Personal Finance

If you follow our blog, then you are definitely familiar with trader Larry Levin, President of Trading Advantage LLC. We have gotten such a great response from some of his past posts that he has agreed to share one more of his favorite trading tips as a special treat to our viewers. Determining the direction of the market can be tricky and just plain confusing at times, but Larry’s expert opinion keeps it simple.

If you follow our blog, then you are definitely familiar with trader Larry Levin, President of Trading Advantage LLC. We have gotten such a great response from some of his past posts that he has agreed to share one more of his favorite trading tips as a special treat to our viewers. Determining the direction of the market can be tricky and just plain confusing at times, but Larry’s expert opinion keeps it simple.

If you like this article, Larry’s also agreed to give you free access to his Weekly Trading Tip.

I have heard that 95% or more of all traders ultimately fail.

Have you ever wondered why?

Most traders will tell you it was the system or method they were using. They’ll also tell you they had a few bad trades they couldn’t recover from. Or their dog chewed through the telephone cord just as their computer crashed, and they couldn’t get out of a losing trade.

Everyone has a different reason, but when you hear enough of them, a pattern begins to develop. I believe most traders fail because they sabotage themselves.

The markets work differently from other investing opportunities. There is probably more freedom in the trading business than any other industry in the world.

You can do what you want, whenever you want to do it. You can trade 1 contract or 100. Buy the market or sell it; it’s up to you. The only thing that holds you back is running out of capital.

Most people are not accustomed to that much freedom.

If you can’t control the market, the only thing you can control is yourself.

Trading is also very different than the things we do on a daily basis. In everyday life we exercise some control over our environment. If a room is too dark we turn the light on. If we want to go somewhere, we jump in the car and turn the key.

In trading you can’t control what the market does.

No matter how much you want the market to go in a certain direction, there is nothing you can do to force that to happen. You can’t turn a key or flip a switch. Hoping, pleading, screaming… nothing will make the market do what you want it to.

Embrace the uncertainty – plan for the best and worst cases

One of the most important things you can do to avoid the mental sabotage is to understand the lack of control you have over the market, and plan for every trade. Now I don’t mean a trading plan like buy a contract and then close the position when the market trades higher. I mean a real plan. That includes specific entry points based on certain market movements or conditions. It means exit strategies for when things go right and for things go really wrong. It means placing limits and stops and keeping your emotions in check. If you have a roadmap for your day, you are less likely to fall into that trap of mental sabotage.

Remember: if you can’t control the market, the only thing you can control is yourself.

Successful traders all understand and embrace this concept. Unsuccessful traders continue to try to make the market conform to their wishes.

Click here to see Larry’s Weekly Trading Tip

Best Trades to you,

Larry Levin

Founder & President- Trading Advantage

Disclaimer: Futures and options trading involves a substantial degree of risk and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Secrets of Traders LLC provides only training and educational information. By accessing any Secrets of Traders or Trading Advantage content, you agree to be bound by the terms of service. Click Here to review the terms of service.

Two pieces of business news announced this week provide a convenient frame through which to view our dysfunctional and distorted economy. The first (which has attracted tremendous attention), is Facebook’s blockbuster $19 billion acquisition of instant messaging provider WhatsApp. The second (which few have noticed) is the horrific earnings report issued by Texas-based retail chain Conn’s. While these two developments don’t seem to have much in common, together they shed some very unflattering light on where we stand economically.

Two pieces of business news announced this week provide a convenient frame through which to view our dysfunctional and distorted economy. The first (which has attracted tremendous attention), is Facebook’s blockbuster $19 billion acquisition of instant messaging provider WhatsApp. The second (which few have noticed) is the horrific earnings report issued by Texas-based retail chain Conn’s. While these two developments don’t seem to have much in common, together they shed some very unflattering light on where we stand economically.

Given the size and extravagance of the Facebook deal, it may go down as one of those transactions that define an era (think AOL and Time Warner). Facebook paid $19 billion for a company with just 55 employees, little name recognition, negligible revenues, and little prospects to earn much in the future. For the same money the company could have bought American Airlines and Dunkin’ Donuts, and still have had $2 billion left over for R&D. Alternatively they could have used the money to lock in more than $1 billion in annual revenue through an acquisition of any one of the numerous large cap oil producing partnerships. Instead they chose a company that is in the business of giving away a valuable service for free. Come again?

