Stocks & Equities

General Motors Co. (GM), almost five years after first receiving government aid, is free from U.S. taxpayer ownership after the Treasury Department sold off its remaining stake in the nation’s largest automaker.

The sale marks the end of Government Motors, as GM was derisively labeled by some critics after the U.S. government stepped in with emergency funding in 2008. Bailouts from the George W. Bush and Barack Obama administrations helped GM avoid liquidation and reorganize in a 2009 bankruptcy that has given new life to the company.

The U.S. lost about $11 billion on its investment of about $50 billion in GM, which was the largest piece of an industry bailout that became a centerpiece of Obama’s first term. With lower labor costs, less debt and only its strongest brands, GM has been poised to take advantage of the best U.S. industry sales since 2007.

“This marks one of the final chapters in the administration’s efforts to protect the broader economy by providing support for the automobile industry,” Treasury Secretary Jacob J. Lew told reporters today on a conference call.

“The trouble with the world is that the stupid are cocksure and the intelligent are full of doubt.”

“The trouble with the world is that the stupid are cocksure and the intelligent are full of doubt.”

Bertrand Russell

EU versus US Yield Spread: It seems to matter for the currency

If you can forecast interest rates, you should just trade bond futures and make a fortune and forget about currencies, to paraphrase John Percival of Currency Bulletin. John’s point was simple and it was two-fold: 1) You shouldn’t base your currency forecast on your interest rate forecast; 2) Because no one can consistently forecast interest rates and even if you could it doesn’t mean it will help you with your currency forecast. But most currency traders do watch interest rates. That is because over time there does seem to be a correlation between rising a country’s rising yield differential (if for the right reason and usually driven by internal factors) and that country’s relative currency value.

Interest rates are the real fundamental factor operating continuously in the background of the currency markets…

Ed Note: It is probably advisable for retail investors to diversify as much as possible so trading in physical commodities and companies that are in that business is obviously a huge area that you can seek out positive new investments. Given that commodities generally follow international trends and separate cycles that domestic investors may not be entirely versed in, I have chosen an article on Cycles by Chris for you to both diversify into commodities (we will never stop eating for example). Also possibly improve your abilities in other investment areas by brushing up your skills in Cycle analysis. Below is Chris Vermulen’s great article on Cycles:

THE MARKET YOU TRADE IS NOT RANDOM…

The use of cycles is perhaps the most misunderstood areas of technical analysis. And is widely miss used within automated trading systems. This is because there are a wide variety of approaches ranging from magnetic, to astrology to time based cycles.

The purpose of this tutorial on cycle analysis and implementation into automated trading systems is to present a logical perspective on what cycles and how they enhance your technical analysis studies.

Originally I was attracted to cycle analysis back in 2001. Back then, there was very little information about cycle analysis and even less on how to identify them within financial instruments. Cycles can be somewhat measured using conventional indicators such as RSI, stochastics and moving averages. But, better yet is a custom cycle analyzer indicator I created to make cycle identification and implementation automatic within my trading strategies and my fully automated trading system.

