buy a company and sell the parts to pay the bill. Countless deals and billions of dollars latter Carl is front and center in his efforts to take Michael Dells DELL Computer. Well today he gave up that battle. Below is his letter of resignation or submission of defeat.

“Dear Fellow Dell Inc. Stockholders:

I continue to believe that the price being paid by Michael Dell/Silver Lake to purchase our company greatly undervalues it, among other things, because:

|

1. |

Dell is paying a price approximately 70% below its ten-year high of $42.38; and |

|

2. |

The bid freezes stockholders out of any possibility of realizing Dell’s great potential. |

Although the board accepted Michael Dell/Silver Lake’s offer in February, it promised stockholders that the Company would hold a meeting at which stockholders could make the final decision as whether or not to accept the transaction. The board recommended that stockholders vote in favor of the proposed transaction because it was Michael Dell/Silver Lake’s “best and final offer”. Icahn and Southeastern argued that stockholders should not give up the huge potential of Dell and therefore should reject the proposed transaction. We won, or at least thought we won, but when the board realized that they lost the vote, they simply ignored the outcome. Even in a dictatorship when the ruling party loses an election, and then ignores its outcome, it attempts to provide a plausible reason to justify their actions. Andrew Bary at Barron’s wisely observed, “In an action worthy of Vladimir Putin, Dell postponed a vote scheduled for last Thursday on Michael Dell’s proposed buyout of the company when it became apparent that there was insufficient shareholder support for the deal.” But the Dell board felt they needed no excuse when they changed the voting standard and changed the record date of those eligible to vote, which allowed arbitrageurs to vote a much greater percentage of the stock when the polls reopen and scheduled the annual meeting for October. The board simply relied on the usual “business judgment” catchall and Delaware law to uphold their actions. We jokingly ask, “What’s the difference between Dell and a dictatorship?” The answer: Most functioning dictatorships only need to postpone the vote once to win.

As a result of 1) the change in the record date allowing new stockholders to vote on the proposed Michael Dell/Silver Lake transaction on September 12th, 2) Chancellor Strine’s ruling that a gap period between the September 12th meeting and the annual meeting was legal under Delaware law and 3) the raise in the bid by Michael Dell/Silver Lake, we have determined that it would be almost impossible to win the battle on September 12th.. We have therefore come to the conclusion that we will not pursue additional efforts to defeat the Michael Dell/Silver Lake proposal, although we still oppose it and will move to seek appraisal rights.

I realize that some stockholders will be disappointed that we do not fight on. However, over the last decade, mainly through “activism” we have enhanced stockholder value in many companies by billions of dollars. We did not accomplish this by waging battles that we thought we would lose. Michael Dell/Silver Lake waged a hard fought battle and according to Chancellor Strine, the actions by Dell were within the Delaware law. We therefore congratulate Michael Dell and I intend to call him to wish him good luck (he may need it).

While we of course are saddened at our losing the battle to control Dell, it certainly makes the loss a lot more tolerable in that as a result of our involvement, Michael Dell/Silver Lake increased what they said was their “best and final offer”. As a result of this increase all stockholders are to receive many hundreds of millions of dollars more than the board originally accepted. We will never know how much more stockholders might have received if the board had allowed the annual meeting to proceed at the same time as the rescheduled special meeting which we believe would have put pressure on Michael Dell/Silver Lake to increase their bid.

One of the great strengths of our country is that we abide by the rule of law. However, state laws dealing with corporate governance often favor incumbent corporate boards and management and are weak in many areas. While we must abide by these laws, we believe that they can and must be changed. Among many other things, boards should not be able to treat elections as totalitarian dictatorships do; where if they lose, they simply ignore the results.

The Dell board, like so many boards in this country, reminds me of Clark Gable’s last words in “Gone with the Wind,” they simply “don’t give a damn.” If you are incensed by the actions of the Dell Board as much as I am, I hope you will choose to follow me on Twitter where from time to time I give my investment insights. I also intend to point out what I consider to be unconscionable actions by boards and discuss what remedies shareholders may take to change the situation.

I wish to take this opportunity to thank all Dell shareholders who supported Southeastern and Icahn.

Very truly yours,

Carl Icahn”