Mark Zuckerberg, the owner of Facebook, is not your typical corporate CEO. Through a combination of technological smarts, timing, luck, and questionable business ethics, he became a billionaire before most of us bought our first cars. And in the years since social media became the buzzword of the business world, Wall Street has been falling over backward to funnel money into the hot sector. As a result, it may be that Zuckerberg looks at real money the way the rest of us look at Monopoly money. It also helps that a large portion of the acquisition is made with Facebook stock, which is also of dubious value.

But even given this highly distorted perspective, it’s still hard to figure out why Facebook would pay the highest price ever paid for a company per employee – $345 million (more than four times the old record of $77 million per employee, set last year when Facebook bought Instagram). The popular talking point is that the WhatsApp has gained users (450 million) faster than any other social media site in history, faster even than Facebook itself. Based on its rate of growth, the $42 per user acquisition cost does not seem so outrageous. But WhatsApp gained its users by giving away a service (text messaging) for which cellular carriers charge up to $10 or $20 per month. It’s very easy to get customers when you don’t charge them, it’s much harder to keep them when you do.

Boosters of the deal expect that WhatsApp will be able to charge customers after the initial 12-month free trial period ends (it now charges 99 cents per year after the first year). Based on this model, the firm had revenues of $20 million last year. But what happens if another provider comes in and offers it for free? After all, the technology does not seem to be that hard to replicate. Google has developed a similar application. More importantly, no one seems to be projecting what the cellular carriers may do to protect their texting cash cows.

WhatsApp gives away what AT&T and Verizon offer as an a la carte texting service. As these carriers continue to lose this business we can expect they will simply no longer offer texting as an a la carte option. Instead it will likely be bundled with voice and data at a price that recoups their lost profits. If texting comes free with cell service, a company giving it away will no longer have value. People will still need cellular service to send mobile texts, so unless Facebook acquires its own telecom provider, it can easily be sidelined from any revenue the service may generate.

Some say that texting revenue is unimportant, and that the real value comes from the new user base. But how many of the 450 million users it just acquired don’t already have Facebook accounts? And besides, Facebook itself hasn’t really figured out how to fully monetize the users it already has. In other words, it is very difficult to see how this mammoth investment will be profitable.

From my perspective, the transaction reflects the inflated nature of our financial bubble. The Fed has been pumping money into the financial sector through its continuous QE programs. The money has pushed up the value of speculative stocks, even while the real economy has stagnated. With few real investments to fund, the money is plowed right back into the speculative mill. We are simply witnessing a replay of the dot com bubble of the late 1990’s. But this time it isn’t different.

In another replay of that spectacular crash fourteen years ago, the appliance and furniture retailer Conn’s has just showed the limits of a business built on vendor financing. In the late 1990’s telecom equipment companies almost went bankrupt after selling gear to dot com start-ups on credit. For a while, these “sales” made growth and profits look great, but when the dot coms went bust, the equipment makers bled. Conn’s makes its money by selling TVs and couches on credit to Americans who have difficulty scraping up funds for cash purchases. For a while, this approach can juice sales. Not surprisingly, Conn’s stock soared more than 1500% between the beginning of 2011 and the end of 2013. These financing options are part of the reason why Conn’s was able to keep up the appearance of health even while rivals like Best Buy faltered in 2013.

But if people stop paying, the losses mount. This is what is happening to Conn’s. The low and middle-income American consumers that form the company’s customer base just don’t have the ability to pay off their debt. The disappointing repayment data in the earnings report sent the stock down 43% in one day.

In essence, Conn’s customers are just stand-ins for the country at large. In just about every way imaginable, America has borrowed beyond its ability to repay. Meanwhile our foreign creditors continue to provide vendor financing so that we can buy what we can’t really afford.

So thanks for the metaphors Wall Street. Too bad most economists can’t read the tea-leaves.

Peter Schiff is the CEO and Chief Global Strategist of Euro Pacific Capital, best-selling author and host of syndicated Peter Schiff Show.