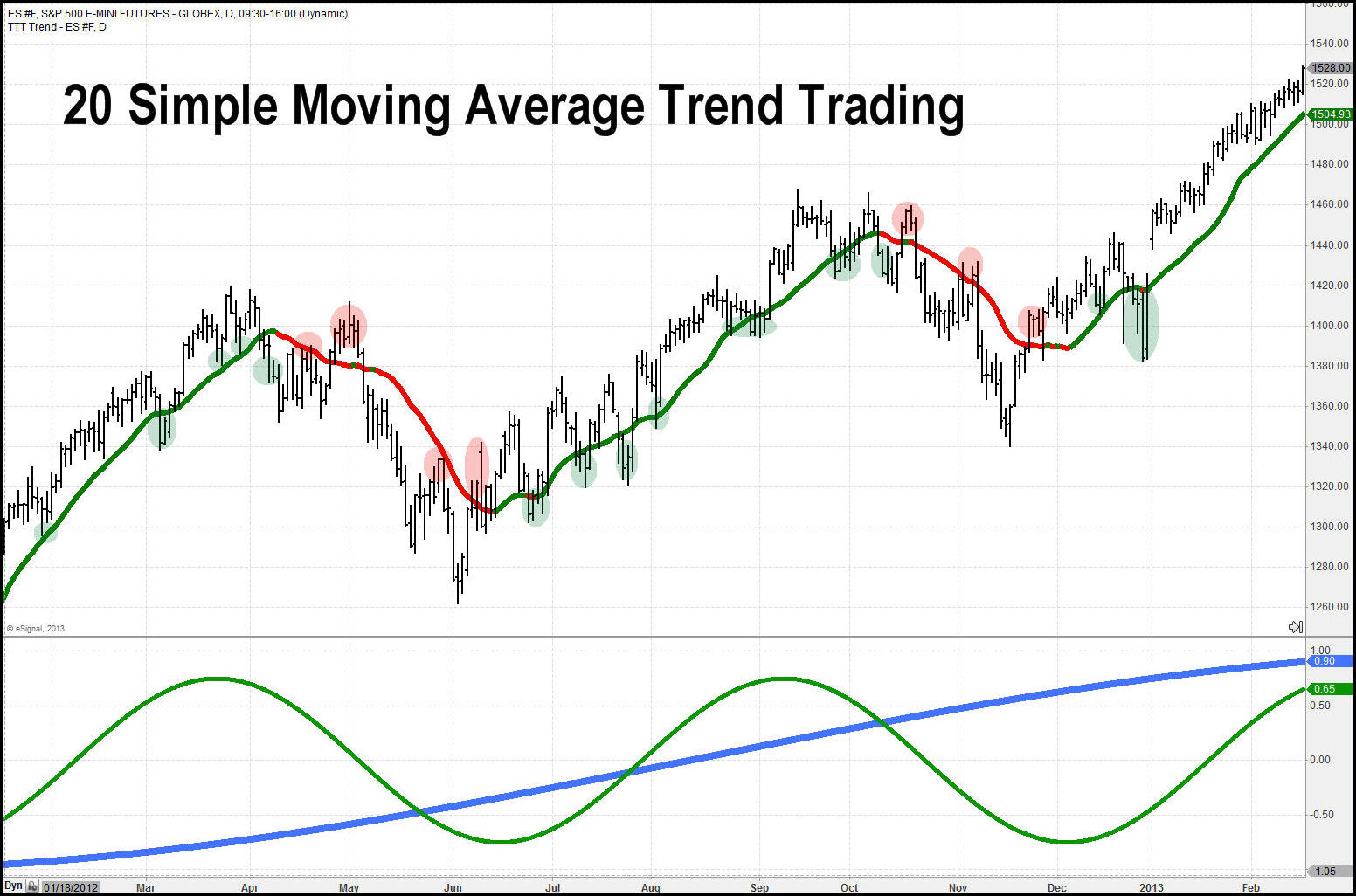

Here is how the moving average can help spot cycles, but keep in mind they are lagging indicators. The lower indicator shows the long term cycle and swing trading cycle I focus on. Remember cycle lengths change over time which is why I automated the indicator and have it run within my automated trading system. But you should get the gist of how cycles look and function.

I am going to touch quickly on a few areas of cycle analysis which I hope you find somewhat interesting.

Cycle Perspective by Market Participants

Cycles also known as waves are observed almost everywhere including nature. Ancient civilizations designed calendars and time measurements cased around cycles. This has creating the most standard measurements we all live by and track on a regular basis. The length of day, year, seasonal changes and even the phases of the moon and stars. These are just time based cycles but the same type of thing carries across noise like musical notes, light spectrum’s, and in liquids like waves in the ocean.

Philosophical Cycle Foundation

The financial markets are truly efficient and follow random walk principle. The fact that so many like Larry Williams and Paul Tudor Jones along with many other long term consistent traders pull money from the financial markets prove this if a more detailed analysis of the random walk theory is applied and you will see some interesting results through cycle analysis.

Understanding cycles and through tracking where they are I their current phase gives you a pretty good idea to where the financial market is headed for a short distance into the future with high level of accuracy.

Understanding Cycles & Automated Trading System Implementation

The stock market or any financial instrument chart is similar to an aerial photo of a river. There are times (sections) where the price movements appear random while other sections have distinctive cyclic pattern (waves or a snake like pattern).

No matter how good you are of a trader or investor you are, trading the markets requires us to take a leap of faith along with many assumptions to follow our trading system whether it is an automated trading system or not.

Understanding cycles is just a piece of the overall puzzle although I would account for it to be 1/3rd of my analysis for timing and position management of my automated investing system.

So what are the other pieces of the puzzle?

Glad you asked (subconsciously)!

According to my research the market is in a cyclical state roughly 20-35% of the time. Logic indicates that you should have a trading strategy that can identify and trade this type of price action.

The stock market trends roughly 25-35% of the time also. So another trading strategy is required for taking advantage of this price action also.

And then there is the random none tradable price action. This is when the market is giving off mixed signals and this typically happens during a change in market conditions from an uptrend to a down trend or from cyclical price action to a trending market.

Understanding and identifying what I just talked about will greatly improve your trading, investing and reduce stress and emotional trading.

My Automated Trading System Identifies Active Cycles and Trades

In conclusion, it took me years of studying cycles to master identification and timing of trades based around them and to be honest I am still learning and improving this process.

If this short tutorial sparked some interest. In a week I will be making my soon to be published book “Technical Trading Mastery – 7 Steps To Win With Logic” which is the perfect holiday read and trading education book to kick start 2014. I will be making the book available to my followers only two months before it’s available on Amazon, Barns & Noble’s etc., which won’t be until Feb.

While I am bias towards this MUST READ BOOK, I do feel it will truly improve how you think, feel and trade the markets for the rest of your life.

Happy Holidays, and remember to send me your feedback and ideas on topics you would like me to learn more about!

Cheers,

Chris Vermeulen

ETF Trading Strategies Newsletter

Politicians and Special Intersest groups constant declare that they care about income inequality. Well in this comentary Michael will have them heading for their character assassination kits so that they can do their best to take the focus off their own hypocrisy and place it where they think it belongs…..on anybody, like Michael, who has the audacity to point out the facts, or worse disagree with them.

Which may mean these groups are either intentionaly deceptive and dishonest for political reasons…… or what could also be true I suppose…..they have an inability to process the facts.

{mp3}mcbuscomdec11fp{/mp3}