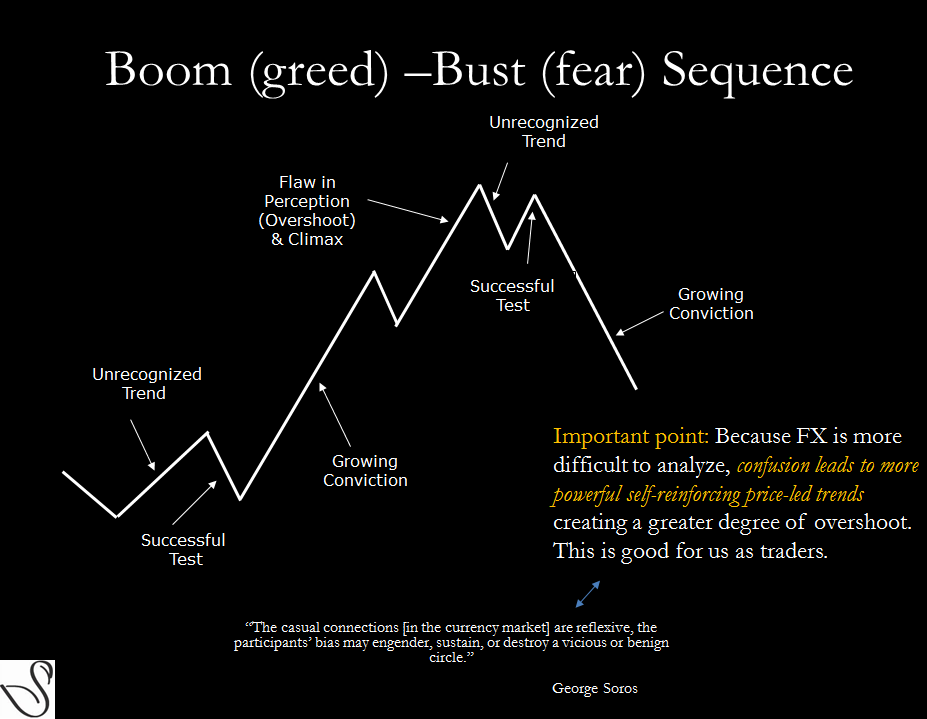

I layout my best available insight about the currency markets on a daily basis. I tried to sound “smart.” Often I tried to convey some sense of prescience I may have about currencies. But I have no “gift of hindsight,” few of us do. I know that. And because I have seen some very strange things happen over the years that have drained more money from my trading account than I care to talk about (or let my wife know about), I do my best to approach markets as a game of probabilities. I think it’s the right way to do it.

I layout my best available insight about the currency markets on a daily basis. I tried to sound “smart.” Often I tried to convey some sense of prescience I may have about currencies. But I have no “gift of hindsight,” few of us do. I know that. And because I have seen some very strange things happen over the years that have drained more money from my trading account than I care to talk about (or let my wife know about), I do my best to approach markets as a game of probabilities. I think it’s the right way to do it.

Earlier today, Charlie Rose who traveled to Damascus previously, interviewed Syria’s president al-Assad at the presidential palace. The interview will air in its entirety on PBS’s “Charlie Rose” show on Monday night just as Obama’s full media campaign to push for a Syrian war is peaking. In the interview, previewed by Rose on CBS’s “Face The Nation” on Sunday morning, Assad denied that he had anything to do with the chemical weapons attack that took place on August 21, 2013 and that there was no evidence that he had “used chemical weapons against my own people”. Rose also said the Syrian president would not confirm or deny that the regime has chemical weapons. When asked if Assad though there would be an attack, the president told him “I don’t know.”

Earlier today, Charlie Rose who traveled to Damascus previously, interviewed Syria’s president al-Assad at the presidential palace. The interview will air in its entirety on PBS’s “Charlie Rose” show on Monday night just as Obama’s full media campaign to push for a Syrian war is peaking. In the interview, previewed by Rose on CBS’s “Face The Nation” on Sunday morning, Assad denied that he had anything to do with the chemical weapons attack that took place on August 21, 2013 and that there was no evidence that he had “used chemical weapons against my own people”. Rose also said the Syrian president would not confirm or deny that the regime has chemical weapons. When asked if Assad though there would be an attack, the president told him “I don’t know.”

If you want to hear a rosy view on the market, you’d better not listen to Marc Faber .

The editor and publisher of the Gloom, Boom & Doom Report has long held that a correction was coming—and even though that thesis has not exactly played out this year, he’s standing by it.

“In my view, we’ll go back to the lows in November 2012—around 1,343” in the S&P 500 Faber said. Overall, he considers U.S. equities a “better sell than a buy.”

Here are his three three main reasons for his bearish view.

Reason one: The U.S. will follow emerging markets down

It hasn’t been an easy summer for emerging markets. In the period of a month and a half, the iShares MSCI Emerging Markets ETF (which tracks emerging markets’ large- and mid-cap stocks) lost nearly 20 percent of its value and has hardly bounced back from the lows.

That has made the U.S. market an outperformer, but Faber believes it cannot last. In fact, he said, U.S. equities could be hurt by their relative costliness.

“When emerging markets go down and the S&P goes up, the asset allocators say, ‘Do I want to buy the S&P near a high, or do I venture back into emerging economies that are down 50 percent from their highs, like India or Brazil and so forth?’ So you understand that the pool of money can flow back into emerging markets,” Faber said.

Reason two: The Middle East will become a “disaster”

Reason two: The Middle East will become a “disaster”

The stock market has lately been hurt by the concerns about U.S. military action against Syria. In fact, the market lost half of its gains last Tuesday when House Speaker John Boehner (R.-Ohio) said that he would support President Barack Obama ‘s plan to strike Syria. But Faber believes we haven’t seen anything yet.

“The Middle East is a powder keg, and it will go up in flames because the Western imperialistic powers, they still meddle into the local affairs,” Faber said. “It’s going to be a disaster. And it’s going to strike from Syria and Egypt into Saudi Arabia, into the Emirates eventually, and so forth and so on, and you’re going to have a huge mess.”

Reason three: Interest rates have become a headwind

Before Syria became a concern for the market, the focus was clearly on interest rates. Though Fed easing has kept rates low by historical metrics, “the interest rate has doubled on the 10-year Treasury note” since the July 2012 low, “despite Mr. Bernanke’s maddening asset purchases since September 2012,” Faber said.

So what does that mean for the market?

“Interest rates are no longer a tailwind” but are now “a headwind,” Faber declared, adding that yields will drop even further. In fact, he advocates buying bonds as a safety trade, because he thinks that after the market drops, deflation concerns will come to the fore.

You can read more market comments at http://www.marcfabernews.com