Subscribe to Euro Pacific’s Weekly Digest: Receive all commentaries by Peter Schiff, John Browne, and other Euro Pacific commentators delivered to your inbox every Monday!

To order your copy of Peter Schiff’s latest book, How an Economy Grows and Why It Crashes – Collector’s Edition, click here.

For in-depth analysis of this and other investment topics, subscribe to Peter Schiff’s Global Investor newsletter. CLICK HERE for your free subscription.

“If the teaching of experience bears fruit in us, we soon give up the pursuit of pleasure and happiness, and think much more about making ourselves secure against the attacks of pain and suffering. We see that the best the world has to offer is an existence free from pain-a quiet, tolerable life; and we confine our claims to this, as to something we can more surely hope to achieve. For the safest way of not being very miserable is not to expect to be very happy. Merck, the friend of Goethe’s youth, was conscious of this truth when he wrote: It is the wretched way people have of setting up a claim to happiness –and, that to, in a measure corresponding with their desires–that ruins everything in this world. A man will make progress if he can get rid of this claim, and desire nothing but what he sees before him.”

Arthur Schopenhauer, Counsels and Maxims

I don’t know whether or not there is some grand German strategy predicated on Europe’s single currency regime; but it sure does look as if Germany policy makers are a lot smarter than the rest of the animals on the farm. They understood a single currency would allow for German industrialists to dominate the zone and develop a captive export audience. And the austerity thrust to deflate periphery countries under the guise forcing countries labor rates in line with Germany, these countries will magically be competitive. That is of course a fantasy. The last time I checked, Bangladesh has much lower labor rates than German; yet Germany doesn’t seem to be fretting about Bangladesh machine tool manufacturers stealing their markets.

…read it all at Currency Currents 24 February 2014

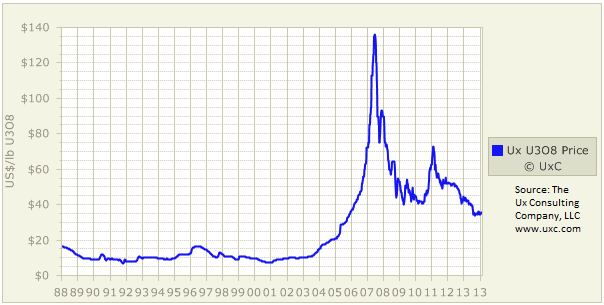

Buy when there is blood in the streets – Baron Rothschild – Ed Note: This is contrarian investing at its heart – the strongly-held belief that the worse things seem in the market, the better the opportunities are for profit. Fortunately in the Uranium market there are a broad variety of investments you can make from dividend paying blue chip stocks like Cameco Corporation which is the world’s largest publicly traded uranium company right through to a large number of higher risk Junior Mining companies buying properties and striving to find the next big Uranium mine while the price of Uranium is trading at a mere 25% of what it was in 2007.

Fundamentally driven

As outlined in our previous articles in November and December, we anticipate uranium prices to improve significantly in 2014 for a number of reasons. Today, the fundamentals for uranium and nuclear power generation are stronger than ever. More reactors are under construction, planned and proposed than before the Fukushima incident.

For uranium prices to appreciate in the foreseeable future, one must look not only at the reactors under construction worldwide, but the ones coming online soon. China has 28 reactors under construction, yet 5 are ready to be connected to the grid this year. Japan has submitted applications for 17 reactors to be restarted, whereas analysts are expecting at least 6-8 reactors to be granted permission for restart in 2014. Both China and Japan are set to add vast amounts of demand back into the uranium market.

….continue reading & viewing charts HERE

In short: In our opinion short positions (half): gold, silver, and mining stocks are justified from the risk/reward perspective.

Gold, silver and mining stocks didn’t do much on Friday, so what we wrote in Friday’s alert is generally up-to-date. However, since the week is over, we have weekly closing prices and volume levels. One of the ratios that we monitor provides a very significant indication as far as weekly price changes are concerned. Let’s take a closer look (charts courtesy of http://stockcharts.com).

This is the juniors to stock market ratio – more precisely, the GDXJ ETF (proxy for the junior mining stock sector) to the SPY ETF (proxy for the S&P 500 Index) ratio.

What does this have to do with gold?

Much more than one might expect. Let’s keep in mind the following about precious metals junior mining stocks and investors in general:

- Juniors are less likely to be held by institutional investors than individuals (mutual funds, for instance, often are allowed only to invest in big, senior companies, listed on major stock exchanges)

- Generally, individual investors tend to depend more on emotions than financial institutions do

- When the sentiment peaks, local tops are formed

Connecting the dots, we might expect juniors to perform particularly strongly right before local tops. Taking into account the fractal nature of the markets, we might also expect that this phenomenon to be present on a short- and long-term basis, but since large movements in sentiment are easier to detect from the long-term perspective, this type of analysis might be particularly useful in detecting more important tops.

Ok, but why divide juniors by other stocks?

Because that will allow to better focus on this sector’s performance with regard to precious metals’ price moves. In case there is a broad rally in the stock market, it could also lift mining stocks, including juniors, which could incorrectly make us draw conclusions about the precious metals sector. By dividing juniors by the stock market, we get the price of juniors without the impact of the general stock market. Technically, we get a ratio, but the above is a convenient way to think about it.

Moreover, the price is not the only thing that is divided. The above chart includes volume, but since a ratio is not traded by itself and doesn’t have volume of its own, it’s not a volume of ratio, but the ratio of volumes. Again, this will tell us when the volume in the junior sector was particularly significant but not because of huge volume across the board.

So, theoretically, if the juniors to stocks ratio rallies sharply then we might be looking at a local top. Does it work in practice?

There are no guarantees in any market, but it certainly looks this way. We included a 4-year chart and marked sharp rallies of the ratio – see for yourself. We put the ratio in the background (candlesticks) and we put the gold price (orange line) to make it easier for you to check the signals’ performance. There are actually two different ways to approach the ratio and they both seem to work. One of them is the ratio itself and the second comes from the analysis of volumes.

Rectangles mark situations when the ratio moved much higher in a short period and then at least paused. It’s easier to observe these phenomena using indicators: ROC (Rate of Change by definition should be very useful here) and Stochastic. We focused on the times when Stochastic was above the middle of its trading range (above 50) and in most cases, the ROC was above 10 as well. The only exception is the early 2012 top, which was included because the rallies in gold, ratio and indicators were clearly visible at that time.

Generally, all (7 out of 7) areas include either a relatively small or a significant decline. Prior to the 2011 top, the declines were local and after the 2011 top, the tops and following declines were major.

The second way to examine the chart is to look at times when volume increased on a relative basis. This is another way to detect increased interest in the juniors sector.

There were 4 cases in the past 4 years, which we marked with black ellipses. We didn’t mark the areas when volume was gradually increasing – only times when it increased quickly. Again, in call cases declines or pullbacks followed shortly after the volume had increased.

What about the current situation? The volume first increased in January, and in the past 2 weeks it was simply huge. As far as the first approach is concerned, we have both indicators at their previous highs and the ROC indicator has already declined slightly. The Stochastic indicator hasn’t flashed a sell signal yet, but if gold at least pauses or declines next week, we will likely see one and then the analogy to previous local tops based on the GDXJ:SPY ratio will be very strong. It’s already strong but a sell signal from Stochastic could actually trigger a decline on its own in the current state of the market.

What does it all mean? Most importantly, it means that not all is as bullish in the precious metals sector as one might think. It seems that the recent rally caused investor sentiment to be too optimistic and this is likely to cause at least a correction.

To summarize:

Trading capital (our opinion): Short position (half): gold, silver, and mining stocks.

Stop-loss details:

- Gold: $1,346

- Silver: $22.36

- GDX ETF: $27.9

Long-term capital (our opinion): No positions.

As always, we’ll keep our subscribers updated should our views on the market change. We will continue to send them our Gold & Silver Trading Alerts on each trading day and we will send additional ones whenever appropriate. If you’d like to receive them, please subscribe today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments – SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment – SunshineProfits.DE

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Does Germany want deflation? It would increase its latent power

Does Germany want deflation? It would increase its latent power